Trades placed by optionFair

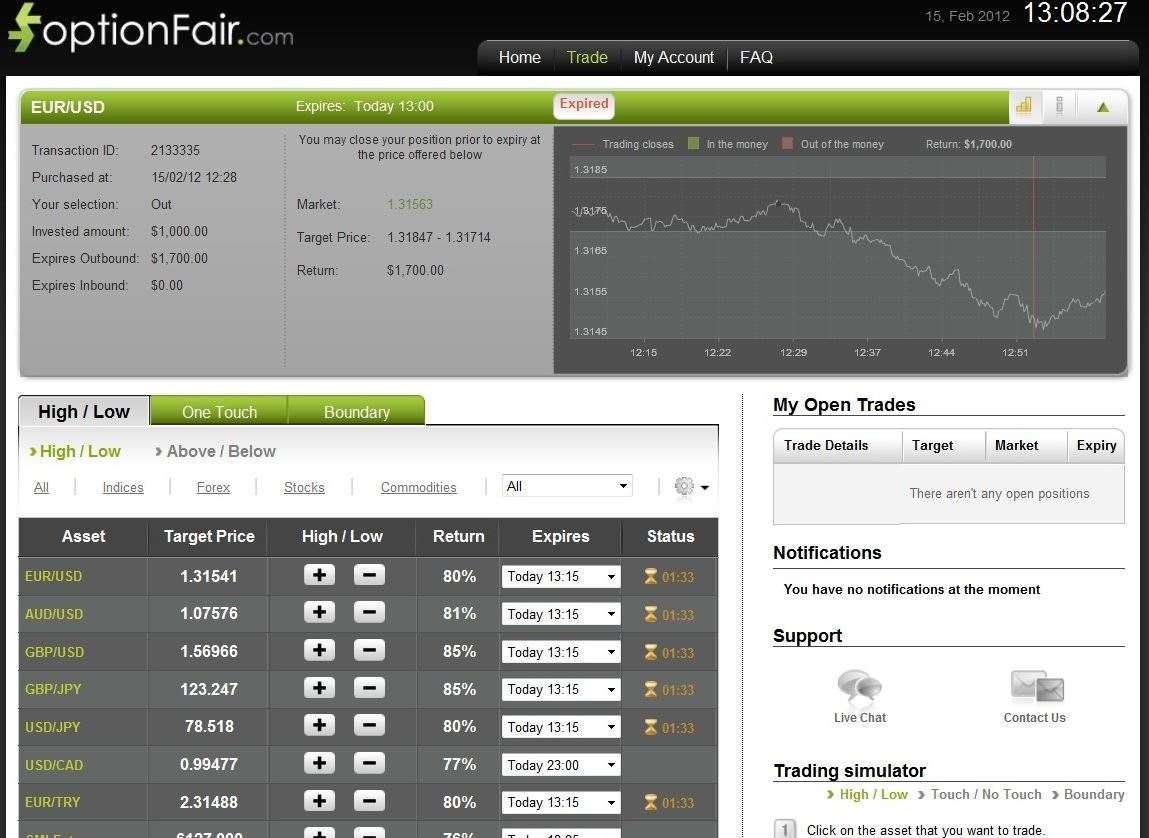

EUR/USD

Based on Christopher's analysis the pair EUR/USD is showing signs of high volatility.

Volatility is the relative rate at which the price of a security moves up and down. Volatility is found by calculating the annualized standard deviation of daily change in price. If the price of a stock moves up and down rapidly over short time periods, it has high volatility. This behavior gives me the opportunity to trade on the "Out" and "Touch" instruments.

I logged into the optionFair™ Binary Options Trading Platform and decided to place money on the "Out" instrument. I traded $1,000 on the pair (at 12:28) with the price of 1.3176 and the boundary I received was 1.13847 – 1.31714. The payout for this option is 70%, which means that if the signal is correct I'll earn $700.

The expiration took place at 13:00 with an expiry price of 1.31563 which is out of the boundary I started with and therefore I won the trade.

