We have now entered a Brave New World of Forex Trading following the disclosure of a US Surveillance program ("?PRISM"), central bank manipulation of currencies ("?currency wars") and random acts of regulators (which are not mutually exclusive). With the increasing politicization of the financial markets, Forex traders are now becoming more exposed to market changes from geo-political rather than economic risk factors. As we know markets subjected to political rather than economic risk factors create unpredictable sharp short term volatility risk and cross country correlation risk which is almost impossible to risk manage and therefore costly to FOREX traders.

The key driver for ongoing FIAT currency intervention is the ongoing battle between emerging and emerged economies trying to out-compete each other for export markets. Some of the competitors in these currency wars are also seeking economic competitive advantage against their competitors via access to information from state owned cyber espionage programs. The ongoing use of illegally obtained information from state sponsored surveillance programs which would likely be used in currency market intervention would further undermine the properly functioning and confidence in FIAT markets.

Politically motivated regulation or lack of regulation remains another key area of risk for FOREX Traders, the LIBOR market manipulation being a prime example. Not only was this a sustained period of manipulation of the trillion dollar fixed interest rate market, under the interest rate parity principle it also represent a sustained per manipulation of the FIAT currency markets by major institutions who have collectively received nothing more than a slap on the wrist (N.B. it would have been speculators with uncovered positions like non-FI FOREX Traders who were most likely to have been negatively affected by LIBOR manipulation). This failure of financial regulators, particularly in the UK and US to supervise market abuses by major financial institutions has set a dangerous precedent for the future with Investment Banks likely to be manipulating markets as before in different forms.

While large FIs have been largely ignored such as HSBC (the largest money launderer in US history), a US regulator FINCEN targeted the financial behemoth Liberty Reserve whose major crime was not that it laundered proceeds from crime but that it may have supported Bitcoin. It must be noted that most of Liberty Reserve customers were just normal consumers, some of which were Banks. So while the same regulators completed shut down Liberty Reserve, advising the media before any trial or other form of judicial process that they were supporters of child pornography and money laundering, HSBC are still trading and none of its staff were prosecuted.

Keen market observers will also have noticed another regulator, the Bank of England quietly jettisoning Paul Tucker who had that famous phone call with Bob Diamond. Despite overseeing and being acknowledged during Parliamentary questioning of Bob Diamond to have supported LIBOR manipulation (now recognized as the largest financial crime ever committed) he was allowed to resign with a pension pot of $8 million.

Photo Credits: www.telegraph.co.uk

Photo Credits: www.telegraph.co.uk

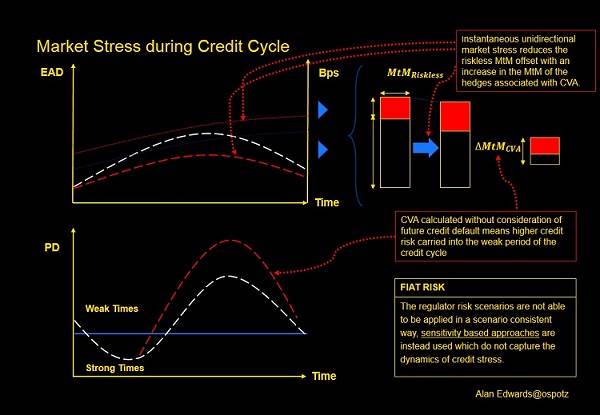

Bringing these strands together we have a pretty dark picture of the future of the world of FIAT FOREX trading, where financial economics play second fiddle to state manipulation of prices by governments. The situation over the next few years will only worsen since we are currently at the middle (high point) of the current credit cycle which means that that the markets will start to experience cross sector correlation risk and a credit squeeze (BIS still has not been able to work out how we properly risk management credit squeezes over a credit cycle despite it being bloody obvious:- ensure the CVA desk includes the credit cycle when calculating the credit charges or mark to market the CVA portfolios). So we can look forward to more FIAT currency manipulation as the currency war combatants who depend on each other experiences future credit squeezes.

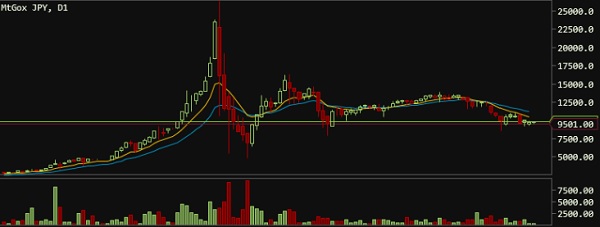

All this interference in FIAT currencies reinforces the need for a currency that is beyond political control by a single geo-political entity and for it to provide security from state interference under the pretext of security. Bitcoins can be still be manipulated, for instance if a government like the US tries to undermine its growth by targeting the FIAT entry points to the market, but only in the short term and not permanently.

As the Bitcoin valuation increases and its integration with normal economy then it will become the most geo politically neutral currency in the world. The lack of political interference in Bitcoin and other crypto-currencies will provide enormous advantages to users and traders alike over FIAT currencies. In particular the need NOT TO REGULATE will be a key one since all financial regulation is pretty much redundant since it is almost always retrospective, rarely applied in the right place and the right time and never proportionate. Bitcoin or another crypto-currency could with some minor enhancements support the self-regulation, politically neutral and market driven currency in a way FIAT currencies could not.