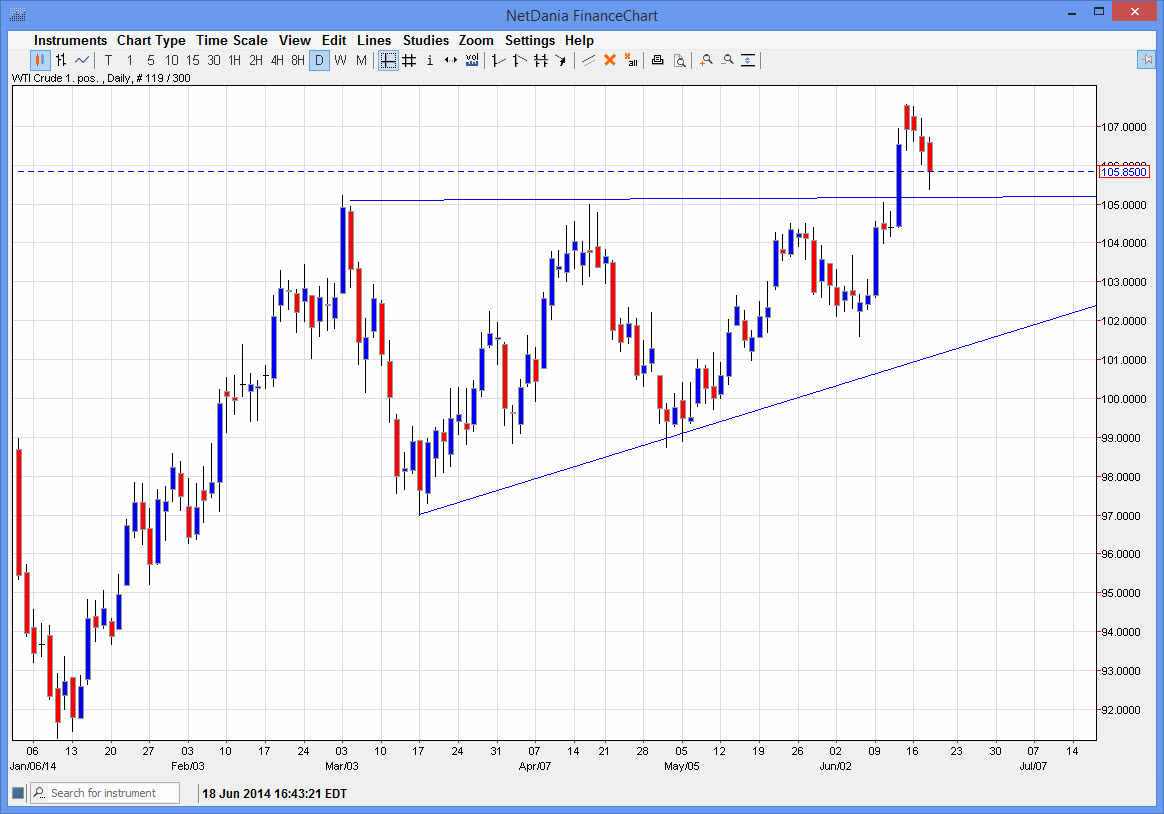

The WTI Crude Oil markets fell during the session on Wednesday, as we continue to drop in value. However, the $105 level below should continue to be supportive as it was the resistance from the top of the ascending triangle, which should now offer buyers as the market has clearly shown itself to be bullish. A supportive candle in this region is more than enough of a reason for me to start buying. On top of that, the measurement of the highs of the ascending triangle suggests that the market is heading to the $113 level.

The candle from the Wednesday session does suggest that there are buyers below, so I feel that the market is in fact going to go higher over time, but at the end of the day there are plenty of reasons to believe that headlines could come into the marketplace and push the market higher over the longer term.

Headlines out there could continue to push the market higher, and I fully intend to capitalize on it.

I believe that there are plenty of headlines out there that could pushes market higher, the most obvious of which is of course the conflict in Iraq. With that, it’s going to be more than likely that we will see headlines coming out over and over again that should send oil prices higher. On top of that, it appears that the Federal Reserve is going to be a bit on the soft side, and that can work against the value of the US dollar. The US dollar falling could be a catalyst for this market to go higher as well, and with that oil markets could move in the opposite direction as well.

I don’t see an opportunity to sell this market, especially considering that the ascending triangle was so significant and obvious, so that being the case this is a “buy only” market going forward, and I see no reason why we won’t eventually hit the 113 level given enough time. I do think though that the 110 level will be a stop along the way.