At the beginning of this week in my last analysis of this pair, I predicted that:

“...we have reached a zone where the trend is likely to make some kind of pull back, although any reversal here would need time to get going. It is doubtful whether any bullish move would be able to break Friday's high of 1.5055 over the next two or even three days.

If the price breaks below 1.4830 decisively, we can expect the downwards move to continue, but it may slow down considerably as there was very bullish action the last time price was at this level.”

I was correct about the pullback and about 1.4830 needing to be broken decisively for the down move to continue, although 1.5055 was taken out late last night due to a shift in sentiment fuelled by the Federal Reserve's signal that the USD stimulus needs to continue, so was just barely wrong about the turn-around needing to take more time.

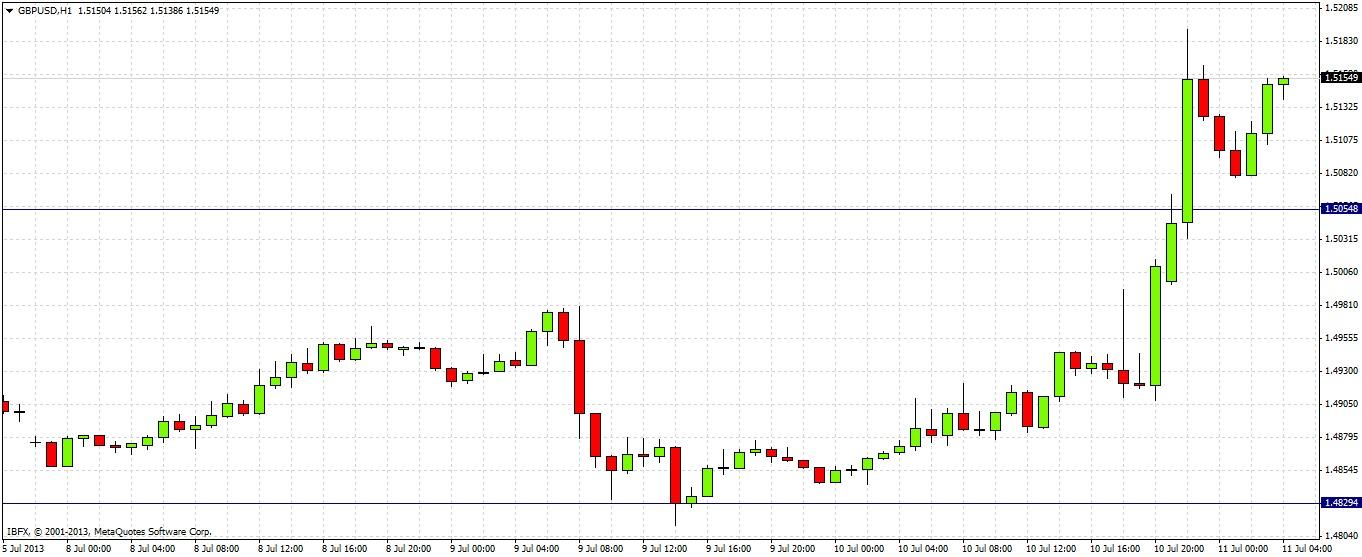

The hourly chart of this week below shows how the move down tried to continue, tested but failed to break 1.4830 being unable to even stay below it for an hour, then turned and moved strongly upwards. Price is now all the way up at 1.5152:

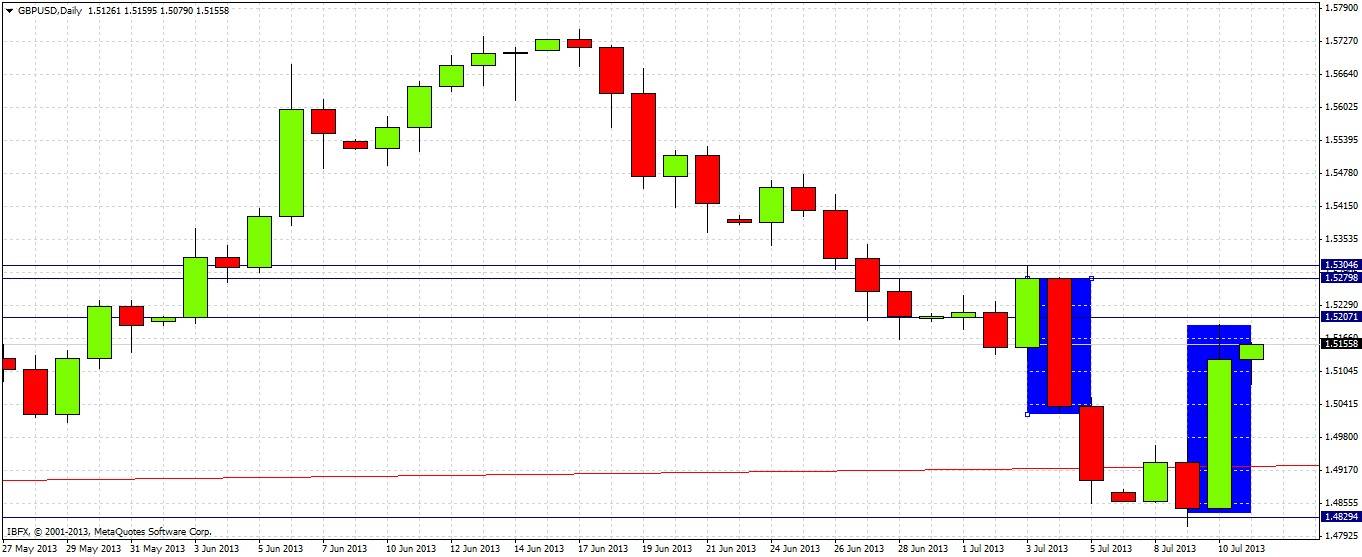

The monthly chart shows a rejection from the pennant's lower trend line and the key support at 1.4830, with this month currently in the shape of a bullish pin bar:

The weekly chart reveals little, except that the price has yet to take out last week's open or high (the open is the point of significance). If this week can close above 1.5207 it will be a very significant bullish reversal and will be more likely to show the beginning of some kind of sustained move upwards:

It can be seen in the daily chart that yesterday's bullish reversal is trying to push the price above the high of 1.5280, the high of the bearish continuation made last week on 4th July:

Yesterday the technical bias shifted from bearish to cautiously bullish. Cautious for the following reasons:

1. The high of last week's bearish continuation at 1.5280 needs to be broken.

2. It would be bullishly ideal if this week were to close tomorrow above last week's close of 1.5207.

3. We have been in the middle of a strong down trend.

4. We are in a zone which when last reached gave bearish action.

Cautiously bullish is still bullish. As the price has been so volatile, it is impossible to pick any good zones for trades right now. Any nice reversals from bearish pullbacks could be bought, but the big move might be over already for the time being. The end of this week should make things more clear.