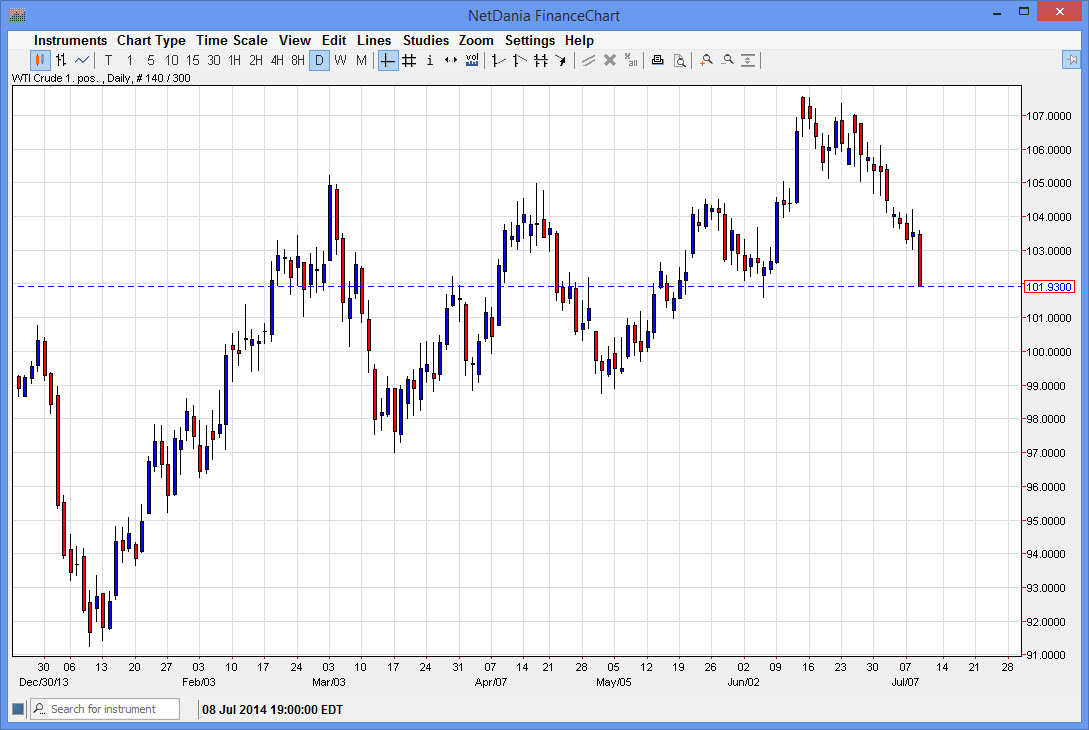

The WTI Crude Oil markets fell hard during the session on Wednesday, crashing through the $103 level. The market is well supported just below the $102.00 level though, so there is the possibility that buyers will step in and start buying in this general vicinity. I actually see the $101.50 level as being somewhat important, so we will have to sit in see and wait for what happens next. However, I think that ultimately this market should find enough support in this general vicinity to continue going higher. With the market closing as low as it did during the day, and most importantly at the very bottom of the range or the session, I believe that there is still plenty of selling pressure to come. The real question is whether or not this area can stand up to all of that.

On the other hand, we could see a trend change if we get too much more downside action.

It is possible that we get a bit more downside pressure, and that could in fact signal a bit of a trend change, I have to admit that I’m a little bit surprised at the recent action, especially considering that we are entering the summer months, a time this typically fairly quiet or this particular market. Any buying that would have been done in anticipation of driving season in the United States and Canada certainly would have already concluded. Typically, by this time most large oil traders are away on holiday, simply choosing to relax instead of face the daily pressure that is found in the oil futures pits.

However, there is the situation in Iraq that could send this market straight back up, as there will be a lot of concerns for supply in various grades coming out of that nation. Because of this, I believe that the downside probably will be somewhat stymied just below, and it is only a matter of time before trying to get back to the $107.50 level. However, I don’t have that signal right now and therefore cannot blindly gamble on that thesis.