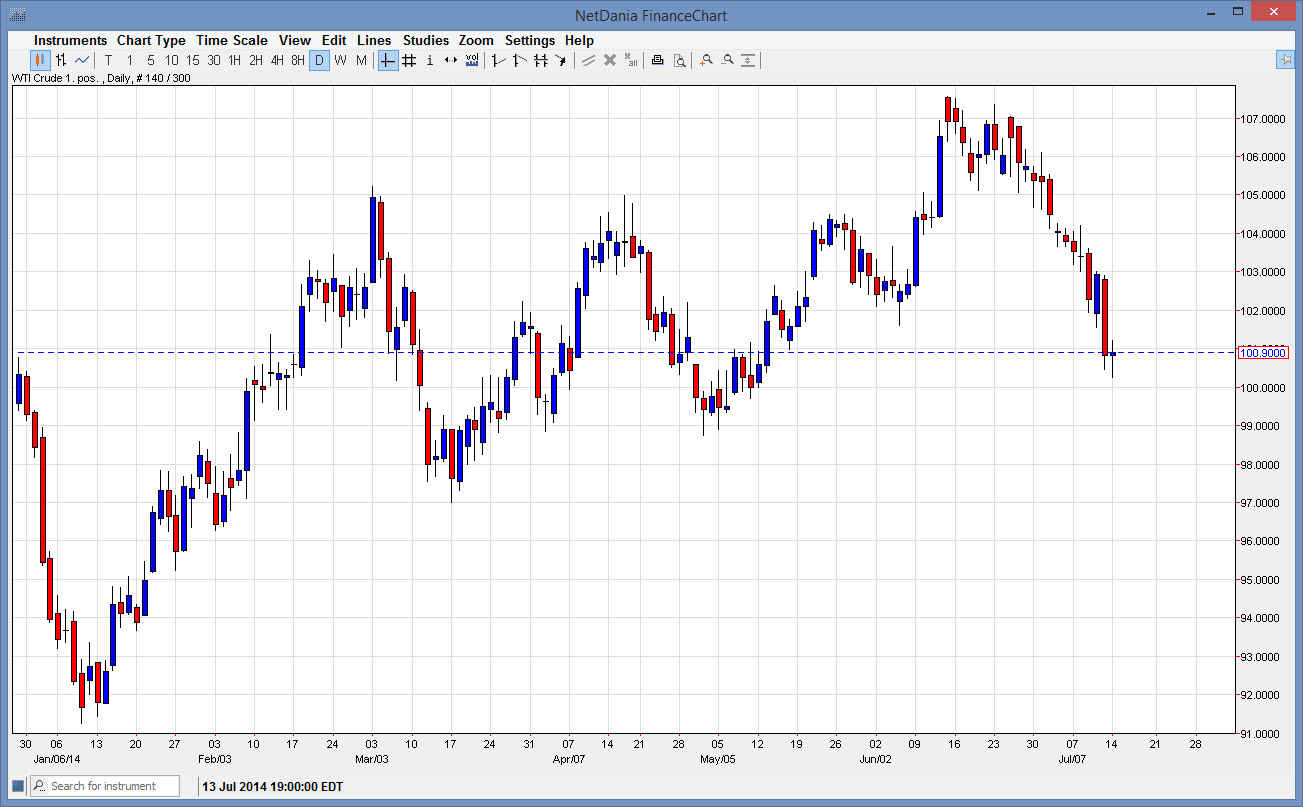

The WTI Crude Oil markets went back and forth during the course of the session on Monday, essentially hanging about the $101.00 handle. The market is a bit broken at this point, and I do suspect that we have a little bit more downside to go. However, I think that there is plenty of support at the $100.00 level, the $99.00 level, and then the $97.00 level. With that being the case, I don’t really see a situation where I want to short this market, but quite frankly am waiting for some type of supportive candle.

That being the case, I can also make an argument for break above the top of the candle for the Monday session has been a signal to start buying again. After all, it is somewhat of a hammer, but I recognize that the market is going to be very volatile going forward, and therefore I am cautious about buying into the futures markets.

Options market will probably be where I play this.

The options markets will probably be where I play this contract as the volatility could get very expensive. Certainly, the futures market will be extraordinarily expensive as the fluctuation of profit and loss will be very difficult for the average trader to take. For those of you who do not live in the United States, you do have the advantage of having the CFD markets, which I believe are a nice alternative to been involved in the futures markets to begin with.

If we can get back above the $103 level, I believe that this market goes back to the $107.50 level. At that area, I would expect to see a lot of resistance, but ultimately this market should break above there. My “line in the sand” is at the $97 level, and if we break below there I believe that the trend has changed completely, and that this market could fall apart, probably heading down to the $92 level first, and then ultimately testing the $90 level below there.