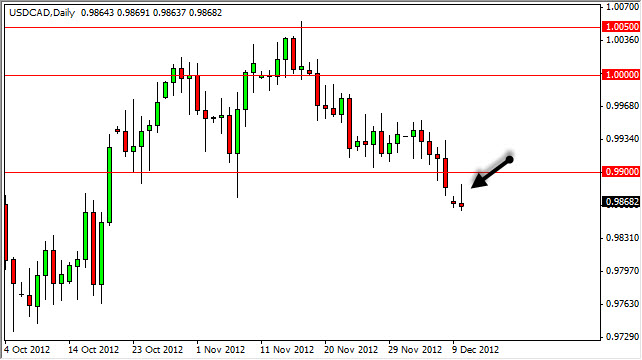

The USD/CAD pair rallied in the beginning part of the Monday session, but found the previous support at the 0.99 level to offer far too much resistance to get above it. It should also be noted that we gapped at the open for the Monday session, but we have bounced enough to fill that gap, and as such it looks like we could be able to continue lower.

For some time now, this pair has been chewing away the 0.99 support level, and now we have a clean break. The shape of the candle is a shooting star, and this suggests that we are going to see continuation to the downside. This wouldn't be a huge surprise, as the overall trend is most certainly to the downside, and this pair has been very bearish for a long time.

Recently, we had seen quite a bit of consolidation between the 0.99 handle and the 1.0050 level, but we have no broken out of that and it looks a bit like a head and shoulders formation has broken down. (I do admit however that you have to use a little bit of imagination for the right shoulder.) Nonetheless, whether it is a real formation or not, it certainly suggests the same thing.

Watch the oil markets, and the FMOC

Over the course of the next couple of days, we will have to watch the oil markets as the Canadian dollar tends to increase in value as petroleum does as well. More importantly, the FMOC meeting could produce more weakness in this currency pair as it appears that the Federal Reserve may be back into doing more asset purchases, which of course weakens the US dollar over time as they have to "print" more of them.

Adding to the potential bearishness of this pair is the fact that the jobs number out of Canada was excellent last week. Also, the jobs number out of United States was as well. This often leads to bullishness in the Canadian dollar as Canada since 85% of their exports south of the border. On a break of the lows from the Monday session, I will begin shorting this pair.