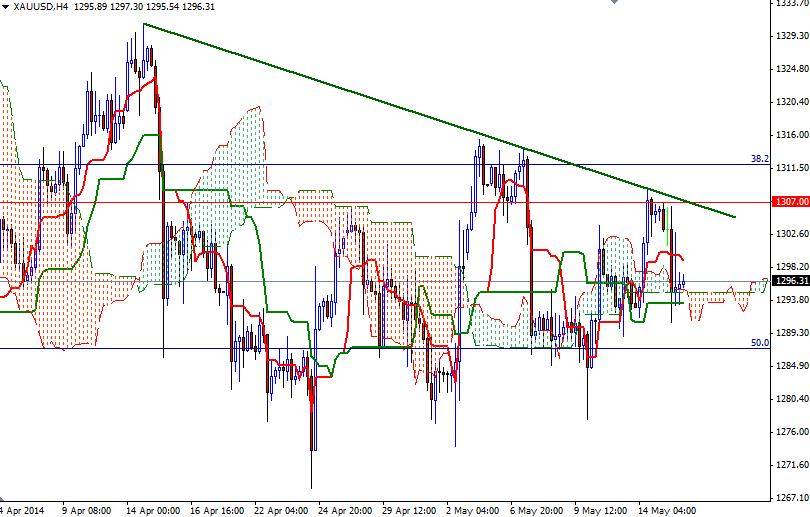

The XAU/USD pair (Gold vs. the Greenback) closed the day lower than opening as the bulls failed to overcome the resistance at the 1307 level and after a series of U.S. economic data came out stronger than expected. According to data released from the Labor Department, initial jobless claims dropped by 24K to 297K and the New York Federal Reserve Bank reported that the Empire State manufacturing index jumped to 19 from 1.3 a month earlier.

It appears that the XAU/USD pair found some support just above the Ichimoku cloud (on the 4-hour time frame) during the Asian session today but gold prices have been swinging roughly between 1268 and 1316 for the last 4 weeks and because of that it will be hard to build a long-term position. As long as the market is in short-term mode, the XAU/USD pair can only be scalped in this zone. From an intra-day trading perspective, breaking above 1303 could signal a run up to 1307.

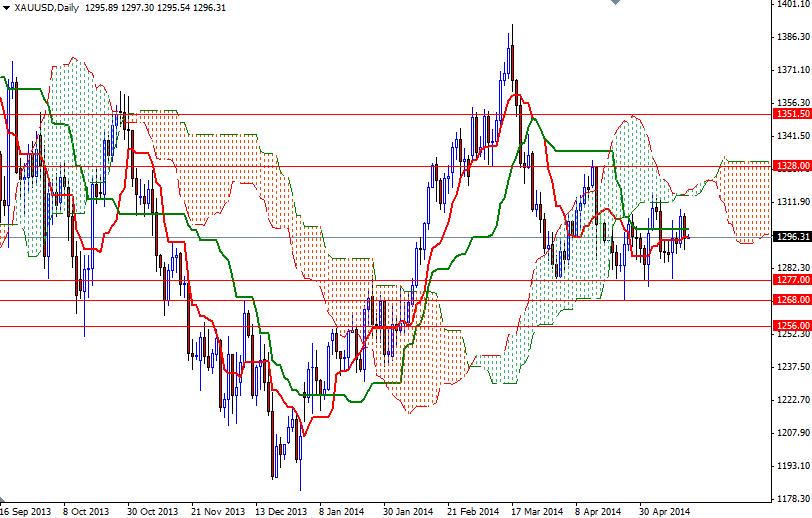

Beyond this barrier, there will be hurdles on the way such as 1312 (38.2 Fibonacci based on the bullish run from 1182.35 to 1392.04) and 1318 (the top of the Ichimoku cloud on the daily chart). However, if the bears take the reins and the XAU/USD pair falls below the support at 1287/4, it is likely that we will be testing 1277. Closing below this support level on a daily basis would indicate that 1268 will be the next target.