By: Christopher Lewis

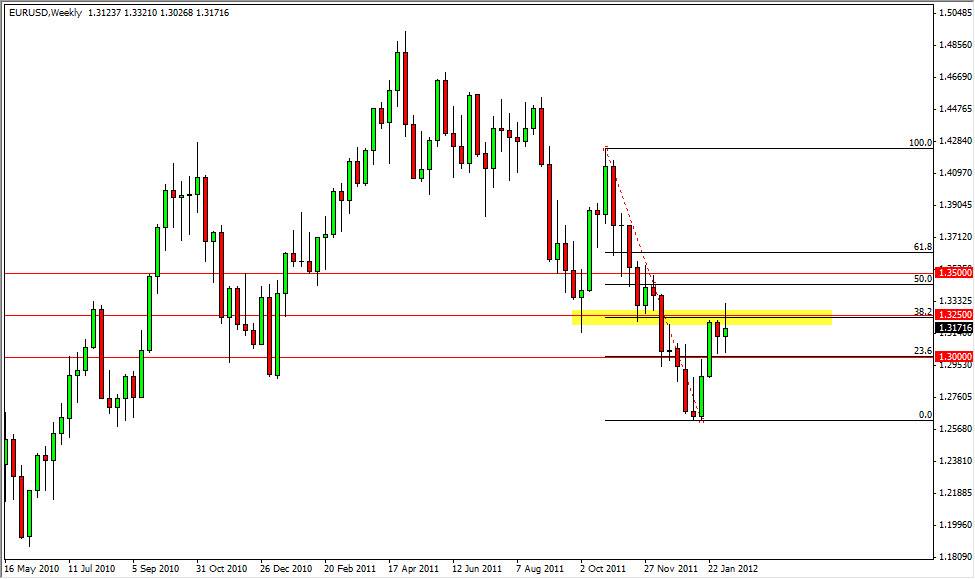

EUR/USD

The EUR/USD pair fell during the previous week as the debt crisis continues to drag on. The pair continues to be the focal point of the Forex world, and will the market trying to push the pair up before a potential announcement, when Friday came about with signs of failure – the pair had to fall.

Also of note is the fact that the candle is a shooting star, and formed at the 38.2% Fibonacci level. The 1.30 level now becomes very important as it is just under the bottom of the candle, and a break below that would send this pair much lower. Until the 1.35 level is broken to the upside, I am simply not interested in this pair.

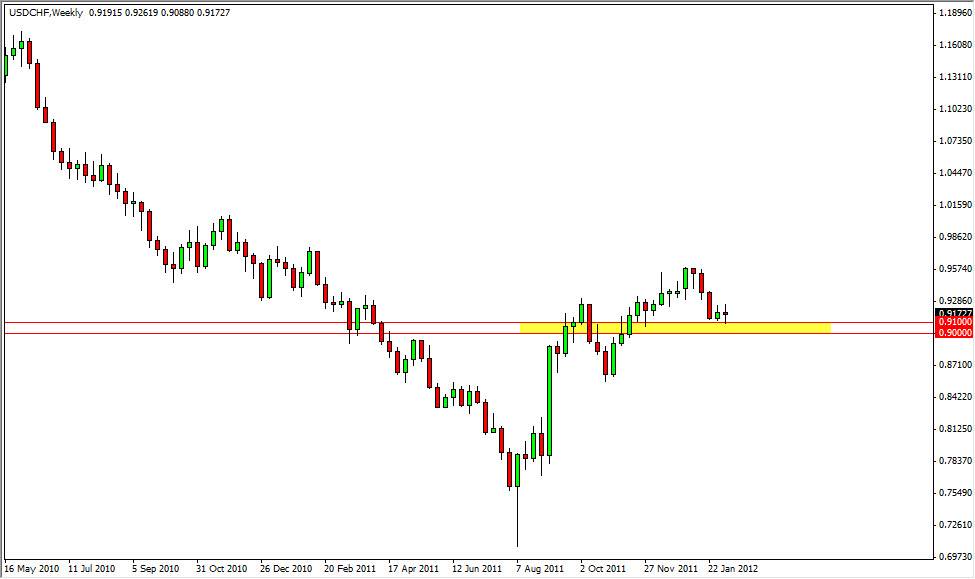

USD/CHF

USD/CHF continues to bounce around the 0.91 level as the floor put in place by the Swiss National Bank (in the EUR/CHF) continues to put a floor in the XXX/CHF markets. The pair doesn’t directly have a floor in it per se, but if the Swiss intervene in the EUR/CHF pair, this one will rise as well. The candle is a bit of a hammer, albeit a stubby one, and this suggests that we may see a bounce at this point in time. The Swiss are highly exposed to the European economy, and as a result will more than likely get a hit as well from the recession coming to Europe. Because of this, the pair is a “buy only” one for me.

