The West Texas Intermediate crude oil market initially tried to rally during the trading session on Tuesday but then turned around to form a tiny shooting star. I would not read too much into the candlestick though, because there was not going to be a lot of volume in the market. By trying to read too much into this candlestick, you could trick yourself into believing that there is a move coming. I do not think that there is, and in this time of the year, you have to be very cautious about getting involved. At this point, I believe that the best thing you can do is notice the market structure and try to place trades based upon that.

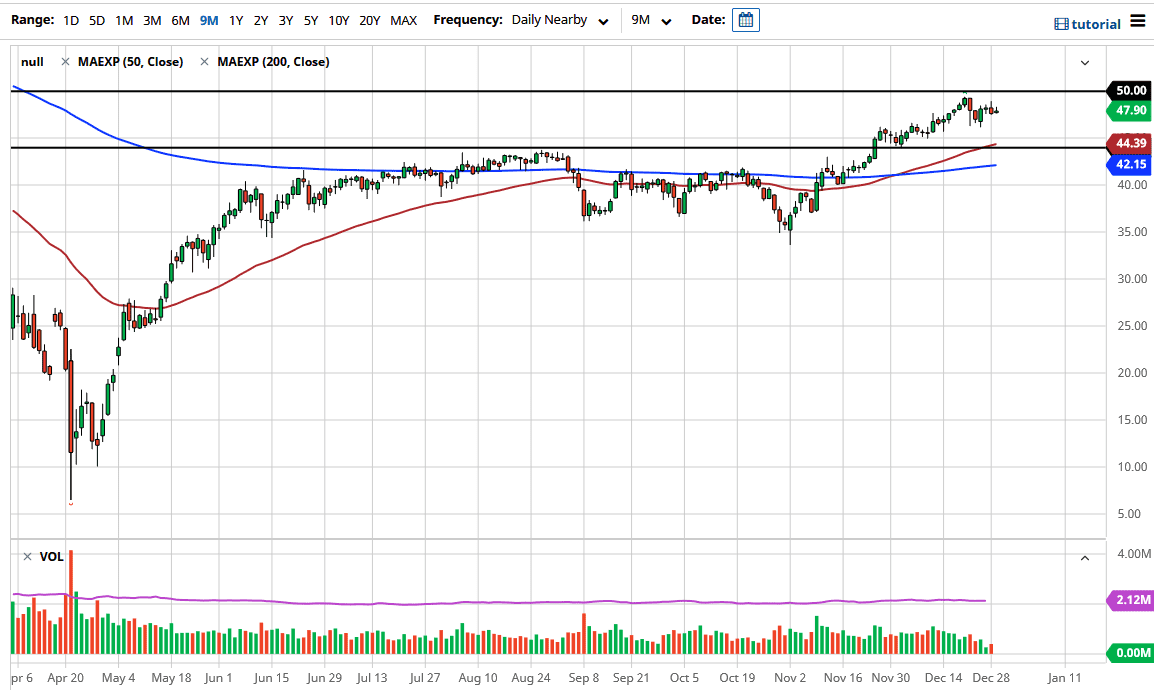

As we are hovering around $47.83 as I write this, we have given back all of the small gains from the trading session, so it looks as if nobody is willing to put money to work. That is fine; your job as a trader is to simply sit on the sidelines and wait for the market to tell you what it is going to do. Underneath, we have the $44 level that has offered significant support, and I would be very interested in buying somewhere near that level. The 50-day EMA is just now crossing above there, so it should attract a certain amount of trend-following traders. To the upside, we have the psychologically and structurally important $50 level, which I think would attract a certain amount of attention for selling as well.

Pay attention to the US Dollar Index because it is approaching the support level between 90 and 88 which, if it gets broken through, will send the US dollar plunging, and anything that is priced in that currency much higher. That is probably the biggest argument for higher oil prices. It certainly is not going to be demand, regardless of what they tell you about stimulus. Stimulus is actually less now than it was before, and we still did not see much in the way of demand. Beyond that, demand was suffering even before the pandemic broke out, so we are going to be hard-pressed to take off to the upside for a significant move, and more likely than not we are going to remain somewhat range-bound heading into and perhaps through the middle of January.