The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.74% on Thursday as the unfolding problems in Portugal reignited concerns over the European banking sector.

Escalating turmoil in Iraq and fears of a wider conflict stemming from Israel and Gaza were also among the factors providing support for gold. As a result, the bulls manage to clear the first crucial resistance zone between 1331 and 1332.43 and expanded their territory.

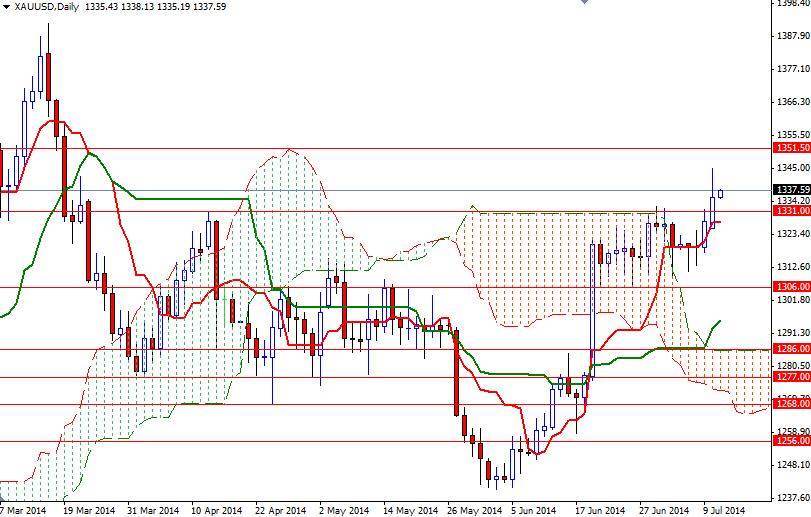

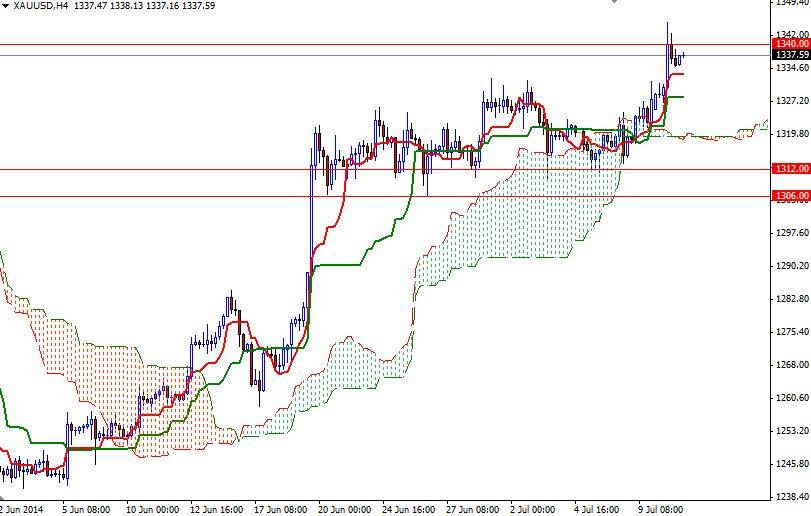

In my previous analysis I had pointed out the importance of this resistance area which had been a cap on prices lately. Not surprisingly, the pair accelerated its ascend right after we climbed above this barrier and traded as high as $1344.92 an ounce. From a technical perspective, trading above the Ichimoku clouds on the daily and 4-hour charts is positive for the XAU/USD pair. However, the market is moving inside the cloud on the weekly time frame. That means, there are tough resistances ahead.

Today the key levels to watch will be 1331 and 1340/3. If the bulls continue to dominate the market and push prices above the 1343 level, there is little to slow this pair down until we reach the next resistance at 1351/2. On the other hand, if the pair encounters heavy resistance and prices retreat below 1331, support can be found between 1324 and 1321. Breaking below the 1317 level where the bottom of the Ichimoku cloud currently resides on the 4-hour chart would suggest that the bears will be aiming for 1312.