If I could journey back more than ten years to when I began trading, and start over, Volume Profile would be one of the first technical tools I would study. It has helped my trading in a way traditional technical tools cannot, and it has made me more profitable than looking at the price chart alone.

In this article, I aim to show why it is a superior tool and how it works.

Why Is Volume Profile Important?

- Most technical tools look at the same information

Most technical analysis indicators derive calculations from the price, which is why most of them lag. And because they’re derived from price, most indicators usually show information traders can see from the price chart alone. In short, most technical tools have everyone looking at the same information and chasing the same ideas, giving little to no edge.

- Volume Profile is different from most other technical tools

Volume Profile is not derived from price or lagging, which is rare in technical analysis. Volume Profile shows the activity that ultimately drives price movement—trading volume activity at different price levels. This is not data that traders can see from the price chart alone or even traditional volume bars.

- Volume Profile finds levels not seen easily on a price chart alone

In my experience trading with Volume Profile, I see significant levels that appear as minor levels on the price chart alone.

- Volume Profile has incredible accuracy down to the lowest timeframes

Most other indicators pick up a lot of meaningless noise on lower timeframes, reducing their accuracy. Volume Profile suffers less from this flaw because it uses “primary data” (rather than being derived from the price or other data).

What Is Volume Profile?

The Volume Profile shows the amount of volume traded at different price intervals over a specified period. It is displayed as horizontal bars, usually overlayed on the price chart.

Each horizontal bar represents the volume that occurred in that price range over a specified time. The Volume Profile can be set to the current session, e.g., that day, or multiple sessions, e.g., the total Volume Profile for the last twenty days.

Let’s break down the key terms:

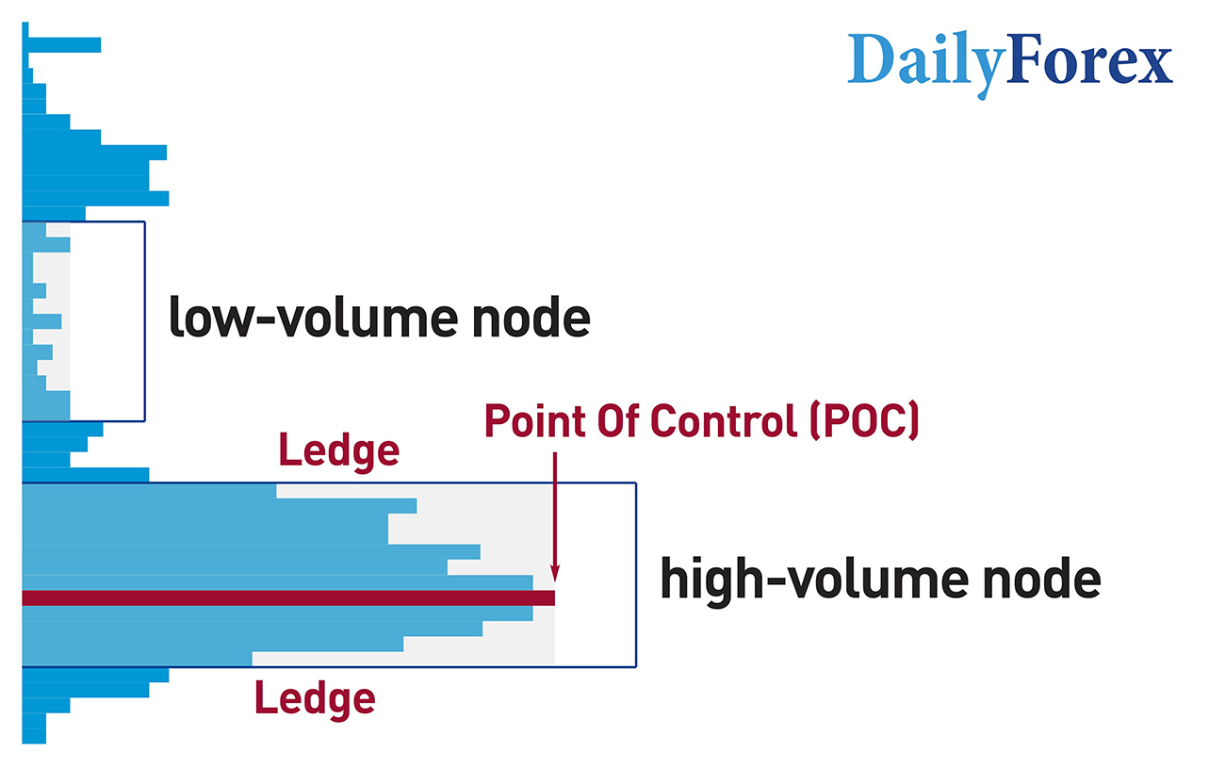

High-volume Node or Distribution Block

A high-volume node is where there is a lot of activity, and we often see distribution on the chart, i.e., a sideways area where the underlying asset changes hands between a lot of buyers and sellers, i.e. a lot of volume activity or distribution.

