Now that the State of Pennsylvania has dismissed President Trump's election fraud lawsuit, it is time to start preparing, in earnest, for the entrance of Joe Biden as America's 46th president. There are a lot of negative things to say about Trump's abrasive personality, but one positive thing to say about Trump's presidency is that he really helped boost the economy. Since Trump ran the country like a business, top stock indexes have hit many historic highs, despite the challenges posed by economic shutdowns during the current COVID-19 pandemic. Likewise, Trump is responsible for many stimulus measures that have kept the economy afloat, including tax cuts and financial stimulus, which may be rolled back during Biden's tenure.

Getting a good understanding of Biden's agenda will help you create smarter trading strategies both before he takes office and once Biden begins his presidency. Here are some stocks that are worth looking at in the coming months, and why they might present good opportunities for profit.

ESG Investing Opportunities

Joe Biden has not been shy about his goal to pursue environmental goals. In fact, he aims to make America into the world's clean energy superpower. Biden aims to help make America a 100% clean energy economy and to reach net-zero emissions by no later than 2050. He's not referring only switching to solar powered homes or electric vehicles; Biden also wants to upgrade commercial spaces to be more energy-efficient and to invest in infrastructure so that buildings will withstand the impacts of climate change. His goal is to take on this challenge by using US-based companies and workers to make it happen, which would also help reduce unemployment.

Investors looking to jump on the ESG investing bandwagon may want to consider trading stragies that include purchasing stock in companies that will take part in implementing Biden's vision, including those in the water, construction, and renewable energies sectors. Some companies tapped by Credit Suisse as good opportunities are Emerson Electric (EMR) and Carlisle Companies (CSL) which focus on upgrading commercial spaces, as well as Acuity Brands (AYI) whose express focus is on creating more energy efficient lighting opportunities in commercial properties.

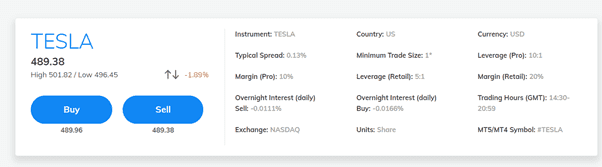

On the ESG investing front, electric carmakers are also trading well these days, and most are poised to head higher. The most obvious one here is Tesla (TSLA), which has already surged some 500% this year, and is available for trade at many retail brokers (click here to trade TSLA now). NIO and NKLA are other EV stocks that are worth looking into but are not available as CFDs with leverage.

Investing in China

President Trump's plan to "put America first" meant slapping high tariffs on products coming from overseas, including (but not limited to) a $300 billion tariff on Chinese imports including pork, aluminum, wine, solar panels, washing machines, and much more. During Trump's presidency, US-Sino relations were marred by more than just tariffs – the past few years also saw a deterioration in diplomacy, with restrictions placed on tech companies and media outlets as well as consulates. Trump also placed the blame for the spread of COVID-19 upon China, thanks to the origin of the pandemic in Wuhan, which eroded relations further.

In an interview with NPR in August 2020, Biden said that he'd likely reverse Trump's tariffs. "We're going after China in the wrong way," he commented. Instead, Biden urged a multilateral approach to getting China to change the questionable business behaviors that have long sullied US-Sino ties. Biden mentioned that he will use US ties with the rest of the world in order to get China to change its ways.

Politics aside, choosing Chinese-based assets could also be a good trading strategy at this time because China not only the second-biggest economy in the world, but it's proving to be a world leader in recovering from the economic disruption caused by COVID-19. In fact, China's economy grew 4.9 percent in Q3 2020 compared to Q3 2019, and analysts suggest that the recovery may continue to strengthen.

Alibaba (BABA) is one of the most popular Chinese stocks for new investors, perhaps because it is so well known, but also because it has a lot of growth potential. It's also offered by many Forex brokers as a CFD, which means that traders can get started trading even with little startup capital (click here to trade BABA now). BABA shares are trading well below their 52-week highs and have much more daily volatility than other assets which makes it a popular option for day traders.

According to CNBC analyst Mike Khouw, Alibaba also has high implied volatility and strong financials, which makes it ripe for a breakout.

Split Congress Opportunities

According to analysis done by CNBC's analysts, the S&P 500 has rallied 13.6 percent on average during calendar years when there is a Democratic president and a Congress that is split between Republicans and Democrats. This is the highest return of any political configuration, including a Republican president with a unified Congress that has average returns of 12.9 percent, and a Democratic president with a unified Congress, whose average returns are only 9.8 percent.

Ride this technical trend by combining it with an ESG investing strategy and consider purchasing Apple (AAPL) or Microsoft (MSFT), companies that provide solid dividends and are committed to reducing their carbon footprints. Of course, an ETF or index fund that tracks the S&P 500 could also be a good option for anyone looking to make an entry without having to choose individual stocks. Start trading MSFT now.

Travel Opportunities

One of the biggest criticisms of Trump's policies was the way he handled the COVID-19 pandemic, preferring to protect the economy rather than people's lives, by avoiding the widespread lockdowns implemented in many countries.

Joe Biden has already said that he will be taking a harsher stand against the spread of the pandemic, which will hopefully hasten its end. Promises of an impending vaccine are also likely to provide a boost to the global economy and to the travel industry specifically. If you have some risk appetite and are optimistic about the end of the COVID-19 pandemic in the near term, one possible trading strategy would be to purchase travel stocks now, while they're at rock-bottom prices.

Depending on your risk appetite, you can look at airline stocks which fell significantly since the start of the pandemic but are slowly crawling back as some countries become green and travelers feel the pressure to travel. Check out Southwest Airlines (LUV) which is down some 17 percent from its 52-week highs, leaving it room to grow as the pandemic ends and people look for low-cost travel options as the economy continues to recover.

Another great travel option is Las Vegas Sands (LVS) whose income is heavily based on the company's Asian casinos, which are likely to open before their US counterparts.

Final Thoughts

No matter what your risk appetite is and what sectors you prefer to trade, there are certainly a lot of opportunities to find profits both before Joe Biden begins his presidency and going into his tenure. Do not be afraid to get started now – you will not want to miss the price rises while you are still weighing your options.

Want to test different stock trading options? Open a free demo account to trade many of the stocks mentioned here and see which ones will best meet your investment objectives.