From all indications, Gold is set to resume its upward ride into the New Year 2013 due to the recent developments being in its favor. With the U.S. Congress finally reaching a compromise on a fiscal cliff deal, it is a bullish signal for Gold along with other commodities.

For the just concluded year 2012, Gold recorded its 12th consecutive year of gains which also stands out as the metal’s longest winning streak in more than nine decades. More good news for bullion is that the Central Banks of top economies e.g. China, U.S., South Korea and India have pledged to accelerate economic growth using all the resources at their disposal. Other countries are also aggressively pursuing fiscal policies that will diversify their foreign reserves away from the U.S. dollar, into gold and other assets.

Consequently, global investors and traders of gold exchange-traded products (ETPs) are positioning themselves with billions of dollars to buy the high value commodity at every opportunity. This means any time there is a pullback in price due to unexpected geopolitical risks or price correction, gold buying is expected to resume.

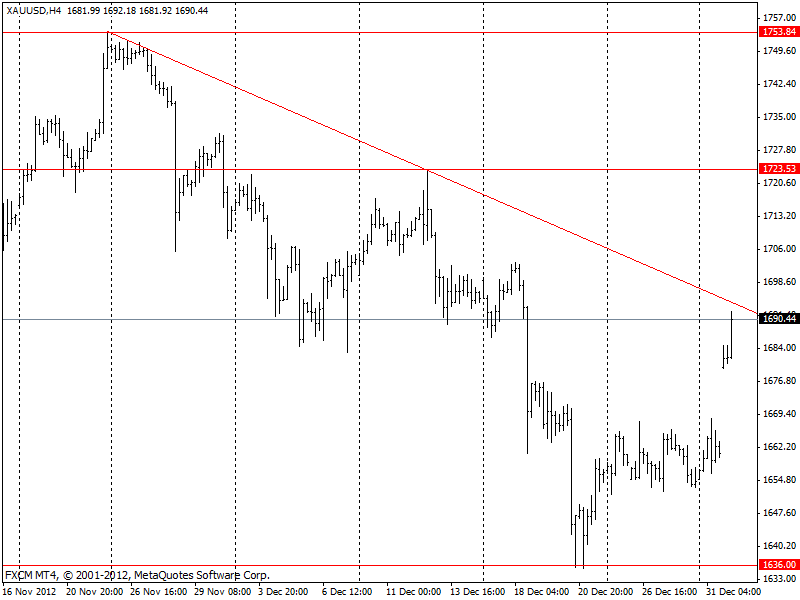

Another key driver of XAU/USD is the U.S. Federal Reserve’s fourth round of Quantitative Easing. This latest round is dubbed “QEnfinity” because of Fed Chairman - Ben Bernanke’s pledge to let it go on indefinitely. Endless pumping of dollars into the system results in a weak U.S. dollar. This translates to a commensurate rise in the price of gold. Watching inflows of this commodity is a good measure of its risk-on mode over the coming months. From the supporting fundamentals outlined above, a 3-month forecast for gold is its November 2012 support-turned-resistance at $1,750-53 an ounce.

Target level for 6 months is its February and October 2012 highs of $1,786-94. A recommended buying level will be a dip towards the most recent December 2012 support of $1,636-40. The chart below shows a short to medium term outlook indicating strong bullish momentum; a buildup that is likely to breakout of the downward trendline.

In the coming sessions, an ounce of gold should be valued at the first resistance level of $1,723 before later traveling towards the 3-months forecast of $1,750-53.