U.S. Dollar. Our bias NEUTRAL, we’ll be sidelines until a clearer picture emerges

FUNDAMENTALS: By last Fridays close the U.S. Dollar Index had shed 1.2% after a tense week for financial markets as the August 2 U.S. debt ceiling deadline looms closer and risk aversion flows saw the S&P500 fall 3.9%, the Dow decline 4.2% and the NASDAQ drop 3.6%. Markets are showing real fear that the U.S. Congress and President could fail to pass an extension of the debt ceiling before the country runs short of funds and becomes insolvent, which virtually guarantees volatility in the week ahead given the debt ceiling threat and Fridays Nonfarm Payrolls report. If an agreement before the 2nd August deadline is not reached, it is unclear how markets could react. At the moment, equities continue trading lower alongside the U.S. Dollar, and momentum would favor further declines in both. A breakthrough on the debt ceiling could in theory reverse recent losses and it will be important to watch what happens and await Monday’s open to see how markets react to the developments. Once markets get past the uncertainty surrounding the debt ceiling, U.S. economic data will again come to the forefront highlighted by the July Nonfarm Payrolls report on Friday. June’s disappointing NFPs data quickly weakened the Greenback against all major counterparts - especially the Japanese Yen - as traders priced in low U.S. interest rates for the foreseeable future. Any similar disappointments from July’s data could legitimately push the balance in favor of fresh Fed monetary policy accommodation and Quantitative Easing Part 3 (QE3). Given Fridays dismal GDP results, it could be only a matter of time before investor’s price in QE3 and the U.S. Dollar sinks accordingly.

TECHNICALS: “The consolidation from the May low at 9,337 has broken lower from lower from the triangle/wedge pattern to re-test said low in recent price action. The decline from 9,757 is unfolding in 5 waves and given that triangles do tend to precede the final move of a trend (exhaustion,) a new low may give way to a U.S.Dollar bottom. After exceeding near term resistance at 9,429 in a 4th corrective wave, the Greenback has plummeted sharply and expectations are for a print at a new low, possibly in a truncated 5th wave. This would complete 5 waves down so expectations are for potential bottom and reversal. As such we remain Dollar neutral in the week ahead until a clearer picture emerges.

Euro. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: At last Fridays close, the Euro had completed a round trip after trading in a 300 point range against the U.S. Dollar, by closing just 3 pips shy of its 25th July open at 1.4398. During the week, Greece was downgraded by both Moody’s and Standard & Poor’s yet again, citing that the restructuring effort from the EU would constitute a temporary default. Notably, the ISDA (the group responsible for determining whether a default event has taken place and swaps should be paid out) has indicated that it would not trigger Credit Default Swaps as a result of the EU program. The real threat however, comes should the sovereign debt infection move closer to the core EU economies. After Moody’s put Spain on review for a possible downgrade last week, the market was reminded that the strain is building for Portugal, Ireland, Spain and eventually Italy. Looking at the week ahead, the ECB rate decision is scheduled for Thursday. Economists are unanimous in their expectations for a hold at 1.50% but the market seems to be pricing in a 62% chance of a 25 bps hike - but that may be just a side effect of the unusual risk influences we’ve seen recently. ECB President Trichet’s commentary will undoubtedly be scrutinized after his ‘strong vigilance’ phrase that markets attribute to a coming rate hike was dropped at last months meeting.

TECHNICALS: Following last weeks false breakout of the descending trend-line connecting the May, June and July highs, EURUSD then broke below the short term support line connecting the 12th, 18th, 21st and 28th July lows. Both trend-lines now intersect at the current market price and serve as a formidable barrier to further upside gains. We are looking lower to key support in the 1.4000-1.4100 area as a measured target with stops above 1.4500 and remain Euro bearish in the week ahead.

