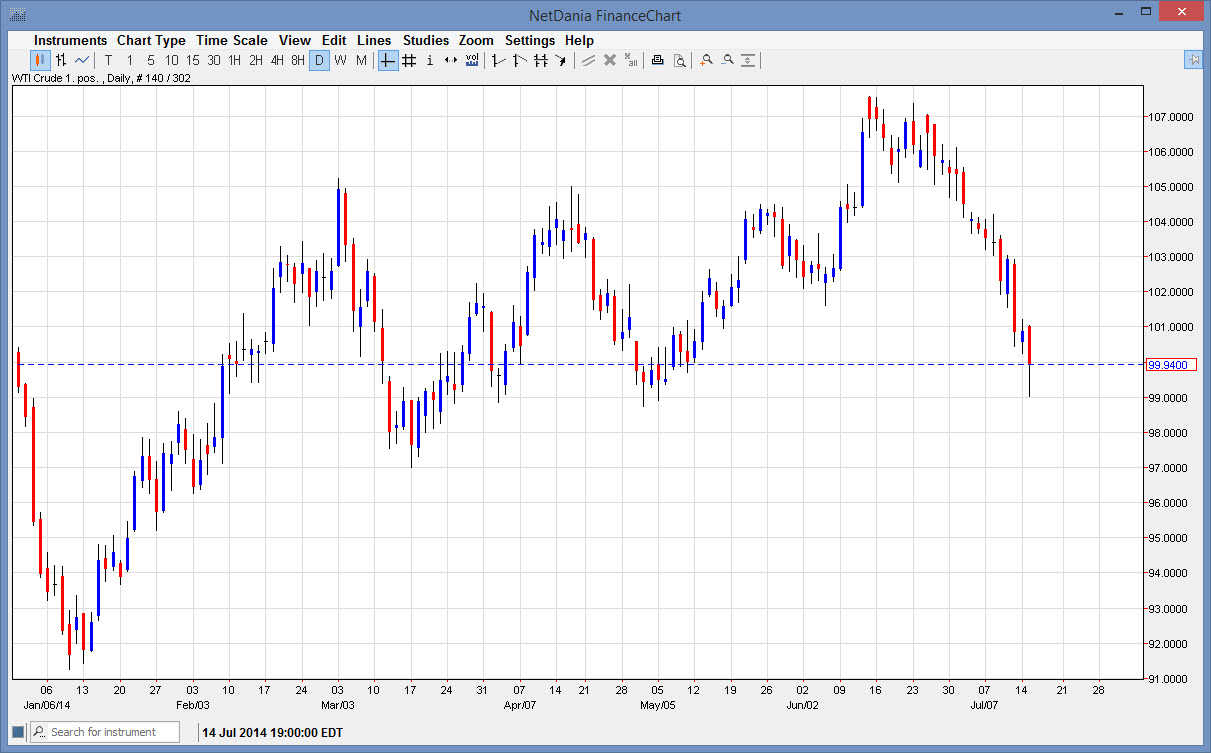

The WTI Crude Oil markets fell during the bulk of the session on Tuesday, and even managed to touch the $99 handle, an area that is without a doubt a significant support area. The support did in fact hold, and as you can see we moved much higher in order to form a hammer. This hammer of course suggests that the buyers are going to step back into the marketplace, and possibly pushes market back into the previous attitude that it had shown for some time. After all, the selloff has been rather brutal, and quite frankly it would not surprise me at all to see at least some type of “dead cat bounce”, as you will typically see after this type of falls.

Ultimately though, I believe that the real “line in the sand” is down near the $97 handle, and it is not until we get below there that I feel that this market has suddenly entered a bearish trend. It’s very unlikely that we will see that shortly, however I have to admit that I have been rather surprised by the ferocity of the selloff up to this point.

The last vestiges of an uptrend.

I believe that we are in the last vestiges of an uptrend, and the next couple of sessions will be vital for the buyers if they are to regain control of this market place, one that has most certainly slipped out of their hands recently. If they do, I think there is one heck of a buying opportunity in this general vicinity, and therefore I am willing to take a bit of a risk and start buying if we break the top of this hammer, clearing the $101 handle. At that move, I feel that the market will ultimately go to the $107 level but it will take a significant amount of time to get there. At that point in time, we can start to ask much more serious questions, as it could be a move to $110 and we would see. On the other hand, if we do break down below the $97 level, I think we could go as low as $91 without too many issues.