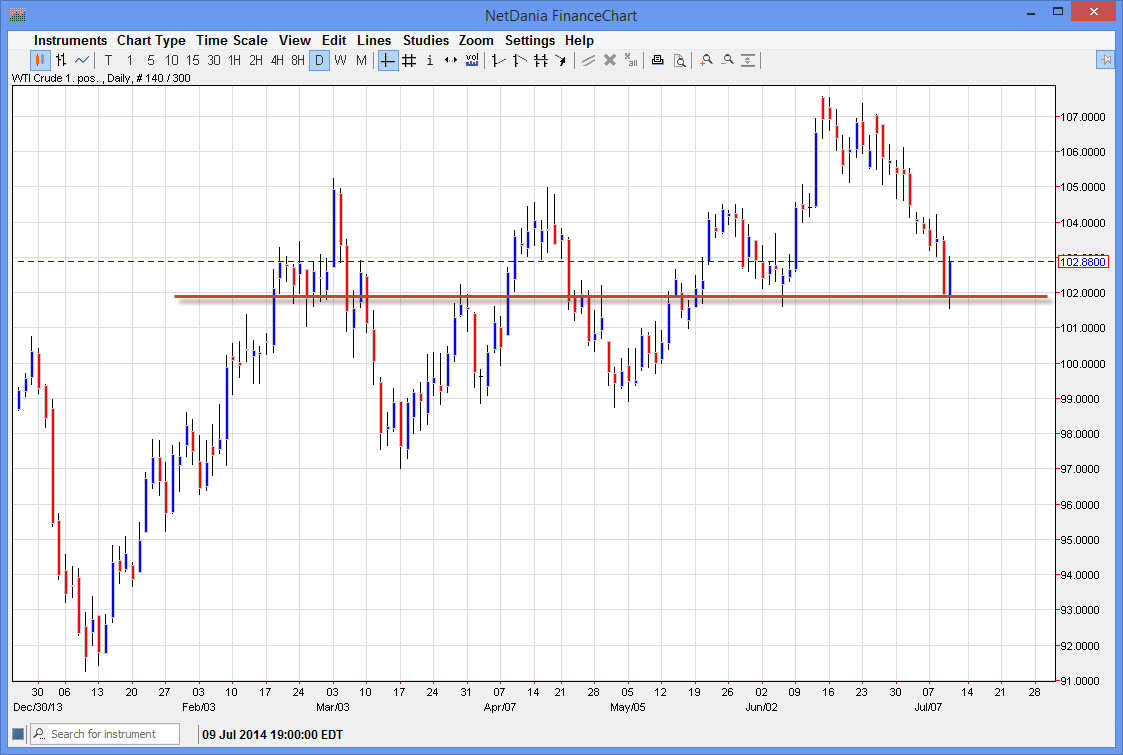

The WTI Crude Oil market initially fell during the session on Thursday, breaking below the $102.00 level initially. That being the case, we found support down there, and as a result ended up heading back towards the $103 level. The $102 level below has been support and resistance several times again and again, so having said that we feel that the market will continue to react to that level.

Breaking above the $104.00 level would send this market looking for the $107.50 level in my opinion, and that being the case the market is still positive as far as I can tell. In fact, it also looks like the uptrend is still intact, and that the uptrend line has been respected. Because of this, I feel that the market should continue to be a “buy only” type of market, and therefore selling simply isn’t possible.

The recent selloff may have been overdone.

The recent selloff in this market could have been overdone in my opinion, and as a result I feel that the market should continue to find bullish momentum over the longer term. That being the case, I feel that ultimately the market should head to the $110 level, which is a longer-term target that I have been talking about for some time. Although the market has been very volatile over the last several months, the general direction has been higher, so certainly I feel that you can only buy this market and that ultimately the buyers will come out on top. There are plenty of noises above that will continue to offer buying opportunities as we dip, but ultimately I think that the longer-term bullish action should continue as we get into a bit of a summer attitude.

Summer tends to be a bit quite in the oil markets, and ultimately trend in one way or another. I believe that we are training and something can to an upward channel, so at this point in time I am actually looking for buying opportunities but need to see a move above the $104 level to put any serious money into the marketplace.