Drawdowns are inevitable, and everyone will face a drawdown in Forex at some point in their trading careers. Without proper risk management, drawdowns can destroy a trading account even if the overall trading strategy is profitable.

That makes drawdown one of the most important metrics to analyze for performance.

In this article, I look closely at how drawdowns occur and what actions you can take to control them and maximize your chances of trading success.

What is a Forex Drawdown?

When I place trades, some will turn into winning trades, and others will be losers. Each time there is a winning trade, my account value increases. After a losing trade, my account value decreases. A drawdown is when the account value decreases after a loss or series of losses.

At any point, if my account value is less than its previous historical highest value, I’m technically in a state of drawdown.

Small drawdowns will happen regularly because losing trades will be mixed in with winning trades. Minor drawdowns are a regular part of trading life.

However, if I have a larger series of losses than normal, drawdowns can turn from a minor occurrence to a significant event, and that’s when I need to pay attention and adjust my trading.

Account withdrawals are not drawdowns:

A drawdown is not the same as an account withdrawal, i.e., when I transfer funds from my trading account to my bank account. Traders only use the word ‘drawdown’ to mean a reduction in account value due to trading losses.

Top Forex Brokers

Why are Drawdowns Important in Forex Trading?

There are three major reasons why understanding drawdown in Forex can help you become a better trader:

- Knowing your historical drawdowns will help you predict when the next one should end. For example, if I know my average drawdown is two weeks long, I will not get worried if I am one week into a drawdown. This is also valuable knowledge if I rely on my trading for income, as I would prefer to withdraw when the account is at a high point rather than take money out when my account value is down.

- You do not want to destroy your trading account. When a drawdown grows too large, I can ‘crash and burn’ and destroy my account because my capital becomes too small to trade effectively. I want to know in advance if I’m in danger of destroying my account so I can adjust my trading to prevent it from happening. A smart trader once told me, “It is essential to live to fight another day.”

- You want to know the health of your trading. The size and frequency of drawdowns tell me about the health of my trading, even if I am profitable. If my drawdowns become more frequent or larger, it indicates my trading is not as good as it used to be. This could be because market conditions have changed. But it could also be because my skills have declined—whatever the reason, I want to investigate. For example, am I still trading according to my rules? Or am I taking emotional trades that are not part of my strategy?

Types of Drawdowns

There are two main types of drawdowns:

