The NZD/USD pair is one that is very risk sensitive. The action on Monday was certainly positive, and as such it shows that the markets expect some type of deal in the "fiscal cliff" talks coming out Washington DC. If this is the case, this should be very good for risk assets such as the New Zealand dollar, and it would make sense that this pair should continue higher.

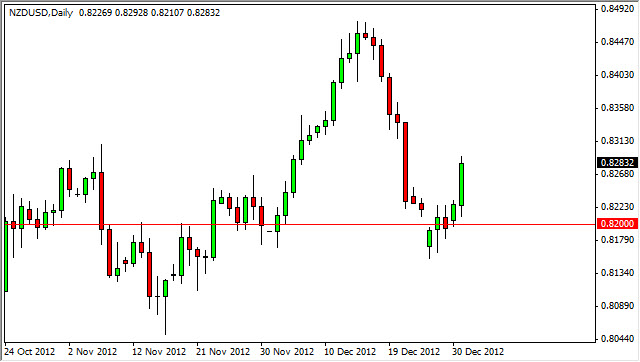

Would also catching my attention on this chart is the fact that the gap from last week has not only been filled, but been broken through significantly and decisively. This suggests to me that the 0.82 level is now going to be massive support as it should have been pretty significant resistance to begin with. When you look at the Wednesday and Thursday candles from last week, you can see that there definitely was serious resistance right around the 0.8225 level, and as a result we have broken through and that does look very bullish to me.

Bullishness ahead?

Looking at the candle from the Monday session, it's easy to see that the markets definitely are much more optimistic now than a few sessions ago. However, we need to clear the 0.83 handle in order to be completely and decisively free from resistance. At that point time, I would fully expect a move to the 0.8450 level in the short run. Beyond that, I do think that this market does have a bit of bullishness in it for the year coming up, and as a result I do prefer going long than shorting it on the whole.

If we can get above the 0.85 handle, we really could take off and start to hit areas that people have been suggesting for quite some time. In fact, parity is not out of the question albeit some ways off. In fact, that move probably won't come for a couple of years, but it is definitely the trajectory we are heading on that gets me convinced that the New Zealand dollar is a currency you want to own, not sell. Having said that, I need to see the 0.83 level cleared in order to start buying again. As for selling, there is so much noise between here and 0.80, it's almost impossible to consider it.