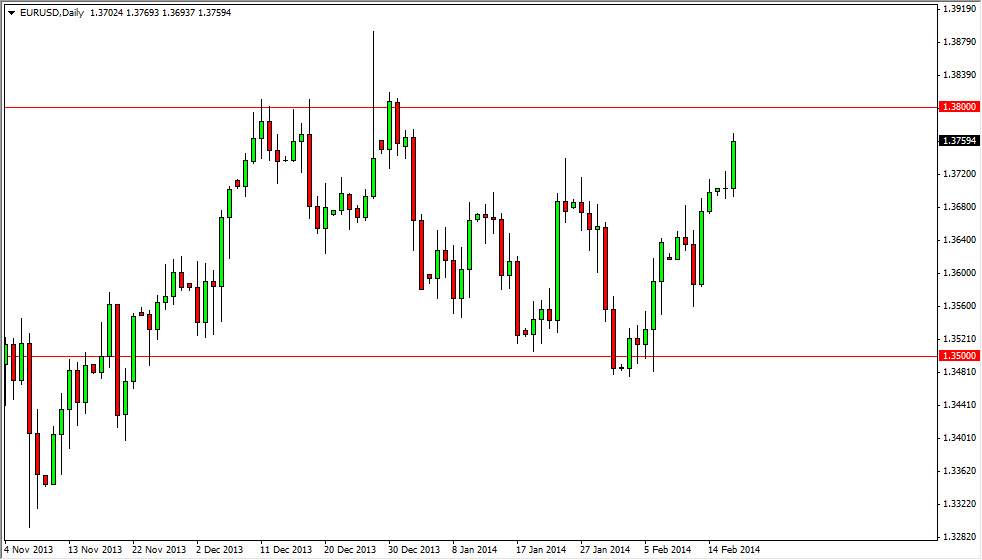

The EUR/USD pair continued its bullish attitude during the session on Tuesday, breaking well above the 1.37 level. This is an area that has been resistive lately, but I feel that there is quite a bit more resistance above anyway. With that, it’s a must impossible to go long of this market, knowing that the 1.38 level has been even more resistant than the aforementioned 1.37 level. Because of this, I am on the sidelines of this market and really don’t have any interest in being involved in it.

The 1.38 level could be interesting though, as a resistant candle in that general vicinity probably signals a pullback that’s good for about 100 pips or so. Above that level, I think things get difficult simply because we had seen such a reactive and resistive move back in December. The 1.38 level is significant from a longer-term perspective, so that does not surprise me at all.

There are easier ways to trade the Euro.

Trading the Euro could be very difficult against the US dollar as the world focuses its attention on one side of the Atlantic, and then the other. It’s never at the same time, because quite frankly neither one of the economies are that much to write home about. Essentially, we have a situation where one of these economies is probably doing “less worse” than the other one. That’s not exactly a model for economic confidence, but at the end of the day it’s all a relative play.

Going forward, I think we need to get a handle on what’s going on with the Federal Reserve, and then of course whether or not the Europeans need to be worried about deflation. Right now there are so many mixed signals that this pair has been almost impossible to trade for anything resembling a trend. However, I do believe that the Euro can be bought, but not necessarily against the US dollar. It’s not to say that we don’t go higher, but I recognize that using this is a strength indicator for the Euro in general is probably going to be much more profitable in trading this actual pair. In fact, I believe buying the EUR/JPY will be the way to go.