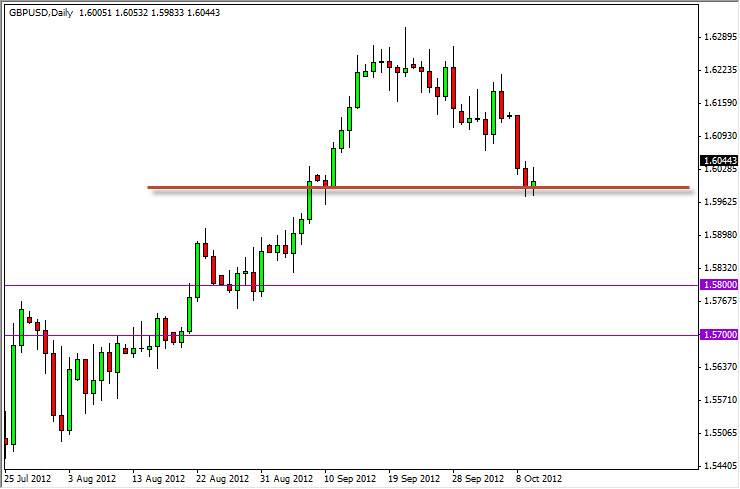

The GBP/USD pair fell again during the Wednesday session, to test the 1.60 handle. This area is of significance to me because of the "large round number aspect" of the value. Most of these large numbers will attract traders in one way or another, and as such we often see moves right around them.

Previously, we had seen a hammer formed the last time we were in this general vicinity, and this should suggest support. We did break out of a massive ascending triangle, and that should not be forgotten. This should in theory keep a bid under this market, and as such I feel that this pair is very possibly going to be one of the strongest over the next several months.

The Bank of England is sitting still with its interest rates and monetary policy. When you contrast that with the Federal Reserve, which of course is expanding its quantitative easing policies, by all means all things being equal this pair should continue to rise.

1.60, 1.58, 1.57

Looking at this chart, I can see three different areas that interest me as far as buying a supportive candle would be concerned. The 1.60 of course as I've mentioned previously, as well as the 1.58 and 1.57 levels. The reason for the 1.58 level is that it was the last vestiges of resistance for the ascending triangle that we broke out of in order to go much higher. 1.57 of course is the bottom of that zone, and I actually treat that as one big line.

When I look at this chart, I see the potential for a pullback all the way to the 1.57 area, and a bounce much higher. In fact, I think this would simply invite buyers to take advantage of cheap prices. In a world of almost zero yields everywhere, anytime you can get some type of interest rate paid to you, it will attract investors. I believe that going forward, this will eventually win out, although there will be runs to the Dollar from time to time. Again, I am looking for supportive candles to buy.

**Please note that due to circumstances beyond our control, this analysis was posted with a delay, but we hope that it will still help some traders understand the market.