At the turn of the 21st century, gold embarked on a lustrous journey, from trading at a low of $277.10 in 2002, to touching a high of $2075 in 2020, amounting to nearly 11% compound annual growth rate and about 650% return in over 20 years, the latest analysis by Fxview reveals.

The decade of 2002-12 saw the metal turn brighter by nearly six times, while the 10-year US treasury yield fell from 5.4% in 2002 to 1.3% by 2012. The average annual US CPI rose from 1.6% in 2002 to 3.9% in 2008, which to some extent supported the demand for the yellow metal, considered to be an inflation hedge.

Following the 2008 financial crisis, the global GDP shrank about 5% from 2008 to 2009, which boosted the safe haven appeal of gold. Central bankers worldwide slashed lending rates with the US Fed bringing the overall rate down to 0-0.25% by December 2008. Altogether, the high-priced metal gained nearly 75% from 2008 to 2012. By 2013, with the announcement of a likely Fed tapering, treasury yields surged while the non-yielding metal began to slump and plunged nearly 40% between 2013 to 2015.

Making a U-turn amid rising geopolitical tussles and an unprecedented global pandemic, bullion’s safe haven attraction started gaining momentum. It peaked at an all-time high of $2075.14 in March 2020, followed by a gradual recovery across economies and surplus money ensuing from pandemic-related stimulus packages. These corroborating factors caused the exuberance associated with the precious metal to subside and equities represented by the S&P 500 to rise by nearly 26%, while keeping the yield on the 10-year US treasury low, between 0.9%-1.5%.

Next, bullion scored its second best at $2070.42 (March 2022) as a fallout of the Russia-Ukraine war. Investments in gold remained on a back seat in 2022, mainly due to the hawkish monetary policy observed by Central Bankers worldwide to combat inflation. The Federal Reserve embarked on its fastest ever rate hike cycle, increasing the overall rate by 450 bps in less than a year, rendering the non-yielding metal relatively unattractive. Although the level of inflation peaked by Q3 2022, several other economic parameters remained sticky, especially a tight labour market, warranting the need to continue monetary tightening. Stringent lockdowns in China, the largest gold consumer, further limited the metal’s upside in 2022.

