GBP/USD Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s GBP/USD Signals

• Risk 0.75%.

• Entries may only be made between 8am and 10pm London time today.

Long Trade 1

• Long entry at the first touch of 1.6684.

• Put a stop loss at 1.6654.

• Adjust the stop loss to break even when the price reaches 1.6784.

• Take off 75% of the position as profit at 1.6784 and leave the remainder of the position to run.

Short Trade 1

• Short entry at the first touch of 1.6914.

• Put a stop loss at 1.6944.

• Adjust the stop loss to break even when the price reaches 1.6815.

• Take off 50% of the position as profit at 1.6760 and leave the remainder of the position to run.

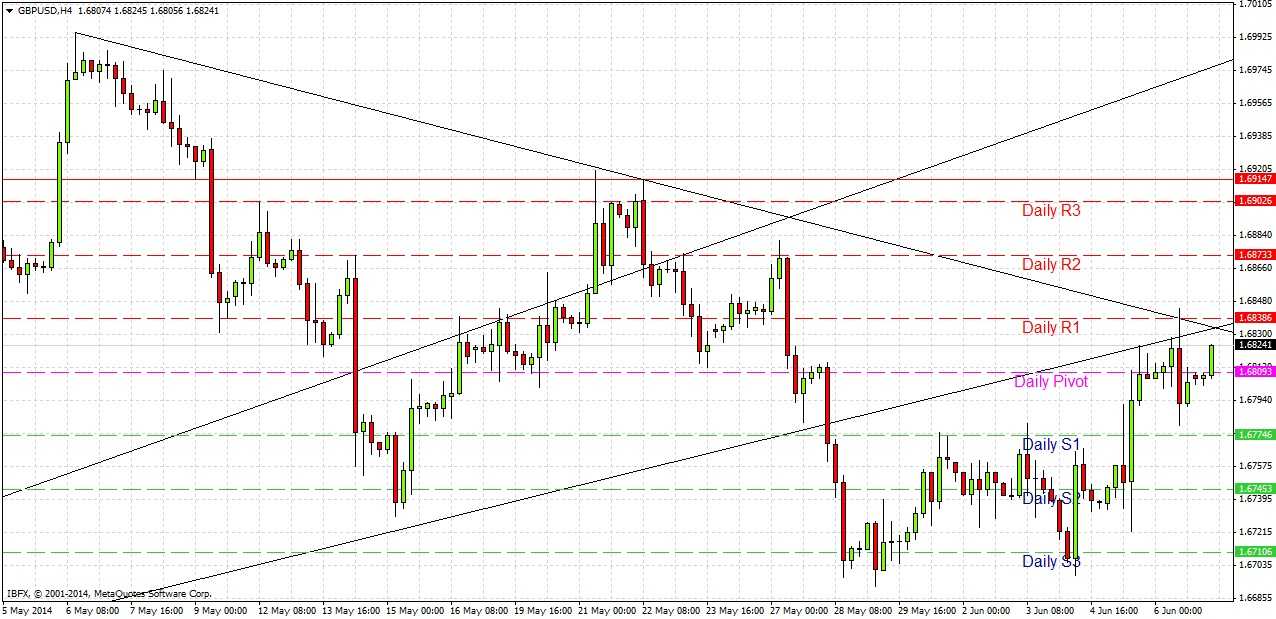

GBP/USD Analysis

Surprisingly, this pair and the GBP across the board rallied in the Forex market last week, especially towards the end of the week. This is a little surprising as we had just broken a major bullish trend line. Although you would expect that with such strong bullishness over the past year that it would be hard for it to fall hard and quickly, this pair can easily turn on a dime and do just that.

Technically, the interesting thing about last week’s rally is that it tested both the bearish trend line that has been established for about one month, and also the broken and very long-term bullish trend line. It fell from that test, but not very far and not for long. The price has been rising again and we are almost back at both of the trend lines that are bisecting now.

This means we may fall back from these trend lines, but it is a little too soon for a significant retest so I am ignoring these lines for the time being, focusing only on the major resistance above at 1.6914 (which is also the high or low of three days), and the support below at 1.6684.

However, it might be that 1.6838 holds today and the high of the day is made at around that price.

It should be a quiet day, so I would be comfortable with touch trades at both levels.

There are no high-impact news events scheduled for today concerning either the GBP or the USD. It is likely to be a very quiet day for this pair.