U.S. Dollar. Our bias BULLISH, we’re looking to buy on dips

FUNDAMENTALS: The U.S. Dollar rallied on Friday closing at 75.58, supported by a flight to safety on continuing worries over Greek debt troubles and Fed Chairman Ben Bernanke’s’ signal that a third round of Quantitative Easing was unlikely. Declining equity markets also helped boost the Greenback with the DJIA down 0.6%, S&P500 losing 0.25%, while the NASDAQ gained 1.4%. The coming week sees the formal end of the QE2 asset purchase program and while this hardly guarantees U.S. Dollar strength, it does removes significant headwinds, providing the Greenback with fundamental support in weeks and months ahead. A busy U.S. economic calendar this week sees on tap; Personal Income and Spending, Conference Board Consumer Confidence, University of Michigan Consumer Confidence, and ISM Manufacturing reports. Investors will be watching for the Dollar to be especially sensitive to large surprises in the consumer confidence figures and employment sub-index of the ISM manufacturing report. Meanwhile, with the conclusion of QE, one potential effect is to see the U.S. Dollar once again the safe-haven currency of choice, sparking Greenback rallies on significant turmoil across financial markets. The Dollar has bounce noticeably against the Euro on the risk of a Greek debt default and broader Eurozone instability; however it has lagged in performance behind the other traditional safe-havens, the Swiss Franc and the Japanese Yen. The end of Quantitative Easing is unlikely to be a cure-all for the Dollar’s ills, but it could go a long way in boosting its attractiveness against the similarly low-yielding currencies.

TECHNICALS: Support at 74.50, resistance at 76.50. Technically, the U.S. Dollar appears poised for a break to the upside. Following last week’s doji candle, price has closed near the high on Friday, as well as closing right on the descending trend-line from the June 2010 and January 2011 highs. The May high at 75 94 is the line in the sand for Dollar bears, with a close above this figure accelerating upside momentum and only a close below 74.50 negating the bullish scenario. As such, we maintain a bullish Dollar outlook in the week ahead, looking to buy on dips.

Euro. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: A volatile trading week saw the Euro close at 1.4185 against the U.S Dollar on Friday. Heading into the new week, market focus will once again be on Greece with the Greek parliament set to vote on the medium-term budget (new austerity measures included) no later than 28th June after EU officials have said that this is a prerequisite to receiving the next round of financial aid. Secondly, European officials will then need to approve the 12B Euro tranche. Thirdly, they will need to move on to the 3rd July vote where the discussion will turn to a second possible bailout package for Greece - when it has been suggested that the IMF may not even continue to fund the initial 110B Euro bailout package from May 2010. Finally, policy makers will need to encourage/coerce/manipulate all private holders of Greek debt to “voluntarily” rollover their obligations for a further five years. Even if these hurdles are cleared, it would still be very difficult for Greece to survive its debt burden (from both a financial and social unrest perspective). Notably, these on-going troubles may not even be the tipping point for the Euro going forward as the persistent financial troubles in the region along with a cooling in global growth have lowered risk appetite on a global basis. Should investor confidence collapse, it immediately exposes the Euro-zone’s financial troubles and makes financing the other struggling EU members - Ireland, Portugal, perhaps Spain and maybe Italy - almost impossible through bailout efforts. The troubles the Euro faces are formidable, but markets can often focus on short-term returns that relegate the more macro-important concerns to the backburner. The scheduled Greece related events are likely to produce short term price volatility that offer no guidance for sustainable direction as price trajectory will no doubt manifest through underlying sentiment trends. Aside from these ongoing developments, highlights from the European economic calendar this week will be the German preliminary CPI, retail sales and unemployment change reports due on Tuesday and Thursday.

TECHNICALS: Support at 1.4100, resistance 1.4350. EURUSD closed Friday below the trendline that connects the January and May 2011 lows. If price does breakdown over the coming week, then focus is on the 100% extension of the decline from 1.4940 levels to 1.3720. Extending a trend-line off of the June 2010 and January 2011 lows would see this target reached on approximately on July 9th - 11th. Only a daily close above 1.4300 negates the bearish scenario. As such, we maintain a bearish Euro outlook in the week ahead, looking to sell on rallies.