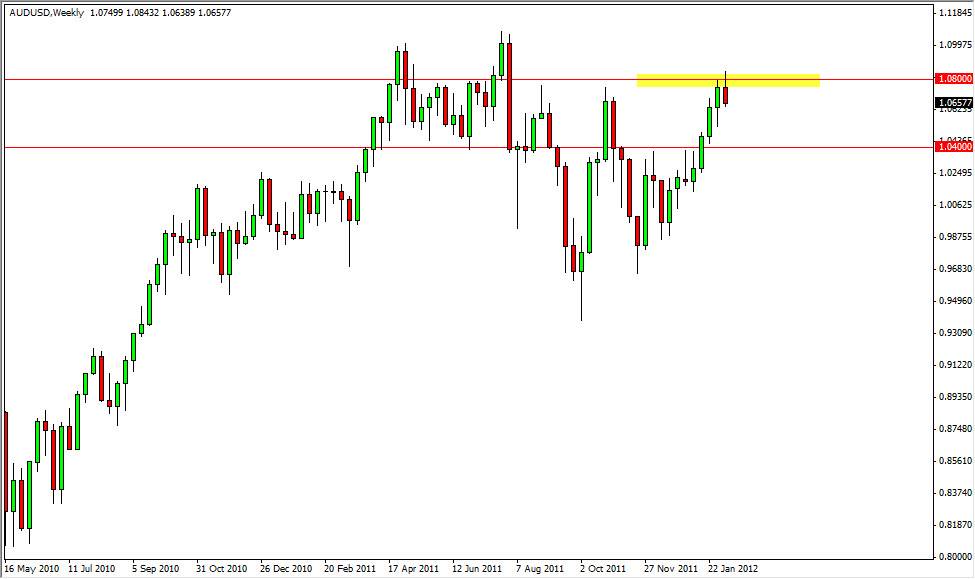

AUD/USD

The AUD/USD pair has been very strong over the last few weeks, and the fall that we saw over the week was probably a necessary evil in this uptrend. The pair fell, but I feel that it is going to prove to be an opportunity to buy the Australian dollar on the cheap. The 1.06, 1.05, and 1.04 levels will all be potential support levels, and I will look for supportive price action in order to go long. It isn’t until the 1.04 gets broken on a daily close that I would consider selling at this point.

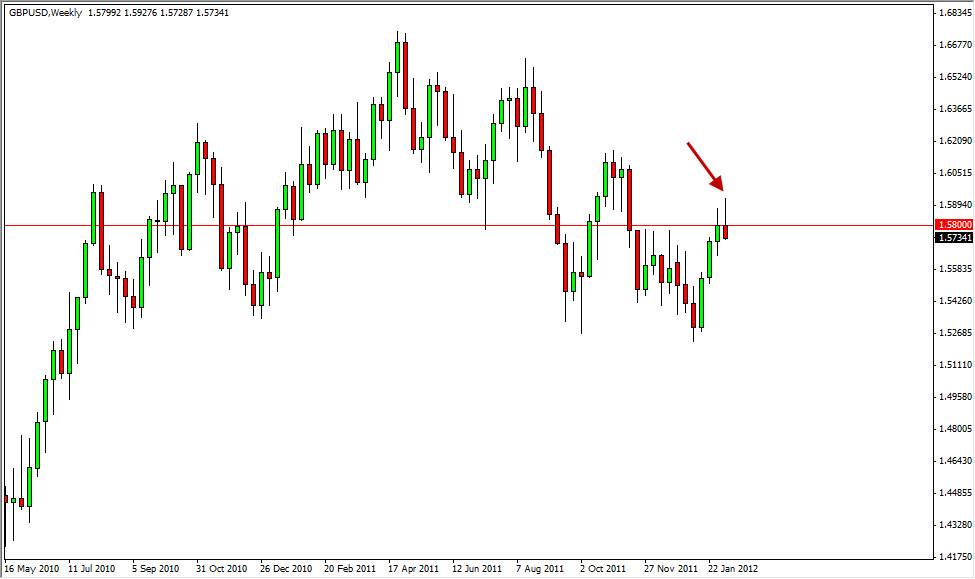

GBP/USD

The GBP/USD pair has been very strong for a while now, but the move is far too parabolic to last for good, and the Friday session gave the pair a potentially strong sell signal. The 1.58 level has been one I have watched with great interest for some time now, and it appears to have pushed back against the bulls. The weekly candle is a shooting star, and looks very weak all of the sudden.

The 1.57 level is only a couple of dozen pips below the bottom of the range of the candle, so I am going to wait for a sub-1.57 level, and will short this pair looking for a move to the 1.53 level. The risk off attitude that the markets could find itself in should propel this pair lower if we get the move. I wouldn’t consider a buy until we are clear of 1.60 in this pair.