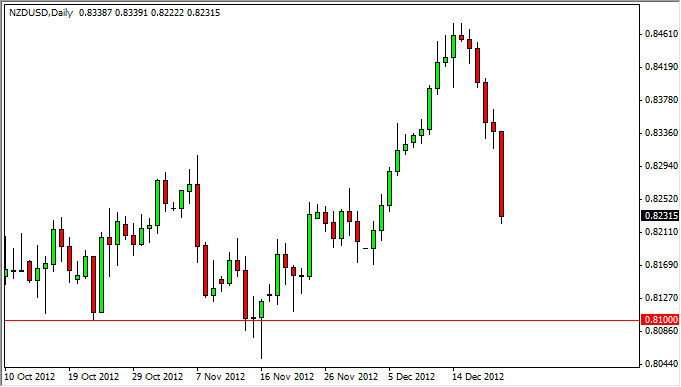

The NZD/USD pair fell precipitously during the Friday session as the "risk off" trade came back into play. The New Zealand dollar is one of the most sensitive currencies to rest, as it represents an amalgamation of the commodities markets in general. In other words, it is a great "mood ring" for the futures markets on the whole.

The candle for Friday was vicious, and we close towards the very lows. This market has suffered a serious pullback over the last couple sessions, and one has to think that lower prices are coming. The biggest problem I have with this thought process of course is the fact that the 0.82 and 0.81 levels below should continue to offer quite a bit of support. By frankly, the easy move has already been done. Now we start to enter significant areas that could offer just a significant support.

Fiscal cliff

Unfortunately, the “fiscal cliff” talks continue to drag on in Washington DC. Quite frankly, this is what is spooking the market in general, and of course gets people running from things like commodities and commodity currencies like the New Zealand dollar. Oddly enough, most of the driving factor for this currency right now is the fact that the United States Congress is so dysfunctional.

I believe that we will see some support in this marketplace between here and the 0.80 level. I know that's kind of a big statement, but the truth is that we are entering a very "spongy" area of the chart that should offer support, and doing so during a very illiquid time of year. Honestly, I believe that if we get some type of deal out of Washington DC, this pair will be one of the quickest movers to the upside as people start to take on risk again.

Most people will pay attention to the Euro when this move happens, but this pair will more than likely outdo that pair by quite a bit. One of the great things about the New Zealand dollar is that it moves so much faster than any of the other majors.