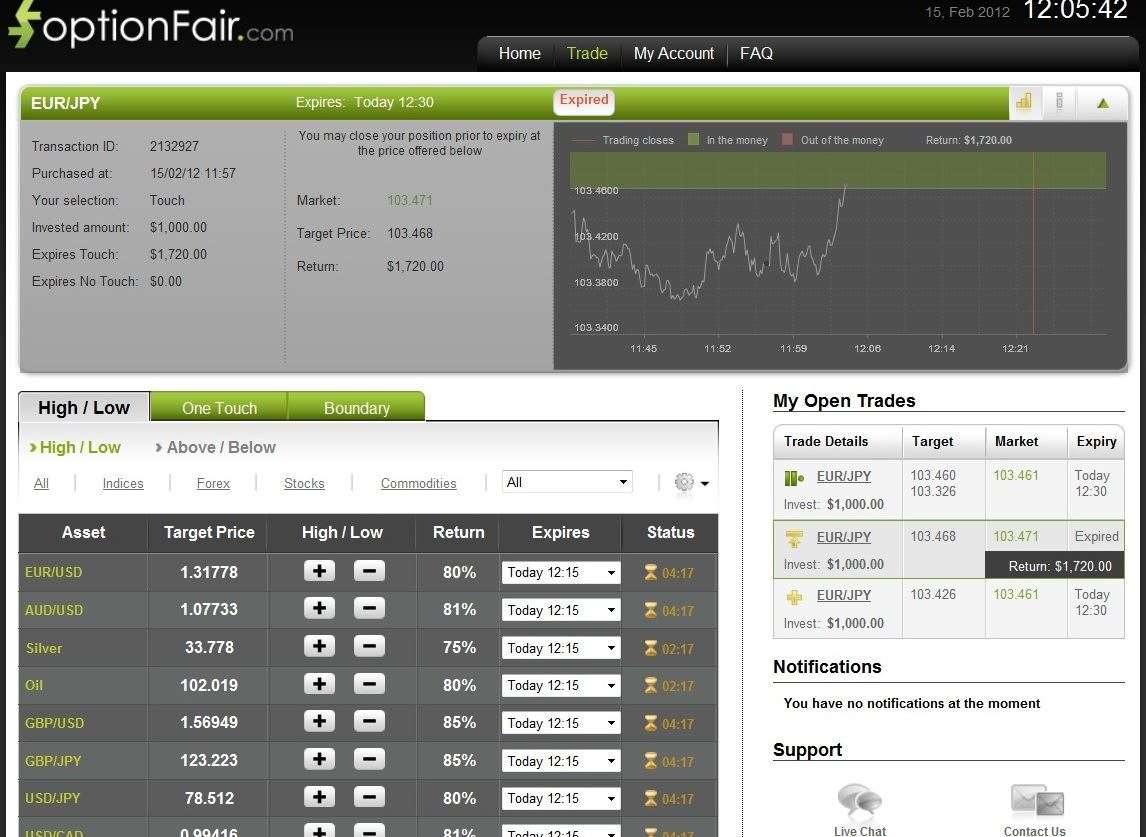

EUR/JPY

According to Christopher Lewis’s analysis of the EUR/JPY, the pair continues to rise. That creates an opportunity on the instruments:

• “High” - The underlying asset will be above the target price when the expiry time of the option is reache

• “Touch” - The underlying asset reaches the target price at any time during the lifetime of the option. (Should a touch option reach the target price at any time during the lifetime of the option then the option automatically and immediately expires “In the Money”).

• "No Touch Down" - No Touch option is used when you speculate that the current price will not touch the target price until expiration.

I logged into the optionFair™ Binary Options Trading Platform and the buying price was above 103.395. I decided to trade on the “Touch” instrument, believing that the option will touch. This kind of option has a return of 72% if the option hits the strike price prior the expiry time.

At 11:57 I traded with $1,000 and I got the strike price 103.468. It took only 8 minutes and the market touched the strike price giving me $720 on my investment.