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Japanese Yen closed last week virtually unchanged against the U.S Dollar at 80.39. The Bank of Japan cited that further easing measures may be needed as the domestic economy continues to see sluggish growth prospects. At the same time, the central bank is widely expected to move in to support its domestic market as Japan struggles to deal with the devastation left behind from the March disasters and with the Fed seen maintaining its zero rate policy through to the end of 2011, all indications suggest further slowing global economic growth and subdued risk appetite. Japan’s economic docket this week sees the May retail trade figures kicking off the week on Monday. Consensus estimates call for a print of -2.2%, a slight improvement from the previous read of -4.8%. Later in the week markets get a closer look at the domestic economy with industrial production, manufacturing PMI, housing starts, household spending, CPI, unemployment and the Tankan surveys all on tap. The reports are expected to show that recent BoJ actions to stimulate the economy were insufficient given the shock from the disasters earlier this year and may prompt policy makers to implement more significant measures. Given the amount of data on tap, coupled with the late week downturn is risk appetite, the Yen’s path over the next week remains uncertain at best.

TECHNICALS: Support at 80.00, resistance 81.00. Gains for the Yen against the Dollar remained limited after numerous attempts to break below solid support at the 80.00 handle. Intra-day resistance for USDJPY is at the 20 SMA, descending trend-line from the April highs and 81.00 level. Although the risk-off environment should benefit the Yen, rapid appreciation in the Dollar and concerns of Bank of Japan intervention may cap any major declines for the pair. Notably, USDPY has bounced off the 61.8% retracement from the 17th March - 6th April rally twice in the last 2 months. We maintain a neutral outlook for the Yen in the week ahead until a clearer picture develops with risk sentiment.

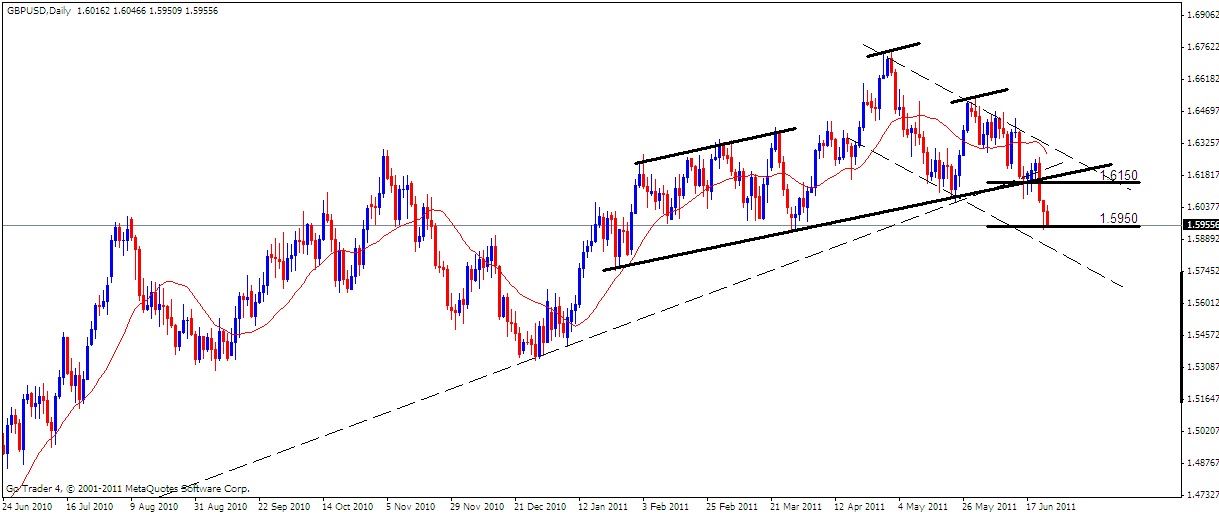

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Sterling slipped to a fresh monthly low of 1.5939 against the U.S. Dollar on Friday following the Bank of England’s dovish tone for monetary policy, and the U.K. currency is likely to face additional headwinds over the near term as the slowing recovery in the U.K. aroused speculation for further monetary easing. The majority of Monetary Policy Committee members see scope to expand the asset purchase program beyond the GBP 200B target, which is likely to see the sharp reversal in GBPUSD gather pace in the second-half of 2011. Although this week’s final 1Q GDP report is expected to confirm a 0.5% expansion in economic growth, the slowing recovery in the U.K. could lead to a downward revision in the growth rate, and a poor reading could exacerbate the reversal in Cable. However, a rebound in U.K. mortgage approvals (46K vs. 45K prior) paired with a faster pace of expansion in manufacturing PMI (52.3 vs. 52.1 prior) may help support the Pound. Nevertheless, the response could be short-lived as household confidence is anticipated to taper off in June, and the data would certainly dampen the outlook for the region as private sector consumption remains one of the leading drivers of growth. Should the bulk of the event risks scheduled this week fail to meet market expectations, GBPUSD will continue to slide heading into July, and the rebound from January may come under pressure as investors speculate for another expansion in quantative easing from the BoE.

