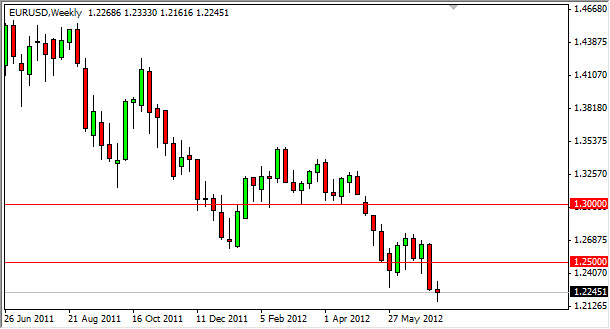

EUR/USD

The EUR/USD pair had a relatively benign week was it was all said and done. Initially, it had fallen yet again, but did manage to bounce back off of the 1.22 support level in order to form a hammer for the week. While I do not expect any type of massive surge from here, a bounce from this area could perhaps see a return to the previous consolidation area. Nonetheless, I still think that in the end, the Euro is to be sold and never bought.

I believe that the 1.25 level will not be overtaken anytime soon. In fact, I think that the 1.23 and 1.24 levels are more than strong enough to slow down the ascent by bullish traders.

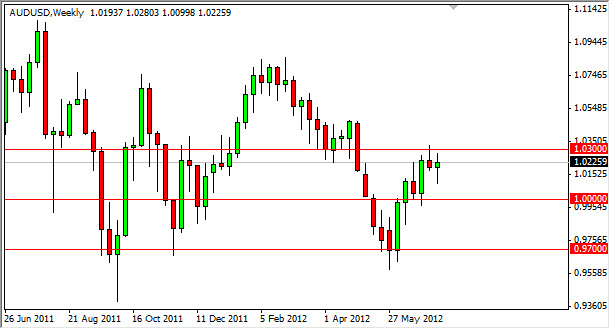

AUD/USD

The AUD/USD pair managed to fall drastically during the week and then turn around and rise drastically. This formed a hammer, and it does suggest that perhaps as it conflicts with the previous week’s shooting star that we are going to see a sideways grind in the near term. I believe that this pair eventually will end up falling, as the 1.0350 level looks so resistive. Of course, the parity level will offer some type of support as well, but I think eventually we see 0.97 or so. There could be an initial pop in this pair based upon Chinese rate easing, but that will be a temporary move, and one that should be faded.

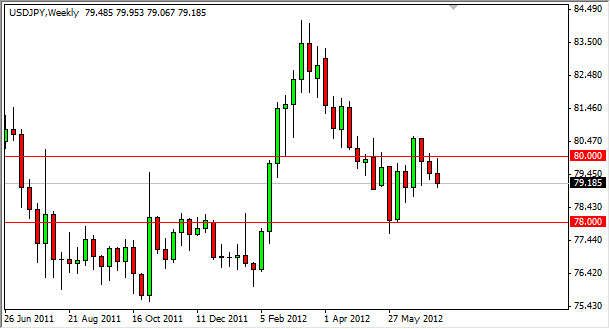

USD/JPY

The USD/JPY pair did very little during the week, as it tightens off its range to within 100 pips. The 80 handle above is obviously resistive at this point, and the 79 handle below is obviously supportive. The Bank of Japan has clandestinely intervened in this market previously, and as such I suspect that the79 area is where they are doing it now. This is probably predicated upon the fact that they expanded their asset purchase program by 10 trillion Yen, only to see this pair fall the very next day.

The Bank of Japan is working against the value the Yen below as well, and I feel that 78 is where they will get really aggressive at that point and start intervening again. Because of this, I only want to buy this currency pair and not sell it. If we can get a break above the recent highs at the 80.60 level that would be enough for me to be convinced that momentum is swinging to the upside. I believe if we get that, we will eventually get the 84 handle. If we fall, I would be very interested in any type of supportive candle near the 78 handle.

EUR/GBP

EUR/GBP is one of the few very clear pairs to me right now. Is dead obvious which direction you should be trading this one, so obviously there is a whole lot to say about it other than the support keeps giving way. The one thing that I would noted however, is the fact that the Friday session smashed through the bottom of two consecutive hammers. This is an extremely bearish turn of events.