What is a “Golden Cross” in Stocks?

A “golden cross”, also known as a “bull cross”, is when the 50-day moving average crosses from below the 200-day moving average to above it. It is a moving average crossover trading strategy. The moving averages are typically calculated using crossing prices from each day within the period.

The crossover gets its “golden” and “bull” names from the fact that this has been seen as a reliable and profitable long-term buy signal. Below I will present the historical data which confirms that this has been true in the US stock market.

Top Forex Brokers

Some analysts prefer to use exponential moving averages (EMAs), where recent prices are given a greater weighting, instead of simple moving averages, or at least to use an EMA for the 50-day moving average. I prefer to use simple moving averages as there is no need to give recent prices a larger weighting, but it makes little difference anyway.

In stocks and other speculative assets such as commodities, the golden cross is a commonly used signal to indicate the start of a bull market – a period of a sustainable rises in the value of publicly listed stocks.

Knowing when a bull market in stocks is beginning can be a powerful advantage to traders, who can buy stocks at this time and hold them for as long as the bull market lasts.

What is a “Death Cross” in Stocks?

The end of a bull market can be forecasted by the opposite signal, when the 50-day moving average crosses below the 200-day moving average. This is known as a “death cross” or “bear cross” and can be used as an exit strategy for long positions.

Golden Cross and Death Cross in the S&P 500 Index 2020-2022

The price chart above in the S&P 500 Index shows the 50-day SMA in gold and the 200-day SMA in blue, with arrows highlighting the golden cross made on 8th July 2020 and the death or bear cross made on 11th March 2022. This period saw the market rise by 33.38%.

The golden cross has been especially effective in the US stock market. Below I will examine its record when used as a signal tool in the main US stock market index, the S&P 500 Index, over the past 50 years.

50-Year History of the Golden Cross in the S&P 500 Index

Golden crosses have occurred 22 times in the S&P 500 Index during the last 50 years (since 1973). If you had used each one as a buy signal, and exited when a bear cross happened, as a moving average crossover strategy - here are the results you would have seen. We can also define a bull market by the 50-day SMA being above the 200-day SMA, so the data also shows the full details of the 21 bull markets since 1973, except the one that was ongoing as 1973 began.

Bull Markets in the S&P 500 Index Since 1973

Following this strategy for investing or trading the S&P 500 Index would have produced very positive results:

- The 21 trades would have resulted in a loss only 7 times. This gives a very good win rate of 66.66% of trades.

- The average trade lasted for a little less than 2 years and produced an average return of 20.80%, annualized at 13.09%, which is a considerably higher annual return than what has been produced by the Index overall since 1973.

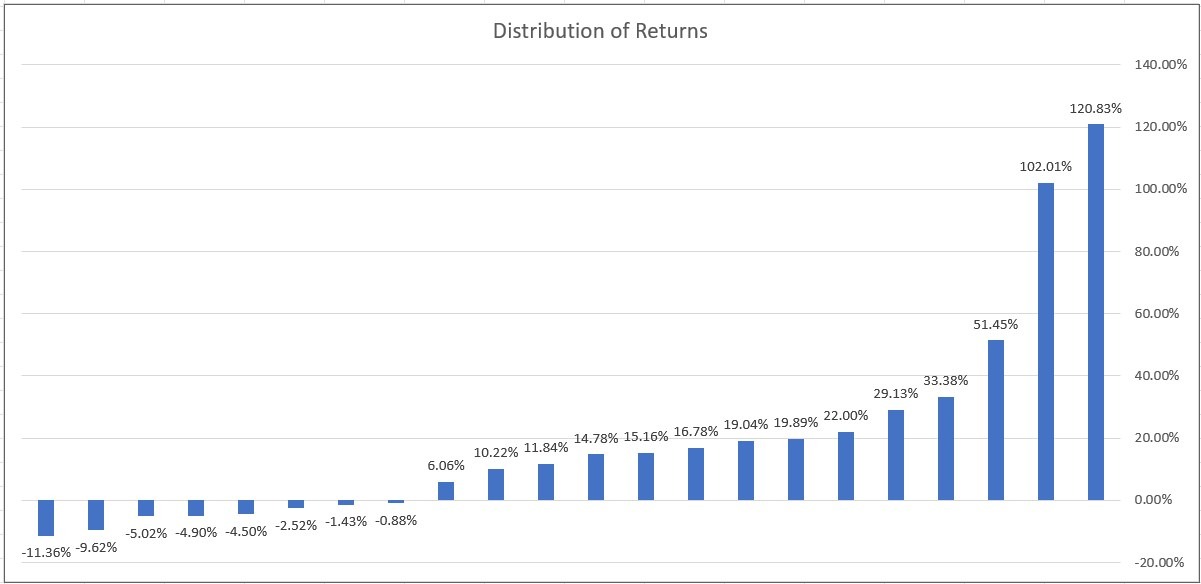

- The losing trades produced by this moving average cross trading strategy were on average much smaller than the winning trades: -5.10% compared to the much larger average win of 33.60%. A graph of the return distributions below shows a heavy leptokurtosis skew (towards positive returns):

Return Distribution S&P 500 Golden Cross Strategy 1973-2023

- When the 50-day moving average is above the 200-day moving average, 53.74% of trading days saw a price increase, with an average daily increase of 0.04%. Taking the entire period since 1973, we see worse results of 52.68% and 0.03% respectively.

- The results do not include dividends or the costs of trading, the latter of which is minimal.

Conclusion

Although a simple buy and hold strategy since 1973 would have produced a higher annualized return over 50 years than the golden cross / death cross moving average crossover strategy in the S&P 500 Index, the risk-adjusted return is higher using the golden cross. This is because it gives you a higher return for your time in the market.

Using this moving average crossover strategy to generate buy and sell signals in the US stock market has an excellent track record over the past half century.

This strategy does not have to be used as a long-term investment strategy. You can simply look for long trades in individual stocks only when the 50-day SMA is above the 200-day SMA. Any long-only stock trading strategy will see improved returns with the help of this filter.

The strategy can also be used with other stock market indices, individual stocks, and the more liquid commodities.

FAQs

What does a golden cross mean in stocks?

A golden cross in a stock or stock index means that the 50-day simple moving average has crossed above the 200-day moving average. It is traditionally the sign of the start of a new bull market, when prices are expected to keep rising for a while.

Which stocks are at a golden cross?

The stocks at a golden cross will change from day to day. At the date of publication, the S&P 500 Index was just about to make a golden cross.

What is the golden cross trading strategy?

In the golden cross trading strategy, you enter a long trade when the 50-day moving average crosses from below to above the 200-day moving average. Different exit strategies can be used, and typically the opposite signal, when the 50-day moving average crosses from above to below the 200-day moving average, which is known as a death cross, is used to exit.

How do you read the golden cross in stocks?

You read the golden cross in stocks by putting a 50-day moving average and a 200-day moving average on a daily price chart and waiting for the 50 to cross from below to above the 200, giving a trade entry signal.