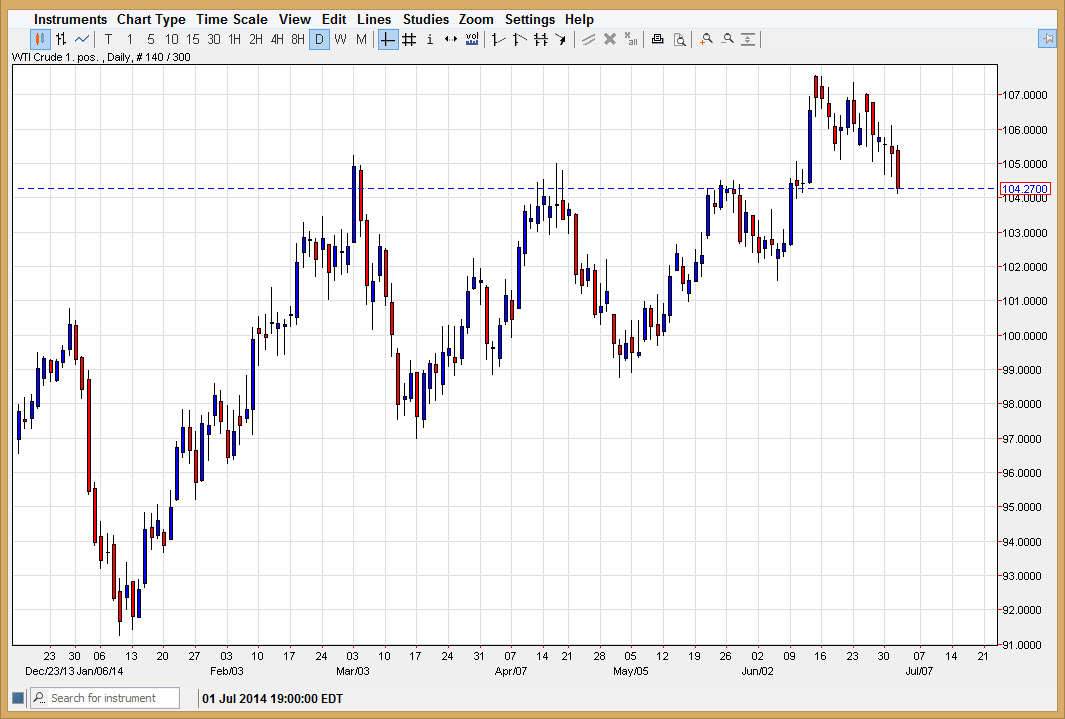

The WTI Crude Oil market fell rather hard during the session on Wednesday, but with the nonfarm payroll number coming out later today it’s hard to believe that the market is ready to make any significant move, at least until it gets the results of that economic report. That being said, I see a significant amount of support in this general vicinity, so quite frankly would not surprise me at all to see markets go higher during the session. When I am looking for at the moment is going to be a short-term supportive candle in order to start buying again. I believe that the market should then go to higher levels such as the $107.50 level, the most recent high.

After all, there is an ascending triangle that we are trying to break down into, and it would be a significant breach of an uptrend if we did continue to fall much farther than current levels. I have the $102 level as the “line in the sand” when it comes to whether I should be long or short of this market, and as a result I’m not necessarily concerned about a right now although I do recognize that the volatility later today could be a bit much.

More jobs? Should meet higher oil prices eventually.

The initial move might be for the oil markets to fall if the jobs numbers fairly strong. The idea is that the Federal Reserve will have to continue to taper off of quantitative easing, and of course that will drive the value of the US dollar higher. This contract of course is priced in US dollars, so it would take less of them to buy a barrel of oil. However, on the other side of that equation is the fact that your jobs means more demand for energy, and ultimately demand will outweigh cheaper currencies as far as a driver of price. Ultimately, I do believe that we go much higher, and I still think that we will see the $110 level over the next couple of months.