TECHNICALS: Support at 1.5950, resistance 1.6150. GBPUSD has closed below the trend-line from the May/December 2010 lows and confirmed a head and shoulders top. Additionally, the 20 SMA has turned over suggesting a change in trend. Using the traditional head and shoulders measuring technique yields an objective near 1.5440 (distance between head and neckline subtracted from point of neckline break), which is near the late 2010 low of 1.5360. A daily close above 1.6150 negates the bearish scenario. As such, we maintain a bearish Sterling outlook in the week ahead, looking to sell on rallies.

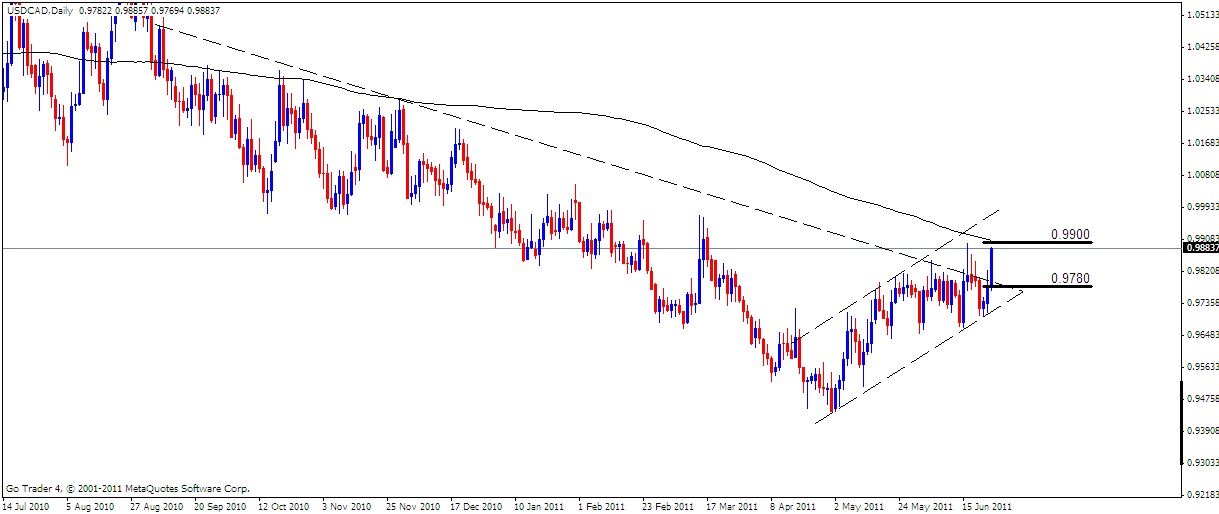

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Last week, the Canadian Dollar fell 0.97% against the U.S. Dollar following a shift away from risk appetite coupled with the depreciation of crude oil prices. The Loonie is expected to see continued downside pressure as concerns linger about the health of the global economy, and, as a commodity currency (a risky asset), the Canadian Dollar is likely to be under pressure in the coming week. Canada has two important events this week that could drive the Loonie further down, and could even result in a potential test of parity with the U.S. Dollar. On Wednesday, the May consumer price index is due, which is forecasted to show a 3.3% jump from the prior month. Price pressures in Canada remained relatively contained, in part due to a stronger Loonie over the first few months of 2011, and with inflation seemingly leveling off; interest rate hike expectations could fall, especially considering data later in the week. Canada releases GDP figures not only on a quarterly basis but a monthly basis as well, and with April’s data expected to show a 0.1% contraction from March, the Loonie could see further downward pressure on a muted growth report. Due to the global shift to risk-aversion that has sent crude oil towards $90.00 per barrel over the past two weeks, and given the inextricable links between the Canadian economy - Canada is the number one exporter of oil to the United States - a global slowdown originating in Europe and the United States could have a major impact on the Canadian Dollar. The combination of risk-aversion, potentially softer GDP and CPI figures could lead to a difficult week ahead for the Loonie.

