As I'm sure you all are aware of, the gold markets have gotten absolutely pummeled recently. Because of this, there is a lot of interest in the gold market presently, as a lot of people think that the trend could possibly be over for good. Recently, we have even seen Goldman Sachs come out and say that gold was going to fall below the $1500 level, and it was going to be very short of the metal. Just a few days later however, Goldman Sachs covered its position somewhere near the $1400 level, and while getting a nice gain in the short term, left the marketplace.

Perhaps this is a bit of a warning. There are certainly plenty of people out there who have shorted gold and have done quite well over the last couple of weeks. However, one has to wonder how long this can go on. After all, it is based upon the idea that there is absolutely no inflation out there. Anybody who actually buys anything understands that there is in fact inflation. In the real world, devoid of the central banker-speak, we understand that gas prices have been going up, as has food. These are two things that many government agencies around the world simply do not measure when it comes to inflation. Why do you ask? Because it would show that inflation was much, much higher than people understood.

Physical gold sales surge

The whole time the markets have been selling off, the demand for actual real gold has skyrocketed. In fact, the US Mint suspended sales of its popular 1/10 ounce coins on April 23. The reason? Simple: they had sold out of them. During the first three weeks of April alone, the US Mint has sold 175,000 ounces of American Eagle gold coins, put it on track to challenge the all-time high of 231,500 ounces sold during the month of December in 2009. Because of this, it is obvious that somebody is out there buying gold. Just because the central banks and the Wall Street types are not interested in buying it at the moment does not mean that nobody else is. Quite the contrary, many people who choose to stack up on physical metals have been using this as a buying opportunity, much like you would expect them to.

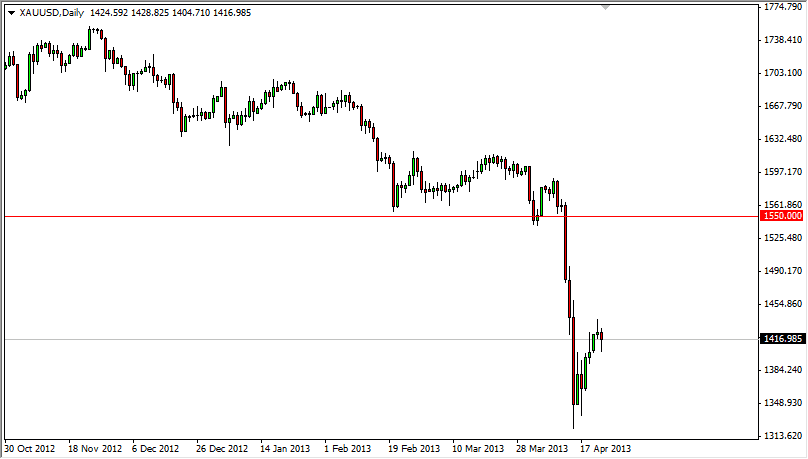

Down 26% from the highs

The gold markets are down 26% from the highs presently, but we have seen quite a bit of support in the general vicinity of $1350. Because of this, I think that we may be finding a little bit of a base at this point in time, and as a result it looks like we are starting to find that the "weak hands" have left the market. One of the biggest tells of this is the fact that the GLD ETF has seen massive amounts of redemptions recently. These are people who cannot or will not be involved in the futures market directly, or buy physical gold. With that being the case, they are without a doubt peripherally involved at best, meaning that they will more than likely be the first out of the market.

$1550 is a crucial spot

Going forward, I believe that this market will continue higher. However, it must be said that the $1550 level is absolutely vital for the buyers to get above. If we can get above that level, I believe that this market will continue much, much higher. In the meantime though, it's perfectly reasonable to expect this market to go up and test that area. After all, "what was once the floor now becomes the ceiling." This is one of the most basic concepts of technical analysis, so I do believe that this market will attempt to find $1550 over the course of the next several weeks. The real question will be whether or not we can get above that level. I also expect to see the $1500 level offer a bit of resistance as well, based mainly upon the fact that it is a large psychologically significant number. At the end of the day however, I do believe that the real fight is $50 above.

As far as selling off, it will take something fairly special to break this market down at this point. It is taken a real beating, and it appears that the $1300 level is going offer significant support. Below that level, I think that we will eventually test the $1000 region, which is a massive support level waiting to happen. However, I do not believe that we will see that happen. By all indications at this point in time, it appears that gold will be going higher in the short term.