- Absolute drawdown

- Maximal & relative drawdown

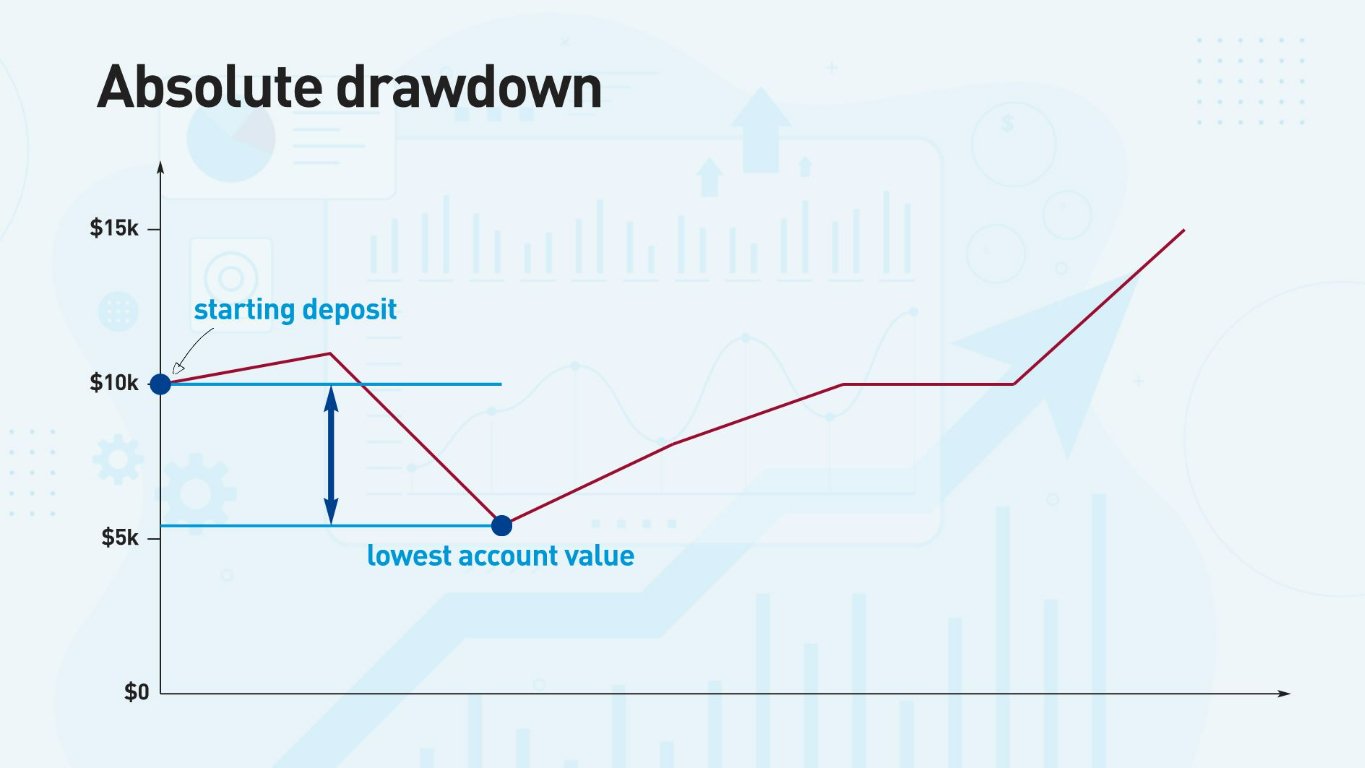

Absolute Drawdown

Absolute drawdown measures by how much an account value has gone below the initial deposit.

It is ‘absolute’ because it always uses the initial deposit as a fixed or absolute value to measure the drawdown. This measurement is most useful when starting as a trader because most traders at the beginning will want to ensure they protect some portion of the initial deposit against future losses.

Absolute drawdown is normally stated as a percentage (rather than a dollar amount).

