Last Monday's analysis ended with the following conclusions:

1. It is hard to make any meaningful predictions right now

2. It looks likely that the resistance will hold at 1.3560 or 1.3600

3. The price is likely to consolidate for a while

4. There will probably be better opportunities elsewhere, but range trading between 1.3460 and 1.3560 could be a viable strategy.

In fact, it has turned out that we have seen some continuing bullishness, although 1.3560 did more or less hold on Monday and Tuesday, and 1.3600 is now acting as resistance, at least at the time of writing just before today’s London open. Apart from that the prediction was not very useful, except for saying that there are probably better opportunities elsewhere.

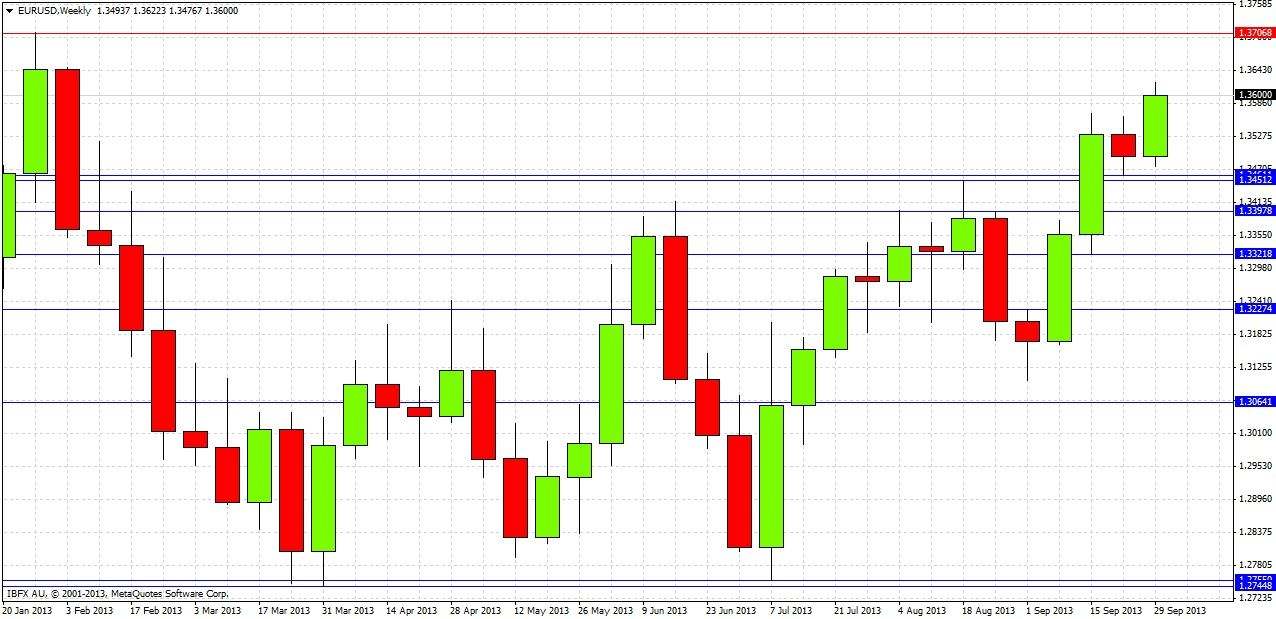

Turning to the future, let's start by taking a look at the weekly chart below

We can see that this current week is going to be a bullish engulfing week, provided that it closes above 1.3533 (last week’s open), which seems very likely to happen. The low of last week is very close to a previous week’s high from August, so it looks like resistance has become support at the zone between 1.3460 to 1.3450. There is a long-term swing high above at 1.3710. This pair has not reached a higher price since November 2011.

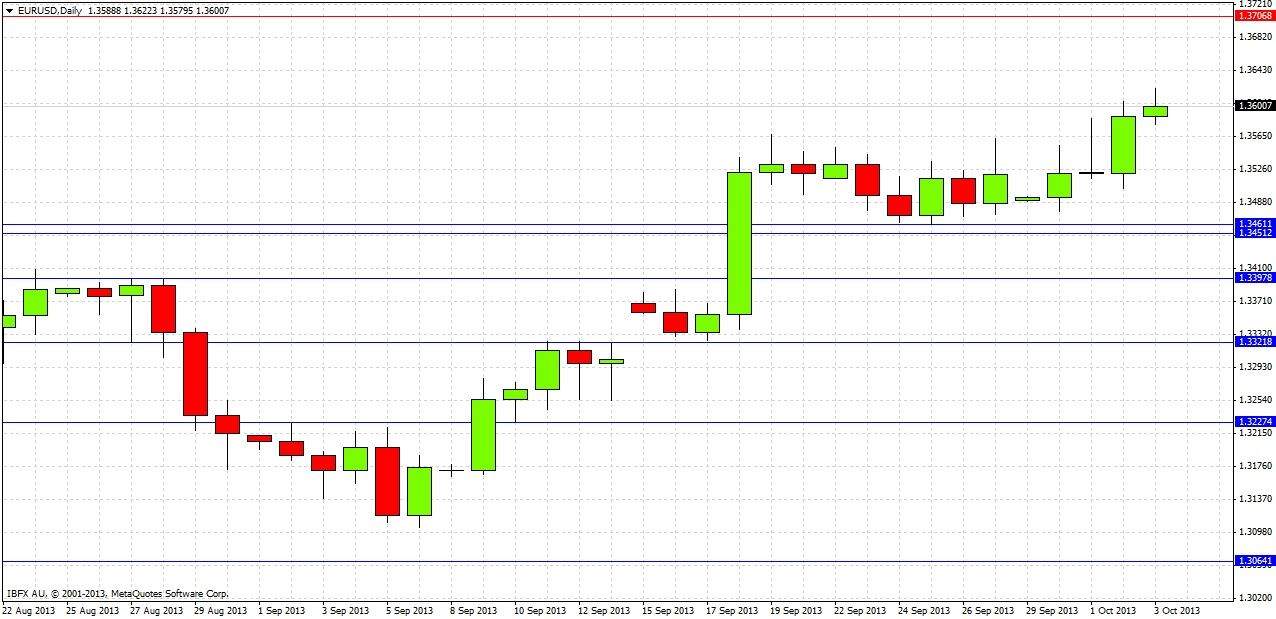

Let's drop down to the daily chart now for greater detail:

This daily chart does not add a great deal of detail. We can see price tried to move up Monday and Tuesday but failed, but then yesterday produced an outside candle with a close close to its high, which is a bullish sign.

Without doubt, there is bullish momentum. Unfortunately the picture is complicated by the fact that we have reached what is like to be a zone of strong resistance between 1.3600 and 1.3710. Therefore we can draw the following conclusions:

1. A pull back to the area 1.3460 - 1.3450 is like to be a good point to enter a long trade.

2. Any serious bearish reversal at a price above 1.3600 and below approximately 1.3710 could be a great short trade.

3. A daily close above 1.3710 will indicate extreme bullishness and a continuing move up to the 1.4000 region.

4. A daily close below 1.3450 will indicate the beginning of a new down trend.