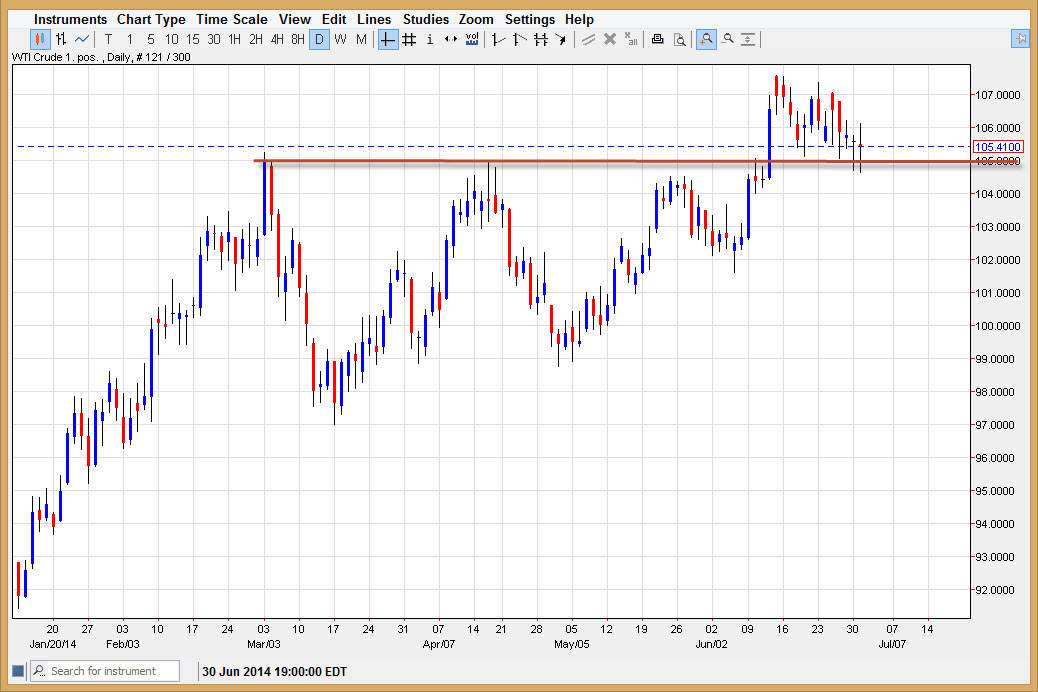

The WTI Crude Oil market did very little during the session on Tuesday, but the one thing that he did do was prove the $105 level to be supportive yet again. With that, it appears that the market is ready to go much higher, but a nonfarm payroll announcement coming out this Thursday could in fact keep this market a little bit quiet. Nonetheless though, I think it’s pretty obvious that the market is bullish of this point, and as a result I have absolutely no interest in selling this market under any circumstances, at least until we close below the $102 level which would be a massively bearish move.

Looking forward, I think that we will essentially staying within the range that we have been in, and it’s going to take a move above the $107.50 level to go much higher. Once we get that move though, I believe that this market goes to the $110 level, and possibly even higher than that. Remember, there was an ascending triangle below that we broke out of at the $105 level, which of course should send this market much higher based upon the technical analysis.

I still maintain a $113 target.

I still believe that this market will go to the $113, and quite frankly it wouldn’t surprise me the when higher than that. After all, the measurement from the ascending triangle suggested that the market was going to go to $113, and there is a cluster in that region on the longer-term charts that could offer a bit of resistance. Ultimately, I think we do go above there and head towards the $115 level, but this of course is a longer-term prediction.

I believe that any pullback in this general vicinity should find buyers below, and using short-term charts for entries is probably going to be the best way going forward. However, as I mentioned above if we find are celebrating below the $102 level, something that I don’t anticipate, that would be a massively negative sign and could send this market much lower.