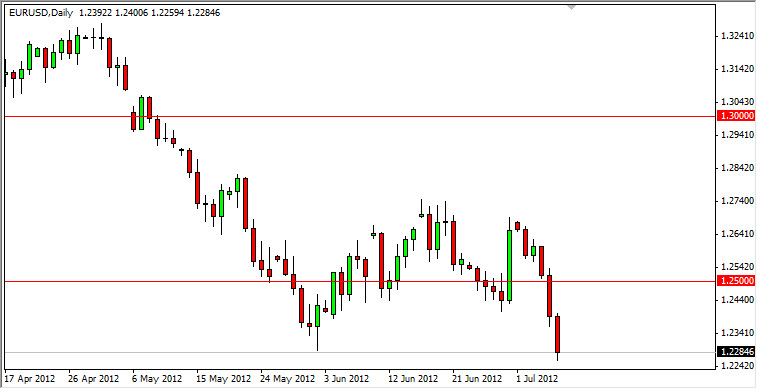

The EUR/USD pair plunge during the Friday session in reaction to a weaker than expected jobs around the United States as traders simply wanted to cover riskier assets. This of course pushes money into the US treasury markets, and as a result brings down the value of the Euro as the Dollar is been up.

However, we all know that the Euro has bigger problems than a run to US treasuries. The fact is that the European Union is a broken concept, with the most poignant example being the currency. The latest example is the fact that the market has reclaimed all of the gains from the latest scheme announced in Brussels. This simply shows how much market and its participants distrust the European leaders at this point in time. 19 summits later, and we are still debating whether or not a solution even exists.

Because of their dragging on of the situation, politicians in Europe have assured that the currency continues to fall in value. With this being said, every rally in the Euro over the last several months is simply been an invitation to sell from higher levels. I see absolutely no reason to think that this is going to change in the near term, especially considering the fact that we managed to dip below the 1.23 level which of course is a two-year low.

1.15 Here we come

The recent bearish flag that I have been paying attention to in this pair suggests that we are going down to 1.15 as a target. I sadly cannot argue with this, because the situation in Europe just isn't getting any better. Spanish and Italian bonds both are seeing yields spike, and this is without a doubt one of the biggest examples of the rest of the world not trusting Europe right now. Every time we get a solution, it just tends to be another example of "smoke and mirrors" instead of concrete solutions like the market is starting to demand. I am absolutely astonished that the markets have been as patient with Europe as we've seen over the last two years. With this in mind, I believe every rally will continue to be a selling opportunity and that a breaking of the lows from Friday also as a selling opportunity. I cannot fathom a situation in which I would buy the Euro at this moment.