TECHNICALS: Support at 0.9780, resistance 0.9900. Friday’s break of the descending trend-line from September 2010 is significant as USDCAD has quietly advanced since its late April low. The series of higher highs and higher lows is intact as long as price remains above 0.9670. A break above 0.9900 and the 200 SMA would signal an important longer term bullish break while a daily close below 0.9780 negates the bearish Loonie scenario. As such, we maintain a bearish Canadian Dollar outlook in the week ahead, looking to sell on rallies.

Australian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The Australian Dollar closed last week at 1.0488 against the U.S. Dollar following the market wide shift toward risk aversion. The bearish sentiment underlying the Aussie may gather pace in the week ahead as the shift away from risk-taking behavior continues to dampen demands for the higher-yielding currency. As the economic docket for Australia remains fairly light in the week ahead, the balanced tone held by the Reserve Bank of Australia last week could exacerbate the near-term reversal as interest rate expectations diminish. Although the RBA sees a heightening risk for inflation, the recent comments suggest that the central bank will keep the benchmark interest rate on hold over the coming months as the risks to the global economy become more prominent. As the region copes with an uneven recovery, the central bank may see scope to retain its mildly restrictive policy stance throughout the remainder of 2011, as the global economic outlook remains clouded. According to Credit Suisse Overnight Index Swaps, investors now see borrowing costs holding steady over the next 12 months, and markets are likely to turn increasingly bearish against the high-yielding Aussie as risk appetite is scaled back.

TECHNICALS: Support at 1.0450, resistance 1.0650. AUDUSD has traded in a choppy style since the top just above 1.1000 in May. The choppy action suggests that a corrective pattern is underway with Fridays tentative break of 1.0500 and 38.2 Fib of the 27th March - 29th April rally testing the floor of the descending triangle pattern. A daily close above 1.0650 negates the bearish scenario, while a close below 1.0450 accelerates declines to next key support by 1.0200 levels. As such, we maintain a bearish Australian Dollar outlook in the week ahead, looking to sell on rallies or a daily close below 1.0450.

New Zealand Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The New Zealand Dollar closed on Friday at 0.8094 against the U.S. Dollar. Weakness was common amongst risky assets last week, as the Japanese Yen, Swiss Franc and the Dollar were the three strongest currencies. With markets clearly shifting to a risk-averse state, the Kiwi, like the Australian Dollar and Canadian Dollar, remains particularly vulnerable this week. New Zealand has some event risk in the days ahead that could help soften the blow by a major shift in market sentiment should the Greek parliament fail to pass the proposed austerity measures necessary to ensure the fifth tranche from the European Troika. On Sunday, ahead of the Asian session open, trade balance data for May is due, which is forecasted to show a decline from NZD1113M down to 1000M. That being said, exports are forecasted to have remained elevated, rising from NZD4651M in April to 4725M in May. However, the differential in imports is expected to have weighed on the net exports figure, rising from NZD3750M from 3538M, as a stronger Kiwi over the past few months has boosted domestic demand for foreign goods amid stronger purchasing power. Also on the docket is the building permits data from May, which is forecasted to show further strengthening of the New Zealand housing market, with the print figure expected to show a 3.2% expansion. Since March 17th, the Kiwi has been the strongest major currency, having gained 13.27% versus the Japanese Yen and 11.58% against the U.S. Dollar. Its worst performance over the same period was against the equally impressive Swiss Franc, on which it gained a weaker figure of 4.64%. Regardless of data, NZD-based pairs will see significant price action as markets brace for the potential news of a Greek default, that would likely send a massive outflow of funds from risky assets into safe haven assets, and the Kiwi could be a casualty of the debt war as broader market risk sentiment will be the key driver of price action over the coming days.

TECHNICALS: Support at 0.8100, resistance 0.8190. As price remains contained by the 61.8 Fib of the 9th - 16th June decline, NZDUSD’s break of the 17th March - 17th May ascending trend-line suggests an important reversal from the 0.8300 highs is in progress. The implications are for a sharp decline from the current level to 0.7960 and further down, key support by 0.7800. Only a daily close above 0.8190 negates the bearish Kiwi scenario. As such, we maintain a bearish New Zealand Dollar outlook in the week ahead, looking to sell on rallies.