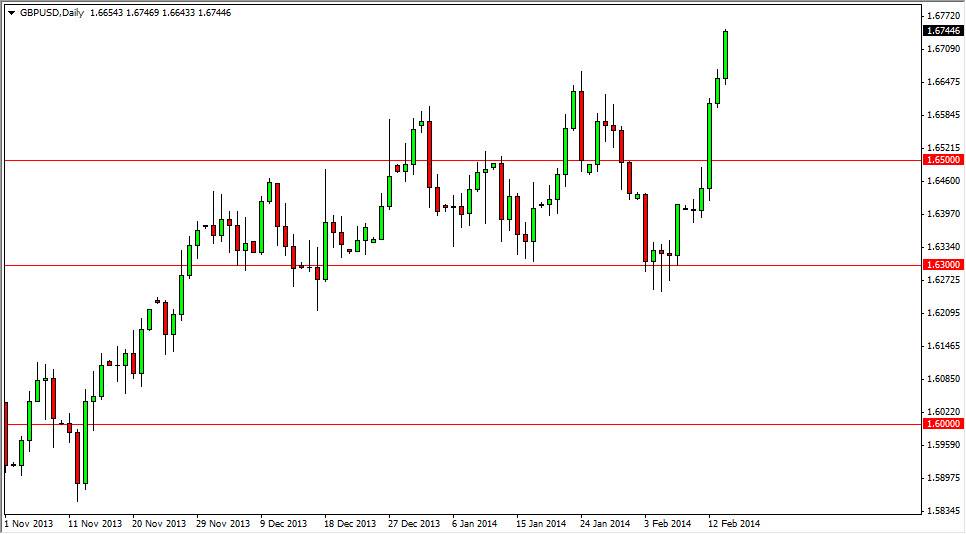

The GBP/USD pair rose during the session on Friday, finally breaking out well above the 1.6650 level. Because of this, I feel that this market is ready to go to its next natural target, the 1.70 level. This is an area that I’ve been aiming for during the last several months, and it appears we have now cleared the last hurdle to get there. A lot of this will be based upon the inflation numbers out of the United Kingdom coming in a little hotter than anticipated so the Bank of England will have to let monetary policy tighten, at least in its natural sense, via the bond markets.

After this breakout, I believe that the 1.65 level will continue to be a bit of a “floor” in this market, and any pullback will be seen as an opportunity near that area to buy on the cheap. However, I don’t even think will pull back that far, based upon the fact that the market has been so parabolic, it would not surprise me at all if the 1.6650 level offers enough support to push the market back up. Anyway, I’m more than willing to buy supportive candles below the current area as it should represent value.

Buying on the dips.

In full disclosure, I am not long of this pair at the moment as I missed the move. However, I am willing to buy dips going forward, and I suspect that there are a lot of traders out there that feel the same way as we have obviously broken out, and they are missing out on the bullish and obvious move. With that, it’s a little bit of a self-fulfilling prophecy that every time this market pulls back people will step in and in order to take advantage. Again, I believe that were heading to the 1.70 level, but that large round number will be very difficult to break out and continue above. I’m not saying that we won’t, just that I’m expecting to run into trouble near that general vicinity that could take a little bit of work to get through.