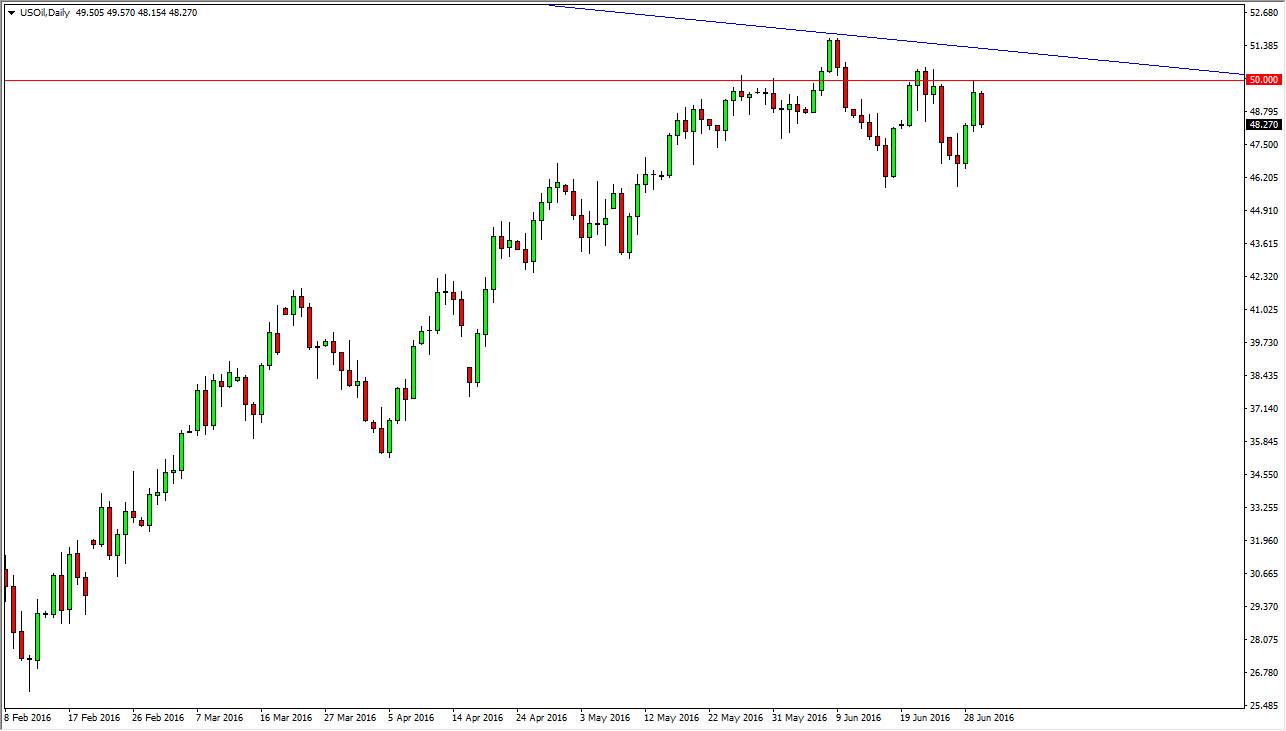

The WTI Crude markets fell during the session on Thursday, but did bounce significantly in order to form something along the lines of a hammer. This of course is a bullish sign, but I see the $97.00 level just above as offering resistance. This resistance extends all the way to the $98.00 handle as far as I can tell, and as a result I am not overly bullish at this point.

I personally feel that we are testing the upper area of the trading range right now, and as a result I do not expect to see this market go much higher. I could be wrong, but the reality is that the market has been a bit parabolic recently, and there is without a doubt significant resistance at the $98.00 level, not to mention the fact that the $100 level above should be rather resistive as well.

Looking at the chart, I think that there is a bit of a "floor" in this marketplace of the $90.00 level, and demand for oil seems to be dropping quite a bit. However, there is a bit of a counterargument to that as the United States seems to be doing a little bit better overall, and this of course could help.

Summer Days

The summer normally brings technical trading to the forefront, as liquidity dries up in various markets. That being the case, junior traders find themselves on the desk alone, simply managing positions more than anything else. As long as that's the case, this market shouldn't take off in one direction or the other too sharply, and as a result I think when we find little consolidation areas like we have right now, it's not a bad idea to day trade it.

This being said, if you are a short-term trader you certainly can make a profit between the $95.00 support level, and the $97.00 resistance area. It doesn't seem like much, but for a day trader, a $2.00 trading range is significant enough to start making profits. Ultimately, comes on your trading style, but that is the only thing I see available in the market right now.