The EUR/USD pair fell during the session on Tuesday as the "risk off" trade came back into play. I currently see several markets showing extreme weakness about anything relating to risk, and it is because of this that I am not a fan of shorting the US dollar in general right now. I certainly see that the Euro is getting a bit of a reprieve, but in the end I think there are far too many unknowns in Europe right now in order to go long the Euro against the US dollar of all currencies.

If I want to play the Euro, I will do it against other currencies as the charts are much clearer in several other pairs. In a world that has several unknowns, you will often see people run back to the US dollar for safety. I believe that this is why this pair has been so difficult to trade over the last month or so.

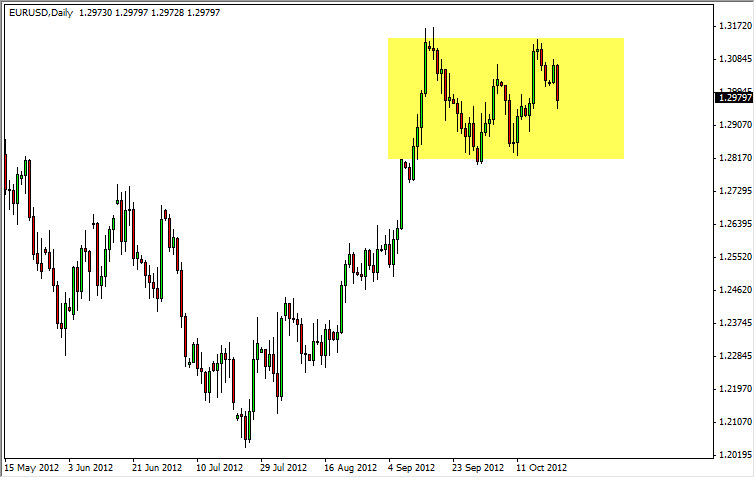

A ton of resistance above

Above the current area, I see an absolute ton of resistance all the way to the 1.35 level. Yes, I do see the fact that we are consolidating and there is a certain amount of support in this pair, but the overhead area simply looks too strong for me to go against. In fact, I would like to see a nice clear signal to sell the Euro at the 1.28 level as it would be a much cleaner trade.

Remember, a lot of this is based upon quantitative easing out of the Federal Reserve, and the possibility of the Spanish asking for a bailout. It may be that the market is going to grow tired of this game that the Europeans have been playing, and punish them accordingly.

Nonetheless, I am not buying this pair as I don't like being short of the Dollar against a currency that is so unknown in its various risks. Because of this, I really don't foresee trading this currency pair until the pullback began that is so desperately needed, and desperately deserved as the run higher has been well over done.