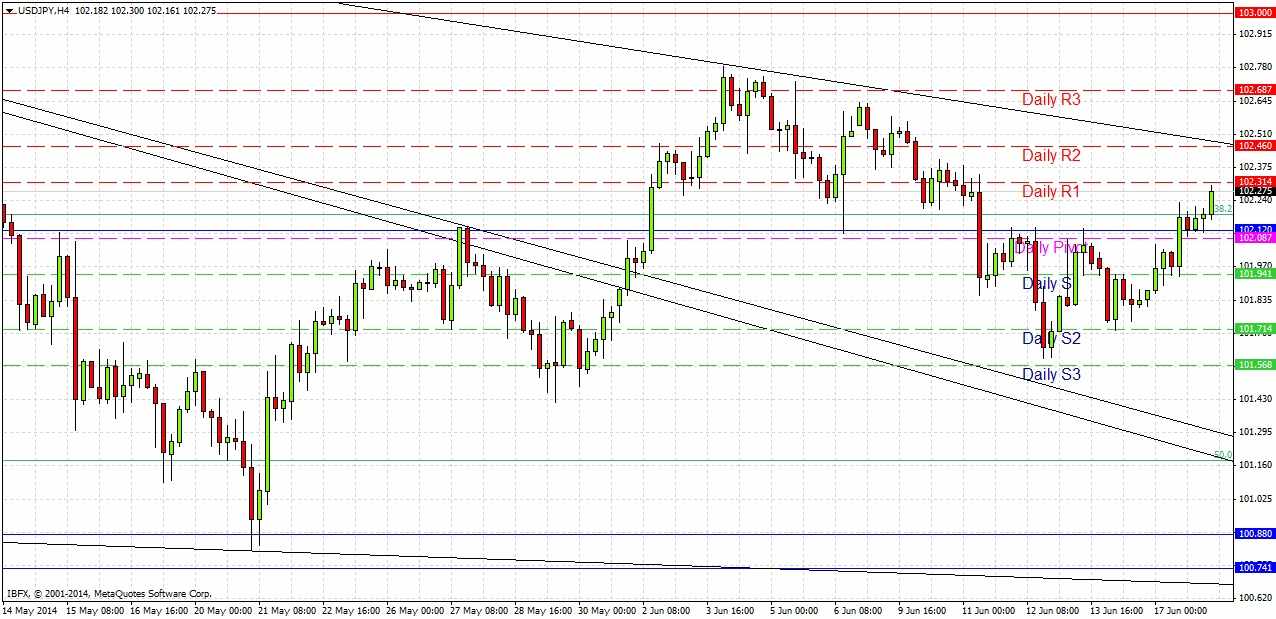

USD/JPY Signal Update

Yesterday’s signals were not triggered and expired. The price did touch 102.12 but there was no bearish price action there.

Today’s USD/JPY Signals

Risk 0.75% per trade.

Entries may only be made between 8pm and 8am London time starting this evening.

Long Trade 1

Long entry following bullish price action off either of the broken bearish trend lines currently sitting at around 101.25 – 101.15.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 101.70.

Take off 75% of the position as profit at 101.70 and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following a first touch of 103.00.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 102.60.

Take off 50% of the position as profit at 102.60, or take all of the risk off the trade if it is more than 50% of the position size, and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame following a first touch of the bearish trend line currently sitting at around 102.50.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 102.25.

Take off 50% of the position as profit at 102.25, or take all of the risk off the trade if it is more than 50% of the position size, and leave the remainder of the position to run.

USD/JPY Analysis

As expected yesterday, the price did move up and managed to pop above the resistance at 102.12, which since then has flipped back to being support again. Despite the persistence of this level, it is too localised and attractive to use for clearly defined signals so we look to the next levels.

It should be expected that nothing much will happen before the FOMC news due tonight after London closes, so trades should only be taken later. However the action so far is suggestive of a forthcoming move up.

The levels at which we are looking for trades are quite well-defined and have been so for a while.

The big news due today is the US FOMC Statement, Projections and Press Conference at 7pm London time. This pair is likely to be very quiet until shortly before that time, when volatility will probably increase.