The USD/CAD pair has been a great pair for people that are looking to range trade lately. This makes sense as the two economies are so intertwined. The fact that there is a “fiscal cliff” possibly happening in the United States will continue to hurt the Canadian dollar as well. After all, the Canadians send 85% of their exports into the US, and they need economically healthy customers to buy all those raw materials that they are known for exporting.

With this backdrop, it isn’t a massive surprise about the consolidation that we have seen. After all, there are a lot of traders that simply aren’t willing to get too long or short in this scenario. The fact is that if the fiscal cliff is avoided, the Canadian dollar will gain as it will be seen as a bullish event for risk assets, including commodities – which is of course a positive for the Loonie.

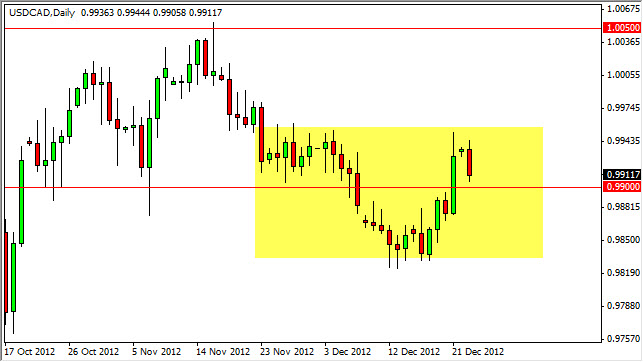

The box

We are currently bouncing around in a larger box that seems to be bordered on the upside at the 0.9950 level, and the downside at the 0.98 level. Because of this, I see a couple of different ways to trade this market.

On the short-term side, simply selling at the highs and buying at the lows makes complete sense. This pair has a long history of going sideways, and as such is one of my favorite short-term pairs. The pair will go on for ages, bouncing between two levels only to suddenly break out. So what do you do when the market finally breaks out? Follow it!

On the break out, we should see a significant move as a result. This pair can move 300 pips in a blink of the eye as the market will suddenly “shift” in one fell swoop. I think that ultimately, the Federal Reserve and its monetary easing will drag this pair down, but we need to see the fiscal cliff “solved” or at least “patched up” before we can really start moving lower. Once that happens, I think that the 0.95 level will be seen in short order.