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Japanese Yen was up more than 1.8% against the U.S. Dollar last week as traders sought refuge on concerns that the U.S. may default if no agreement on raising the debt ceiling is reached by August 2nd. Additionally, a stronger than expected retail trade report, small business confidence data, housing starts, and employment figures all supported the Yen. Notably, while the Yen continues to appreciate, investors remain wary of a possible central bank intervention after Japanese Finance Minister Yoshihiko Noda stated that, “markets are diverging recently from the strength of the actual economy.” Noda also added , “considering such a severe condition, I will take appropriate actions while cooperating with the Bank of Japan.” The remarks come just days after BoJ board member Kamezaki urged that Yen gains could hurt exports and corporate profits. Looking ahead this week, the economic calendar is highlighted by the June labour cash earnings report, the BoJ rate decision, and the June leading index. While Bank of Japan is expected to hold it’s the benchmark interest rate at 0.10% through the end of 2012, investors will be lending a keen ear to the accompanying statement after the central bank upped its economic forecast earlier this month, citing, ”economic activity is picking up with an easing of the supply-side constraints caused by the earthquake disaster.” If policy officials continue to talk up the economic assessment, investors may begin to discount the possibility of further easing measures from the BoJ, and the Yen is likely to stay well supported at current levels. Safe-haven flows continue to be diverted into the Yen and the Swissie as traders remain reluctant to hold the U.S. Dollar on fears of a possible default, but as the Yen advances, investors remain poised as Japanese officials are watching the currency’s rapid appreciation. The threat of a central bank intervention should limit intra-day yen advances while the underlying trend continues to favor U.S. Dollar weakness.

TECHNICALS: USDJPY continues to fall and the March panic low at 76.27 is an obvious target. There are several Fibonacci extensions at the March low - the 100% extension of the 7th April high, 5th May low and 19th May high and 100% extension of the 12th July high/low and 20th July high - indicating that this may be a level of significant support. If 76.29 gives way, then the next extension comes in at 74.43, the 161.8% extension drawn from the 12th July high/low and 20th July high. The imminent prospect of BoJ intervention in the week ahead leaves us with a neutral Yen bias until a clearer picture emerges.

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: At last Fridays close, Sterling was up against the U.S. Dollar, Euro and Canadian Dollar while down against the safe-haven Swiss Franc and Japanese Yen. Economic data from last week was highlighted by the 2Q GDP, and while the reading of 0.2% fell in line with expectations, it still represented weak growth, compared to the 0.5% quarterly growth rate in the first quarter. Similarly, on a yearly basis, growth was subdued at a 0.7% annualized rate in the second quarter. Part of the blame for declining British growth can be pointed towards lower consumer spending, which has led to erosion in the housing sector, as evidenced by Friday’s Nationwide Housing prices data which showed 0.4% trimmed off prices over the past year in July. Looking at the week ahead, the headline event comes on Thursday, with the rate decision for August on the docket. The Bank of England’s Monetary Policy Committee is expected to maintain its key benchmark rate at 0.5%, as the MPC’s focus remains on economic growth rather than on reducing inflation as the U.K. is facing an inflation rate of 4.2%, more than double its mandated target of 2%. Policy makers agree that the economic outlook is not stable enough to withstand higher rates at the current time, given the eroding condition of other aspects of the economy, mainly the housing and employment sectors. With economic recovery expected to be shaky in the short and medium-term, the MPC will likely hold the bank rate at 0.5% through to the end of 2011, as inflationary pressures have been alleviated as of late. Credit Suisse Overnight Index Swaps point towards the same conclusion, with a mere 3.0% chance of a rate hike expected at Thursday’s meeting. As such, rhetoric following the Bank of England decision will guide Sterling over the coming days with investors anticipating a dovish tone.

TECHNICALS: GBPUSD’s rally from the 12th July low at 1.5800 has unfolded in 5 waves. Last Friday’s surge will probably complete 5 waves from said low and give way to a top and reversal. The 31st May high at 1.6546 is probable resistance and the expected decline should prove to be an ABC corrective wave. As such, we maintain a bearish Sterling bias in the week ahead.

Canadian Dollar. Our bias BULLISH, we’ll be looking to buy on dips

FUNDAMENTALS: The Canadian dollar lost ground last week against its major counterparts as economic activity unexpectedly weakened in May. However, the Loonie is expected to pare its recent losses this week as growth prospects improve with the employment report forecast to increase another 15.0K in July after expanding 28.4K in the previous month. Additionally, business spending is expected to increase at a faster pace with the forecast for the Ivey PMI set to increase to 61.2 from 59.9 in June. As private sector activity picks up, fundamental developments may encourage the Bank of Canada to drop its balanced tone for monetary policy, but the softer pace of price growth paired with the contraction in GDP could lead the central bank to maintain its wait-and-see approach throughout the remainder of 2011. In light of the recent comments by BoC Governor Mark Carney, it seems as though the BoC will carry the 1.00% interest rate into the following year even as the central bank projects the economy to reach full capacity by the middle of 2012, and the near-term rally in the Canadian Dollar may continue to give back the advance from earlier this month as rate expectations falter. According to Credit Suisse Overnight Index Swaps, investors now see borrowing costs increasing by less than 50bp over the next 12 months, which compares with bets for nearly 75bp worth of rate hikes earlier in July.

