The GBP/USD pair had a very strong opening on Wednesday as Asian traders reacted to the news that the United States Congress came to an agreement on the so-called "fiscal cliff" situation. In typical "risk on" fashion, the US dollar was sold off in general, while the British pound was purchased. This currency pair has a long history of rising with risk appetite, as well as falling with it. The fact that we may this move during the Asian opening should have been a surprise for many people.

However, the way the Europeans and Americans reacted to it truly was interesting. After all, the stock markets around the world skyrocketed, with the Dow Jones Industrial average closing up 308 points. This should have been a very bullish day for this currency pair, all things being equal, which is why the massive selloff later in the day truly stands out as striking.

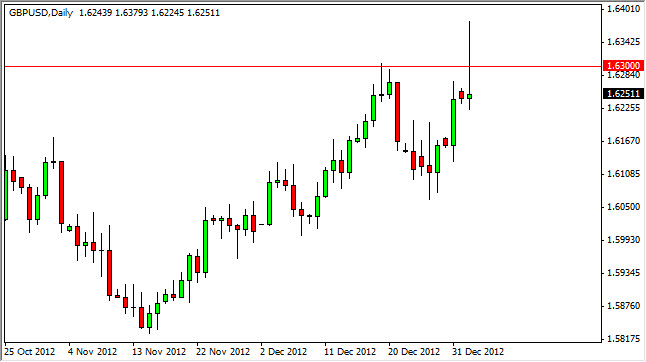

Shooting star

I have been saying for some time that the 1.63 level is significant resistance in this currency pair. I see it on the longer-term charts, and truly believe that it is the gate to higher prices, perhaps all the way up to the 1.70 handle. I still think that's the case, but the fact that we have this massive shooting star now really gets me wondering whether or not we have the ability to break out quite yet.

On a break of the lows, I believe that we will see a return to the 1.61 handle as the markets choose to pullback. Quite frankly, the way this pair acted was very concerning to me from the bullish side on Wednesday. However, if we managed to break the top of the shooting star all things would be forgiven, and the British pound would continue much higher.

I believe that the next couple of sessions will be very important for this currency pair, and if we can manage to break down below the 1.61 handle, we would have a massive reversal waiting to happen. Ultimately, I still think we are going higher and I do think that the top of the shooting star will be broken eventually. However, I don't think that it's completely out of the realm of possibility to see a pullback to the 1.61 handle, and as such will be looking to buy support somewhere near that area.