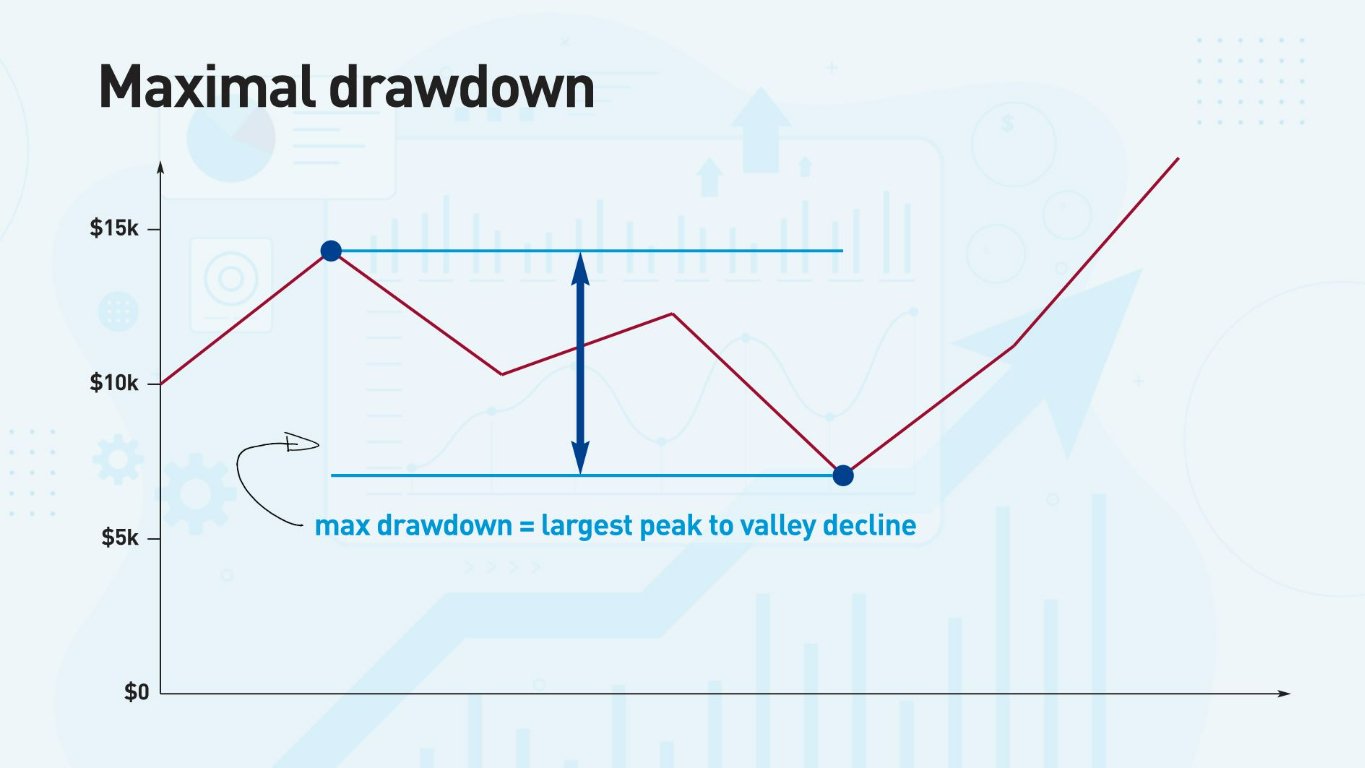

Maximal & Relative Drawdown

This is the largest drop in account value from a previous peak. The maximal drawdown is normally a dollar amount, and the relative drawdown is normally the maximal drawdown stated as a percentage.

Note: Drawdowns do not have to have consecutive losses. There could be wins mixed in with the losses that produce an overall drawdown. For example, I could have 2 losses followed by 1 win and 2 further losses. Together, those 5 trades can create a net drawdown.

How To Measure and Calculate Drawdowns

How to Calculate Absolute Drawdown

First, I take the difference between the lowest value the account has reached in its history and the initial deposit. I then calculate the difference between the two values as a percentage of the initial deposit.

The formula for absolute drawdown is:

(Initial deposit – Lowest Account Value) / Initial Deposit.

To get a percentage, multiply the result by 100.

Let’s look at an example:

Initial deposit: $10,000

The lowest value of my account: $7,500

The difference between the initial deposit and the lowest historical value of the account is $2,500.

Stated as a percentage of the initial deposit, it is:

($2,500 / $10,000) x 100 = 25%.

Can my absolute drawdown change?

Yes. My absolute drawdown can change if my account value goes lower than the previous historic low.

How to Calculate Maximal Drawdown

Note: I have seen different definitions of maximal and relative drawdown depending on the platform, so my interpretation may differ from others.

As the name suggests, the maximal drawdown takes the largest dollar drop in your trading account from a high point. Some traders also refer to this as the “peak to valley drop.”

Let’s say I took my account balance from $10,000 to $20,000. I then had a losing streak, and my account value went down to $12,000 before recovering.

In that case, my maximal drawdown is $8,000.

How to Calculate Relative Drawdown

Relative drawdown is simply the maximal drawdown as a percentage of the highest value of the account.

Using the above example, if the highest value of the account was $20,000 before dropping to $12,000, then the relative drawdown would be 40% because the account dropped 40% from $20,000 to $12,000.

Stated as a formula, it is:

($20,000 - $12,000) / $20,000 = 0.4 or 40%.

