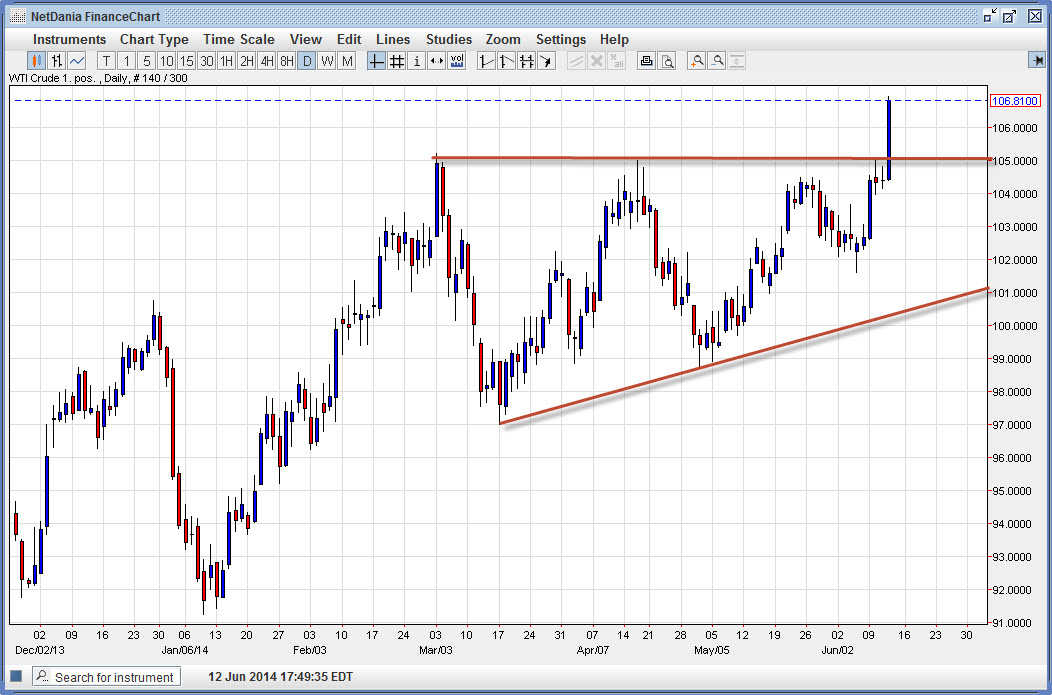

The WTI Crude Oil market broke out of the ascending triangle during the session on Thursday, leaving the $105 level behind. This area has been very resistive over the last few months, and the move above is a major bullish sign. This will begin the next leg up, and based upon on the measurement of the triangle, I expect to see this market go to $113 before the move is all said and done. The market should provide plenty of buying opportunities between now and there, and I will be looking for short-term pullbacks to get involved to the long side.

The shape of the candle is impressive as well, closing towards the top of the range for the session. This is also a massively bullish sign as well. The fact that the market has risen so strong suggests that there is still significant buying pressure in this market. Because of this, it is possible that you might have to be patient and wait for the right pull back in order to go long. It could take a couple of days, or it could come quickly – I will make this decision based upon the daily candle.

The market made a statement during Thursday

The market breaking out tells me that we are going much, much higher. The market looks as if it is going to be a “buy only” market going forward, and only the truly foolish would short this commodity at this point. The demand picture looks good, and the economic strength of the United States will certainly come into play as well. This will put a focus on economic numbers out of America, and this will continue to shape the idea of demand picking up for oil in general, and this shouldn’t be much of a surprise as we go forward.

The $102 level below should offer plenty of support, and I think it is the “floor” in the market at the moment. I also see a lot of support at $99, so a break of the floor could only move it a bit lower. I have no idea how to short this market with this kind of momentum – so every time it falls it will be a signal to start buying again.