The way forward

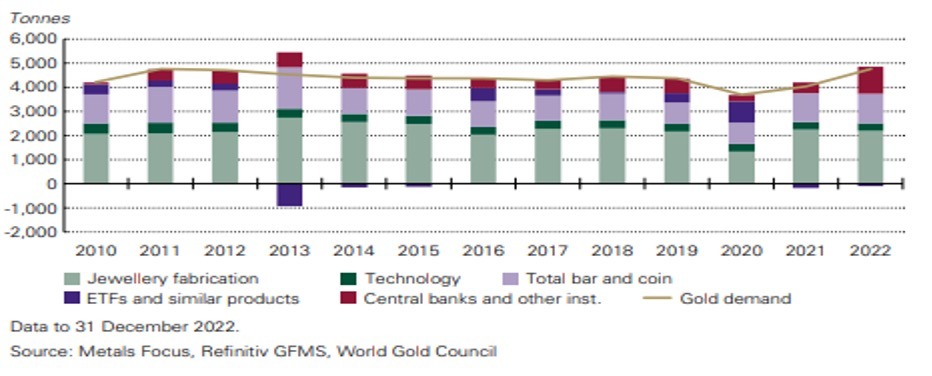

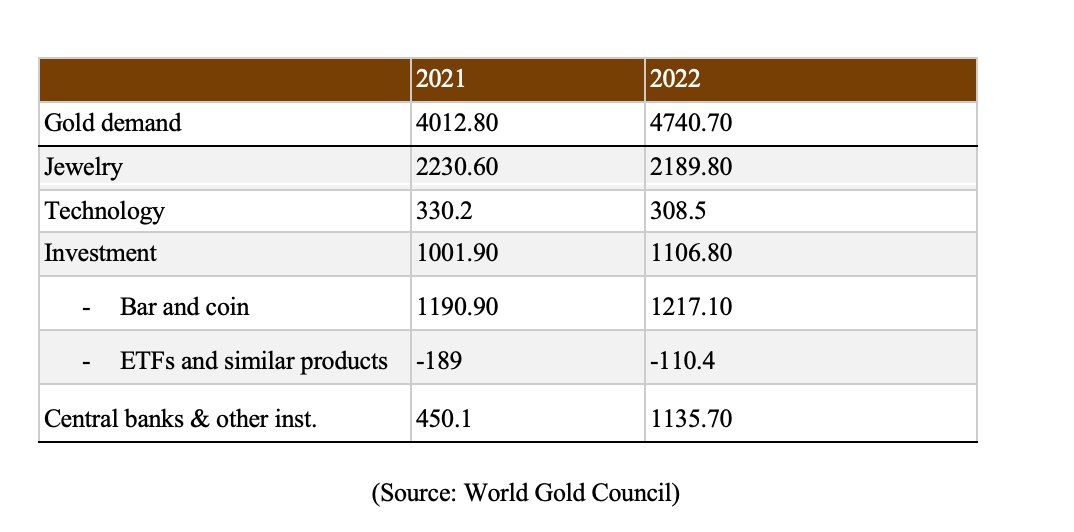

An impending recession and a rate hike pause are likely the key catalysts to drive the yellow metal’s growth going ahead this year. On the demand front, jewellery fabrication and industrial consumption is likely to take a hit. This shall be offset by demand for investment and reserve holding by central banks owing to the metal’s safe haven appeal.

The World Gold Council’s estimate indicated a substantial jump in central banks’ gold demand in 2022 to hedge against any forthcoming financial crisis, while also signals an attempt towards dedollarisation by the economies, making the case stronger for gold as a safe-haven asset.

Macroeconomic and geopolitical tailwinds

A deteriorating economic situation in the recent days has been highlighted by several factors including the following:

- Failure of several US financial institutions including the SVB, Silvergate Capital, Signature Bank and First Republic, in addition to the discount buyout of the ailing Credit Suisse

- Huge layoffs by mainly the tech firms. US unemployment rate rising to 3.6% in the latest estimate for Feb 2023

- Rising cost of financing exacerbating upsurge in sovereign debt levels

- The limited effectiveness of monetary contraction in targeting supply-side inflation

Deglobalization

Low inflation levels, which central banks are trying to target, were largely an attribute of a globalized world, as low-priced goods were produced by outsourcing to other economies. With a sense of deglobalization plaguing the world’s nations, especially since supply chain performance reaching pre-pandemic levels by mere monetary contraction seems far-fetched, according to the Fxview analysis.

With the risk of geopolitical tensions likely to persist, the outlook for gold is strengthened further as not just an investment alternative but a store of value. The war in Eastern Europe is far from reaching an end, the intriguing bonhomie between Russia and China and the widening tensions between the West and China are some of the highlights of the current global paradigm.

Technical Outlook

The precious metal recently moved higher past the $2000 psychological level but failed to close above the same. In the near term, it is likely to retest the zone, attempting to breach its all-time high of $2075/oz, which also corresponds with the 0.5 Fibonacci extension level.

Gold is further poised to clinch a target of $2180, which is a key resistance level corresponding to the 0.618 Fibonacci level followed by a subsequent target of $2200 to be attained by H2 2023. Level of $2200 stands to be crucial, as it also falls in line with the historical growth rate of 11%.

Furthermore, a surge to $2500 by H1 2024 seems plausible, although caution must be observed nearing $2337 (0.786 Fibonacci level). Caution must also be observed as the downside risk remains considerable due to strong fundamental factors in the short run, which can pull the metal down to its immediate support at $1930, followed by support level at $1834/oz, as shown below.

Some of the macroeconomic headwinds include the continuation of a contractionary monetary policy by the Fed, recovery in financial markets and an easing of geopolitical tensions. The Federal Reserve has recently announced the creation of a Bank Term Funding Program to provide relief to eligible depository institutions struggling with liquidity in the near term, which led to temporarily allaying the concerns of a financial crisis.

In this context, the outlook on gold is positive, as investor interest in the shiny metal seems to be improving in the longer term, bolstered by the current economic climate worldwide.