- The price is known as “balanced” when it is within the distribution blocks. When the price moves outside distribution blocks, it is “imbalanced.”

- The price tends to want to stay within the distribution block and rejects the areas at the edges. It wants to keep in a balanced area and hold in larger volume areas.

Ledge

The ledges mark the edges of the High-Volume Node or Distribution block, where the Volume Profile drops off rapidly.

Value Area

Although this is not marked on the diagram, the Value Area represents where most of the volume occurs and is a useful visual check for traders to see where the activity has been. It is usually defined as the first standard deviation or 70% of the volume traded. Most trading platforms that display Volume Profiles can also display the Value Area.

Point Of Control

Sometimes referred to as POC or VPOC (Volume Point Of Control), the Point of Control shows the price range with the highest volume in that Volume Profile.

- When the price enters a Distribution Block, it will often hit the POC.

- The POC is more useful as a price target for a trade rather than an entry-level.

Identifying Key Levels with Volume Profile

Ledges Are Support and Resistance Levels

Given that the price tends to want to stay within the distribution block, and the ledges mark the edges of the distribution blocks, the ledges make natural support and resistance levels.

Ledges can be used as both price targets and entry levels.

- When the price enters a distribution block, it often wants to hit the other side of the block, i.e., the other ledge. That makes the other ledge a target level.

- When the price escapes a ledge, it will want to move towards the next distribution block. The price can also re-test the broken ledge before moving towards the next distribution block, i.e. the broken turn from support to resistance or vice versa. This concept in technical analysis is known as “support and resistance role reversal.

Point Of Control Is a Natural Target

The Point Of Control is also a natural target, as the price often hits it when entering a previously formed distribution block.

Price Moving Between Distribution Blocks

When the price escapes a distribution block (high volume node), it passes through the low-volume nodes relatively easily to move to the next distribution block.

Using Volume Profile to Confirm Trades

I like to use Volume Profile to find trades from scratch, but many traders use Volume Profile to confirm trades found using other tools, such as Elliott Wave or a chart pattern. This is an excellent way to use Volume Profile because it is an independent piece of analysis that does not use the same reasoning as other methods.

Incorporating Volume Profile into Your Trading Strategy

- Decide how far back to build the Volume Profile on your chart e.g. a 20-day Volume Profile setting will build the cumulative Volume Profile over the last 20 trading days.

- Mark out the Distribution blocks and ledges to find support and resistance levels.

- Determine price levels above or below to be comfortable being long or short. For example, if I see the price above a major ledge, I will assume it will move up easily to the next distribution block.

Common Mistakes to Avoid When Using Volume Profile

- Not using Multiple Time Frame Analysis

A guiding principle in all trading is to use more than one timeframe to line up trades, and Volume Profile trading is no different. However, some traders make the mistake of taking a Volume Profile set up in a smaller timeframe and not confirming the analysis in a higher timeframe. - Not identifying Distribution Blocks

The key to Volume Profile analysis is to mark out Distribution blocks vs. Low-Volume Nodes and manage trades as price moves between the two.

- Overtrading Unclear Setups

Because Volume Profile is discretionary, it is easy to take a lot of trades whenever there is the slightest indication of a price move. But the key to success is to be selective and take only the best setups. - Not Having a Trading Plan or Managing Risk

This is not unique to Volume Profile trading. But it is a common mistake, so it is worth highlighting.

Pros & Cons of Using the Volume Profile Indicator

Pros

- Volume Profile lets you see significant levels that often cannot be found from the price chart alone.

- It is not a lagging indicator.

- Traders can use Volume Profile independently or with other strategies.

Cons

- It is a discretionary tool without fixed rules that takes time to learn.

- Not all charting platforms support Volume Profile.

Bottom Line

Volume Profile analysis can find levels that cannot be easily seen by looking at a price chart or simple volume bars. The key to using Volume Profile is identifying High-Volume Nodes (distribution blocks) and Low-Volume Nodes. I can trade the price as it escapes the ledge of one distribution block to another (using the Point Of Control as a target) or as the price moves within the distribution block from one ledge to another.