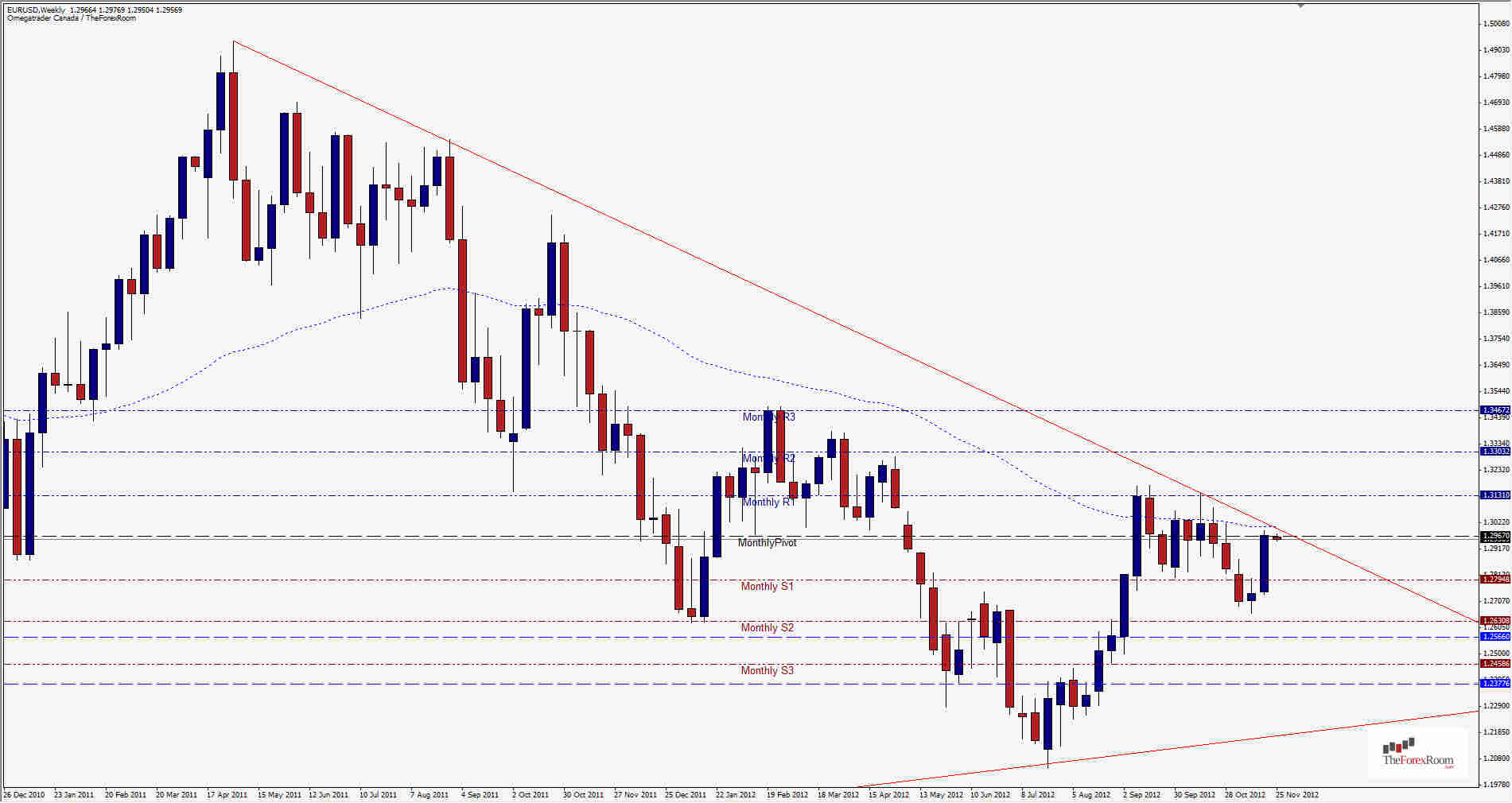

The EUR/USD moved higher last week from 1.2736 to 1.2989, just shy of the Weekly 62 EMA at 1.3005 and a descending trend line at the same level dating back to May of 2011 with a high then of 1.4940. The pair is now up against serious resistance at the 1.3000 level and will need to close above the level and outside of the descending trend line to proceed higher. Further resistance will come into play at 1.3131, 1.3303 & further up 1.3467. If price turns around and heads lower indicating a strengthening USD, we will see support at 1.2795, 1.2631 as well as 1.2459. Considering the Euro zone has officially slipped back into recession, we could see this pair drop from this level as it has struggled to break this level so many times, but the USD isn't particularly strong right now while investors await decisions on how to address the infamous 'fiscal cliff' that looms only a few weeks away. This is a pair that from a technical standpoint could easily go either way, and as a result could be tricky to trade for the immediate future.

EUR/USD Tests 1.300 Again

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address