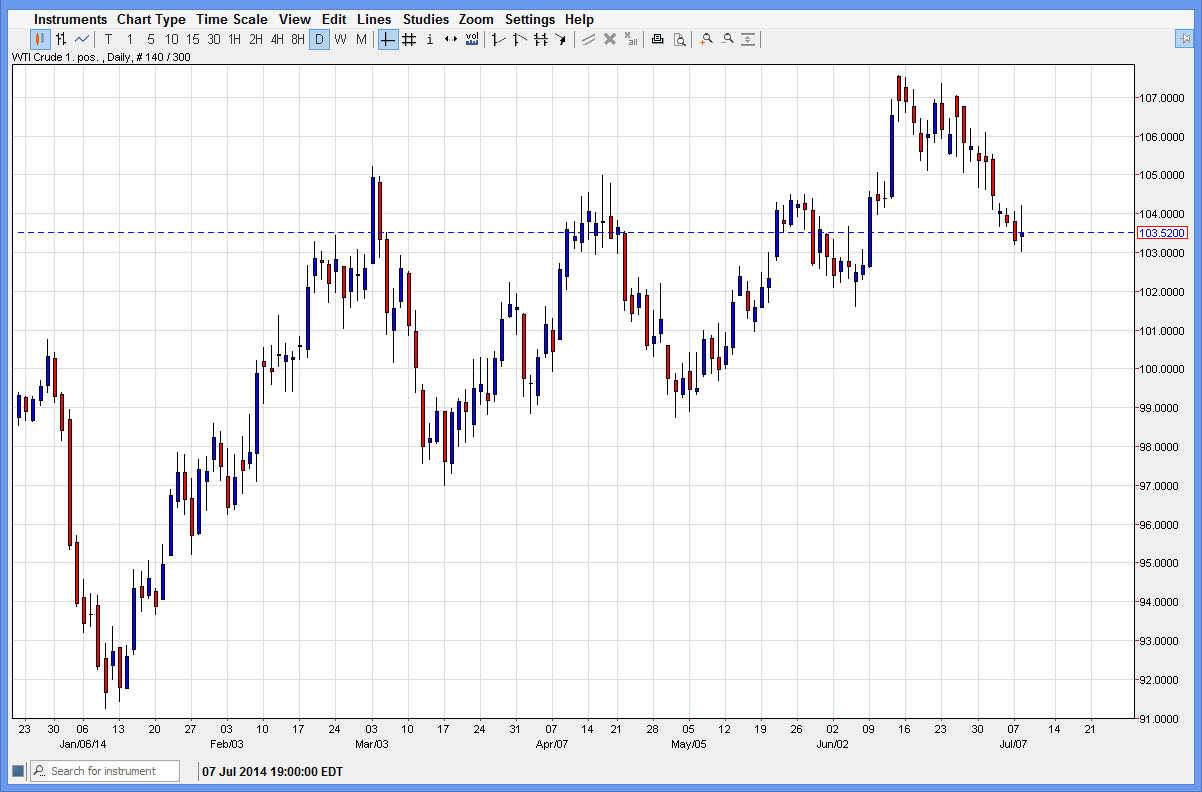

The WTI Crude Oil market went back and forth during the session on Tuesday, testing the $103 level. Because of this, it appears that the market may continue to drift a little bit lower, but most certainly find some type of support below. Any type of supportive candle in this general area should in fact invite buying, as the market has been in a nice uptrend for quite some time now. Because of that, I am bullish of this market, but I do recognize that it is possible that the trend is at least attempting to change.

With this being the case, the market could in fact be one that is still “buy only”, at least until we break down below the $101 level, which at that point in time would be very bearish in my opinion. I believe that the market is quite a bit over sold at this point, and as a result a break above the top of the range for the Tuesday session would be reason enough for me to start buying again.

Until told otherwise, I will not fight this trend.

I don’t see any reason to even begin to think about fighting this trend, as it seems to be rather strong over the longer term, but this last pullback does of course have me cautious. Ultimately though, I believe that the market should continue to the $110 level as long as the buyers can come back into play. The $107.50 level should continue to offer resistance, but right now I believe that the market is going to target that area in an attempt to continue the uptrend. Between now and then though, it could be rather choppy, meaning that it might be more conducive to trade this market on the shorter-term charts, simply buying pullbacks along the way.

With as expensive as the futures market can be, perhaps using the CFD market is the route to go. Alternately, one could use the options market to take advantage of this potential trading opportunity, as if we break down from here, it could be rather brutal and quick.