GBP/USD Signal Update

Yesterday’s signal expired without being triggered.

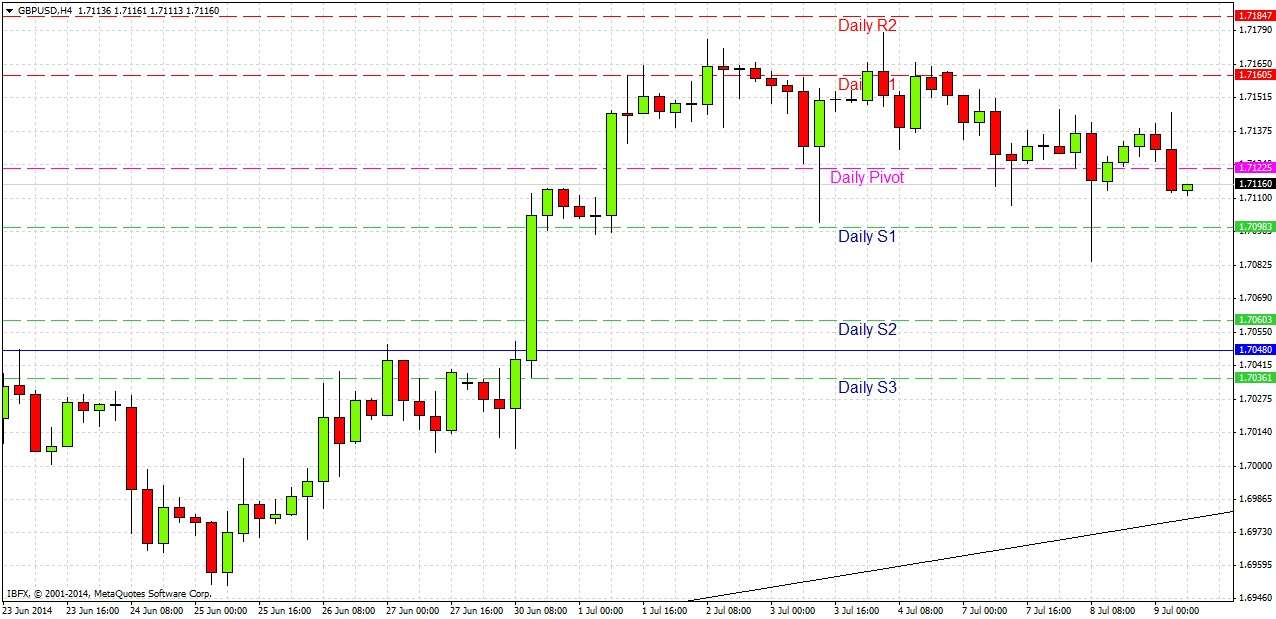

Today’s GBP/USD Signals

Risk 0.75%.

Entries must be made before 5pm London time today or from 7pm to 10pm.

Long Trade 1

Long entry following bullish price action on the H1 time frame after the first touch of 1.7048.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.7090.

Remove 75% of the position as profit at 1.7090 and leave the remainder of the position to ride.

GBP/USD Analysis

As I had expected, even poor GDP news was not able to move the price down to the 1.7048 area, and so my trigger to look for a long entry was not set off.

The daily chart yesterday formed a bullish pin bar, but I suspect that may be deceptive as the action above us really looks like a topping-out.

In any case, it is not a good time to use any analysis immediately as it is likely to be a very quiet session before the FOMC minutes are released tonight. Therefore in the case that we do reach 1.7048 during the London session, a long trade could be taken, but it would need to be protected before the FOMC release.

My colleague Christopher Lewis is also looking to get long at a pull back to around 1.7050, if it supported by bullish price action.

There are no high-impact data releases scheduled for today concerning either the GBP or the USD before 7pm London time when the US Federal Reserve will release the FOMC Meeting Minutes. Until that point it is likely to be a very quiet day, but the news release should cause considerable liquidity and volatility.