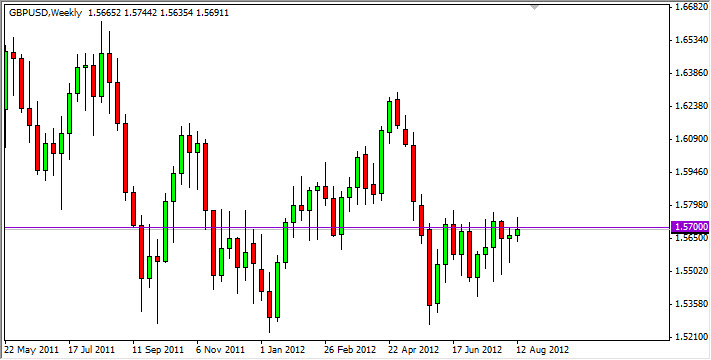

EUR/USD

The EUR/USD pair had a slightly bullish week as the pair rose the majority of the five sessions. However, the weekly candle looks a bit like a shooting star, and as a result it looks like we will continue to struggle to see higher prices.

The pair is currently in a rising wedge pattern that is a bit clearer on the daily charts, and this suggests to me that the pair will fall sooner or later. The 1.25 level above looks very resistive, and as such I don’t think we get above it. In fact, the 1.24 level is where I start looking for selling opportunities. I am also willing to sell a break below the uptrend line in the rising wedge as well.

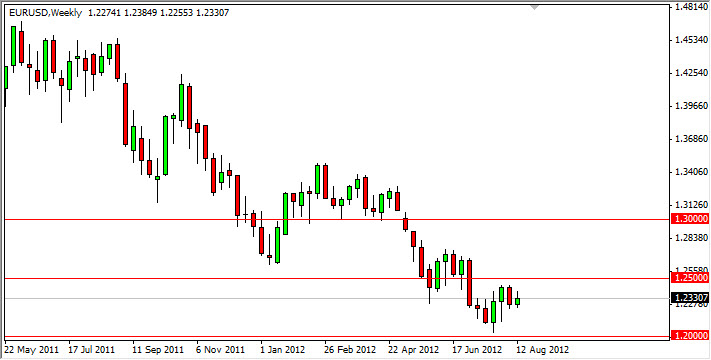

AUD/USD

The AUD/USD pair had a horrible Friday session that made up most of the losses. The pair is currently sitting at the bottom of an up trending channel, and as a result I am still a bit bullish of this pair. The Friday session did look horrible, but it stopped before breaking below that all important trend line. Because of this, I think that any signs of strength will be bought. After all, most large central banks are in an easing pattern, and this is good for gold…..which the AUD follows under most circumstances.

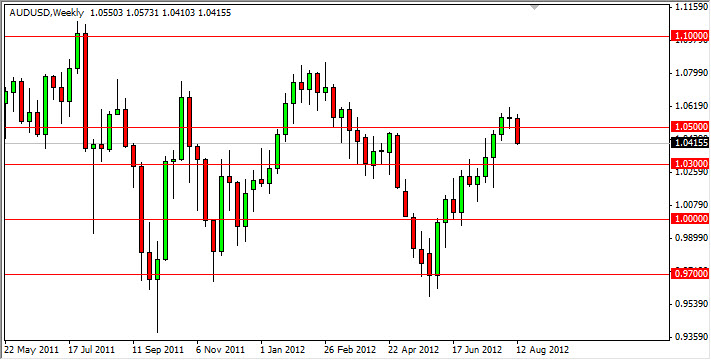

USD/JPY

The USD/JPY pair had a massively bullish week as the interest rates in the US rose. The pair tends to follow the ten year notes in America, and as the rates rise, so does this currency pair. The pair is heading into serious resistance though, and so are the ten year yields. Because of this, I think the move has only a little farther to go. With this in mind, I am not buying until the 80.60 level is taken out to the upside, or the pair pulls back and shows support closer to the 78 handle.

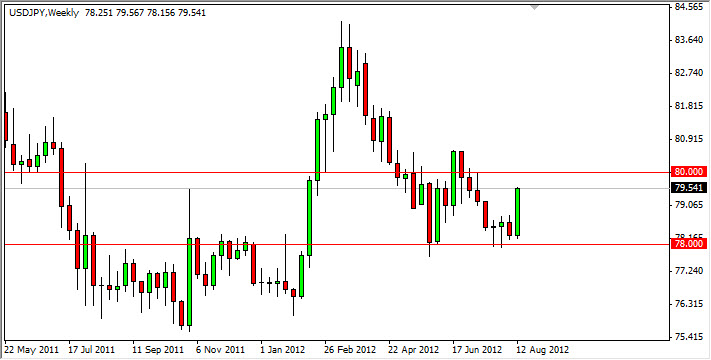

GBP/USD

The GBP/USD pair formed a shooting star for the week, after attempting to breakout several times. Normally, this would be a massively bearish thing for me, but the fact that the bulls have been so persistent about buying on dips has me reluctant to sell. In fact, I think it is only a matter of time before the 1.58 level falls. If it does – this pair goes much higher. Nonetheless, I am a selling if we get below the 1.55 level.