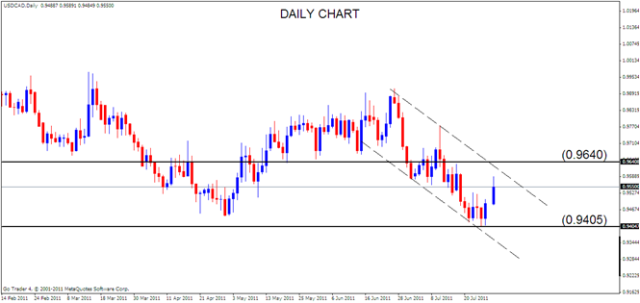

TECHNICALS: USDCAD has rallied sharply from the 26th July low at 0.9405 but faces potential channel resistance at 0.9600 levels. Trading above 0.9640 on a daily close basis would indicate that a more permanent low is in place but expectations are for price to decline from 0.9600 for another test of 0.9400 and as such we maintain a bullish Loonie bias in the week ahead.

Australian Dollar. Our bias BULLISH, we’ll be looking to buy on dips

FUNDAMENTALS: The Australian Dollar held up well last week rallying 230 points at one stage despite global shares plunging. Looking at the week ahead, Aussie strength may prove to be temporary, with the overwhelming headwinds battering risk appetite poised to weigh on the commodity based currencies. The Aussie did find support after an impressive 2Q CPI reading that printed an annual inflation rate of 3.6%, topping economists’ forecasts and marking the highest reading in 2½ years. The outcome proved to be a boom for interest rate expectations, pushing the currency to new record high against the U.S. Dollar, but expectations of further rate tightening seem likely to be short-lived. The RBA Governor Glenn Stevens’ statement accompanying July’s rate decision explicitly said that while “inflation is likely to remain elevated in the near term due to the extreme weather events earlier in the year, it is likely to return close to the target level as temporary price shocks dissipate”. Meanwhile, the global risk-sentiment landscape remains fraught with danger. The U.S. deficit reduction impasse will take center stage over the weekend and into Monday, setting the tone for early price action, and the commodity based Aussie may be vulnerable at its elevated heights on increased risk aversion sentiment.

TECHNICALS: AUDUSD may trend sideways to down early this week to meet the channel line that comes in at 1.0900 levels. A tag of that line would provide an opportunity to get long for a rally to a new high at a measured target of 1.1167, the 161.8% extension of the 27th June low, 8th July high and 12th July low. As such we remain Aussie bullish in the week ahead.

New Zealand Dollar. Our bias BULLISH, we’ll be looking to buy on dips

FUNDAMENTALS: The New Zealand Dollar extended the advance from earlier in July to reach a fresh record-high at 0.8794 last week, and may continue to gain ground in August as the Reserve Bank of New Zealand plans to bring the benchmark interest rate back to 3.00%. After holding the cash rate steady for the third meeting, the RBNZ cited “little need for the March insurance cut to remain in place much longer”, and the central bank looks as though it will normalize monetary policy later this year as the recovery gather pace. At the same time, RBNZ Governor Alan Bollard talked down speculation for a cash rate beyond 3.00%, stating that underlying inflation is expected to stay well within the 1-3% target range, and went onto say that the marked appreciation in the exchange rate reduces the need for additional rate hikes as it drags on the real economy. Despite the balanced tone held by the central bank head, Credit Suisse Overnight Index Swaps show investors seeing the cash rate increasing by more than 100bp over the next 12-months, and expectations for higher borrowing costs should help to prop up the Kiwi in the week ahead as investors weigh the prospects for future policy. Looking ahead this week, Thursday’s employment report may be the catalyst for a near term correction in the Kiwi as the labour force is expected to hold flat for the 2nd quarter after expanding 1.4% in the 1st quarter, while the participation rate is projected to fall back to 68.4% from 68.7% during the same period. As labour growth cools, the data could foreshadow a slowdown in private sector consumption, and the RBNZ may scale back its optimism towards the economy should the data come out worse than expected.

TECHNICALS: NZDUSD’s rally from 1.8109 is viewed as the 3rd wave within a 5 wave advance from 1.7965. If 1.8783 is not a top, then expectations are for a 4th wave correction (possibly a triangle or flat) that ends near or below 1.8620. A drop to 1.8620 levels would present a buying opportunity for the wave 5 advance to new record highs and as such we maintain a bullish Kiwi bias in the week ahead.