Our previous analysis last week ended with the following relevant predictions:

1. An overall long-term bearish bias seems wise for now, but trading both directions is quite possible.

2. A long touch trade at 0.9388 looks like a very good bet.

3. A sustained break below 0.9388 will be a very bearish sign, but is unlikely to happen for a while.

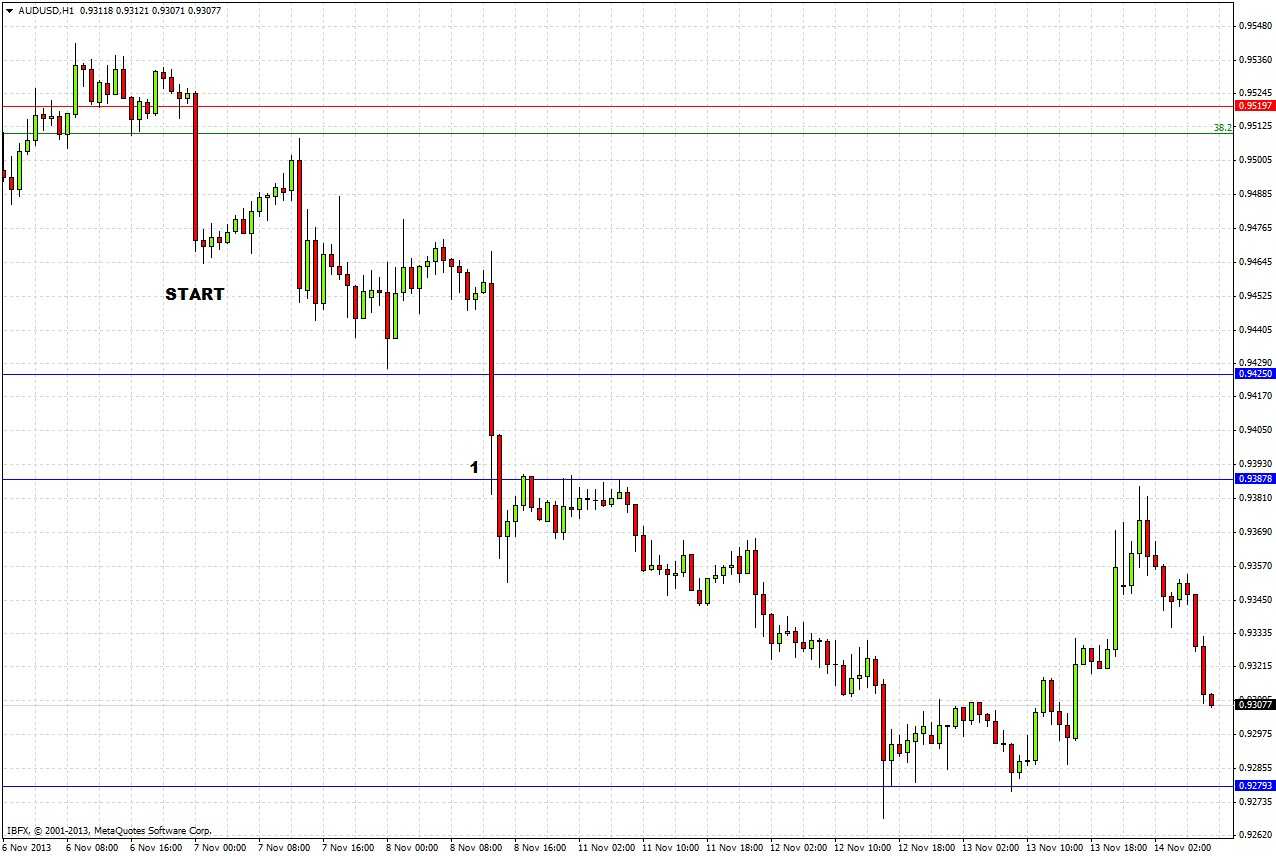

We were right about the bearish bias. The level of 0.9388 was hit just after last Friday's NFP news and gave about 15 pips for little drawdown before being quickly wiped out, as marked at (1) in the chart below, so that was not a good trade to take. The prediction in 3. above worked out well as the sustained break below 0.9388 did lead to a few days of downwards price action, falling all the way to a low of 0.9268. All can be seen on the 1 hour chart below:

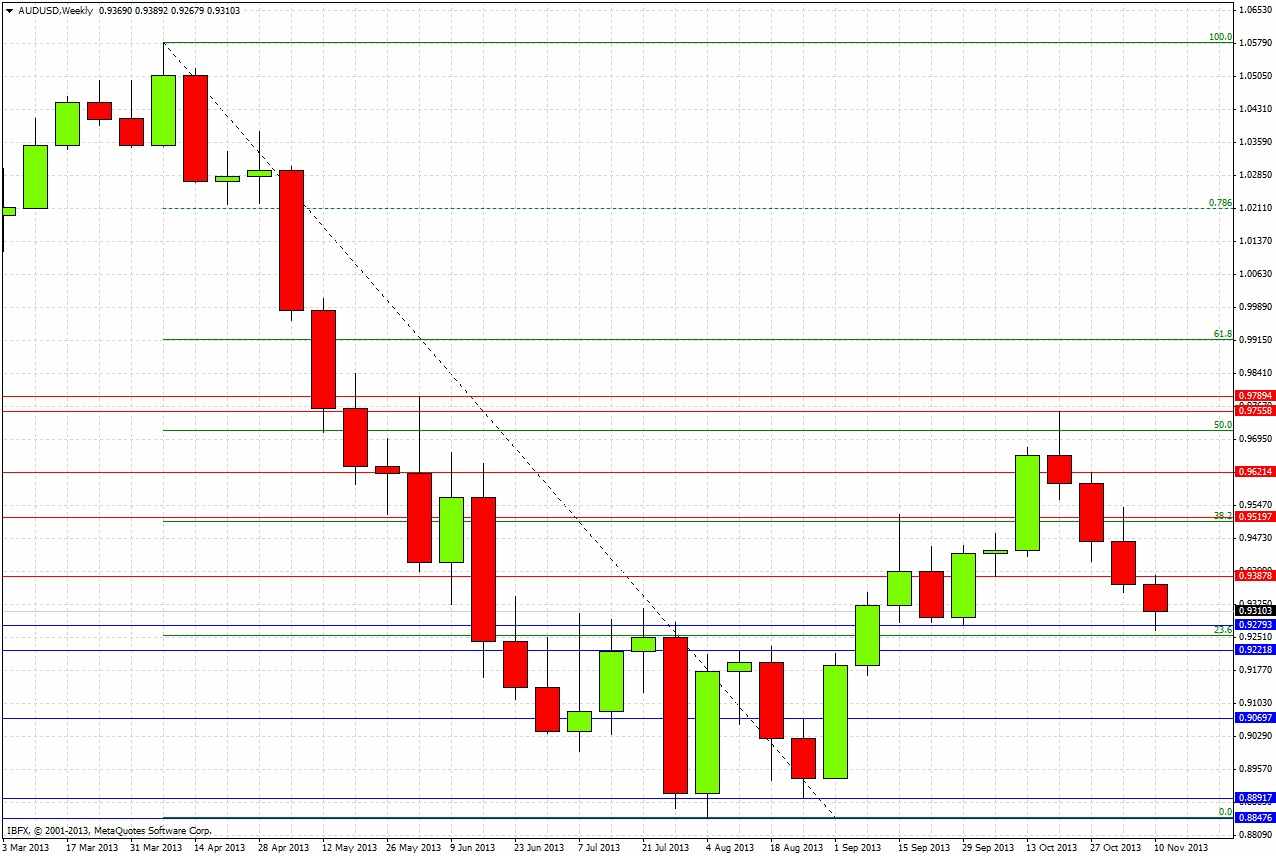

Turning to the future, let's start with a look at the weekly chart:

Last week printed an ordinary bearish candle that closed close to its low and below the support level of 0.9388. Unsurprisingly, this led to a fall this week to the support level of 0.9279, which as held, being breached by only about 10 pips or so.

Let's take a closer look with the daily chart:

The day of the last publication, the pair made a bearish reversal bar marked at (1), closing below the support level at 0.9388 and remaining below it. This was the signal for further bearish action, until we hit the strong support level at 0.9279 two days ago. Note how the previous support at 0.9388 was tested on Monday and earlier today to a few pips, holding now as resistance. The last few daily candles are producing a barb wire pattern suggesting ranging and consolidation.

While the support below looks strong, the resistance above looks even stronger, as its tests have been more spaced by time, and because we are in a major downwards move off the 50% Fibonacci level at 0.9715. Nevertheless it is hard to make any confident predictions until we get a sustained break above 0.9388 or below 0.9279.

From this analysis we can make the following predictions and recommendations:

1. This pair is currently ranging between 0.9388 and 0.9279. It is possible to scalp bounces off both of these levels under relaxed market conditions.

2. The line of least resistance seems to be downwards.

3. A sustained break below 0.9279 will probably take a while to break below 0.9225.

4. A sustained break above 0.9388 is likely to lead to more ranging and consolidation rather than a strong upwards move.

5. It would not be surprising if we remain largely between 0.9388 and 0.9279 over the next few days.