GBP/CHF is a pair that I don't often talk about, but it is one that can offer strong returns as it does tend to trend in move so rapidly in one direction or the other. In the current environment, the Swiss National Bank has been working against the value of the Swiss franc actively. The SNB has even gone on record as saying they are buying British pounds, which obviously lends itself to having this pair rise over time.

Typically, this is a risk on type of environment for the Forex trader. In times of past, the Swiss franc would be the currency of choice for many looking to find shelter in the financial markets. However, with the Swiss interventions this has changed somewhat. In fact, it almost makes the Swiss franc related pairs one way trades. One obvious example is the Swiss franc against the Euro, anyone who has looked at this pair over the last several months knows that there is a floor and it at the 1.20 level. The main reason they can't rise isn't the Franc, it's the fact that the Euro and sell unlocked. Contrast this with the British pound, which of course is a currency that many Europeans are using is a safe haven. Is because of this that we think this pair will eventually rise in value.

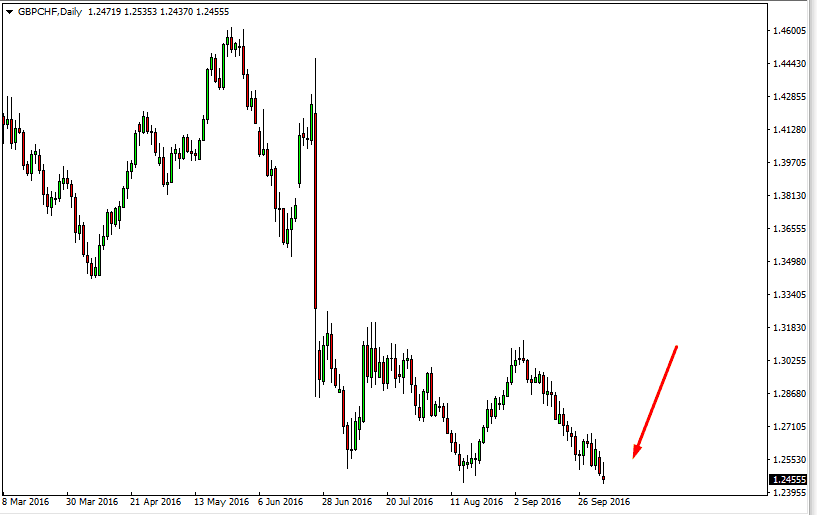

Bullish flag

One of the most intriguing things about this pair to me right now is the fact that it doesn't seem to be on anyone's radar. While the rest the world talks about Europe and European problems, they tend to focus solely on the Euro itself. However, one should remember that there are several different European currencies still, and the Pound and Franc are two of them.

Currently we have a bullish flag that starts near the 1.44 level, and rises to the 1.51 level. This suggests that we will see a 700 pip gain if the top of this flag is broken. With the Swiss National Bank working against the value of the franc, and the British pounds relative strength against other currencies in comparison to the Euro, this move would make sense. I have no interest in selling this pair, only buying a breakout.