Using Open Equity vs. Closed Trades to Measure Drawdowns

Let’s say I am at a new high in my account balance, and I then open a new trade. The trade goes 70 pips in my favour but comes down a little. I end up closing the trade for 50 pips of profit. Using this example, let’s look at how I can calculate drawdown using either the open equity or the closed balance:

- In the open equity calculation, the +70 pips would be the new high point in my account value to calculate future drawdowns.

- In the closed balance calculation, the +50 pips would be the new high point in my account value to calculate future drawdowns.

Time-Based Drawdowns

Some traders like to split their metrics into specific periods. For example, what was the largest drawdown this quarter? How does it compare to the previous quarter? This is an intelligent way of tracking performance because it tells me if my results are improving or deteriorating.

The Importance of Measuring Drawdowns

A drawdown streak is the beginning of losing too much money as a trader to the point where recovery becomes either impossible or extremely difficult. Drawdowns always start small, but before you know it, your account balance could be lower than you have ever experienced.

If I am not measuring my drawdowns, I may not see the damage coming, and I may not be sure whether it is a temporary blip or something more serious. The worst part is that I may realize it is a severe drawdown when it is too late to repair the damage. I’ve seen traders whose account balances are down 70% to 80% before they address adjusting their trading. By that point, they need a 300% to 400% gain to get back to their initial deposit.

Measuring drawdowns allows you to take preventative steps to prevent severe damage before it occurs. Measuring drawdowns can also help you act more strategically rather than emotionally, which can help prevent problems.

Steps to Control Drawdowns in Forex Trading

Controlling drawdowns means controlling risk. Here is a five-step process that anyone can implement.

- Use a stop loss. Always, always use a stop loss, and never widen the stop-loss once the trade is open. Stop losses are the foundation of risk control because they cap the risk of every trade.

- Target positive reward to risk ratios. If a trade cannot earn more than the size of the stop loss, I will not take the trade. All my trades have a minimum of a 1.5:1 reward to risk ratio, meaning that I want to make at least 1.5 times more than I am willing to risk. A positive ratio means I am not relying on a high win percentage to make money. An excellent real-life example is the independent self-funded trader from Sweden, Kristjan Kullamägi, who in 2020 turned $4 million to $32 million with only a 30%-win rate. To achieve those returns, he had very high rewards compared to his risk.

- Have a maximum percentage risk per trade on your account. For example, if the maximum risk per trade is 2%, the stop-loss size in dollar terms cannot exceed 2% of the entire account value. If my account balance is $10,000, a trade cannot cost me more than $200 if I get stopped out. That means I need to calculate the position size for each trade if my stop loss size and Forex pairs are different for individual trades. For example, an EUR/USD trade with a 50-pip stop loss will have a different position size than a GBP/USD trade with a 100-pip stop-loss. It also means that as my account value decreases, the dollar value of my stop losses also decreases, which further helps to protect my account.

- Have a maximum drawdown before reducing risk even further. The temptation is to increase risk after a losing streak because I want to make back the losses faster, but that is emotional trading. If I am experiencing a drawdown, I am not in sync with the markets. I should get in sync at a lower risk before returning to my usual risk level. For example, if my account is down 10%, I will go down to 1% risk and wait until my account is back to the previous equity high before returning to my normal 2% risk.

- Have a maximum drawdown before going to cash. At some point, I may be in a territory where I cannot stop depleting my account. Before I get to a point where my account is destroyed, I want to stop trading and reassess. For example, if my account is down 30% from its peak value, I will stop trading and examine my method and execution.

Conclusion

Drawdowns will happen to the best of traders, so I consider them an inevitable part of trading. That’s okay—there’s no reward without risk. But to ride out drawdowns, it is essential to manage them proactively.

Measuring drawdowns is easy, and most platforms will easily capture the drawdown in Forex without the trader having to calculate it manually.

Managing drawdown in Forex and any other market means controlling risk. I use a five-step process:

- Have a stop-loss.

- Keep a minimum reward/risk ratio.

- Have a maximum percentage risk per trade.

- Have a maximum drawdown before reducing my risk.

- Have a maximum drawdown before going to cash.

You might also be interested in reading the below articles: