The XAU/USD pair rose for a sixth consecutive week as the conditions in the marketplace have increased investors’ demand for safety. Gold prices hit a 16-week high of 1344.92 on Thursday after worries over the health of one of Portugal’s biggest bank and violence in the Middle East pushed down stocks on major world markets and drove up buying of safe-haven gold. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 150021 contracts, from 146025 a week earlier.

Although Portugal simply isn’t big enough to derail the Eurozone, it reminded markets that southern Europe's economy is still fragile. The developments in the Eurozone and Middle East will continue to be on investors’ radars as fear factor always holds the potential to spook stock market participants. Plenty of economic data is scheduled for next week but of course (since minutes from the Federal Open Market Committee’s June meeting offered no new insight into Fed policy) the next focus will be testimony by Fed Chair Janet Yellen to the Senate Banking Committee on Tuesday.

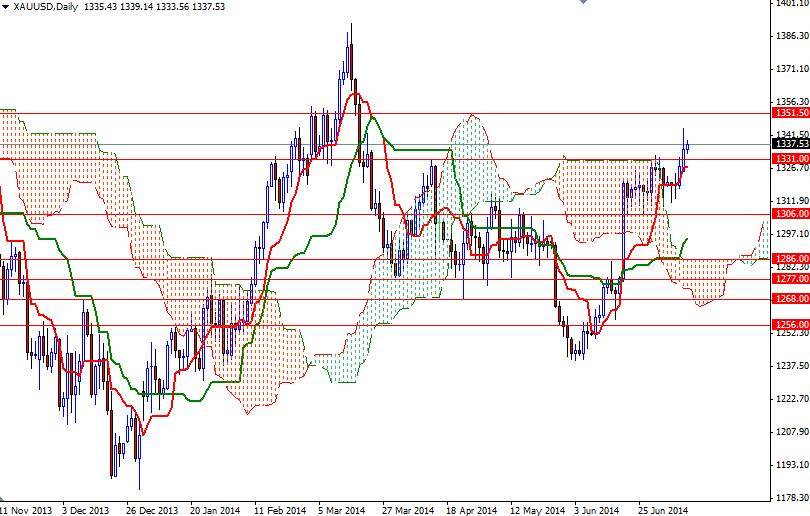

Looking at the charts from a purely technical point of view, the odds favor the bulls as long as the market trades above the Ichimoku clouds on the 4-hour chart but there will be strong resistance levels ahead of us so I wouldn't rule out a pull back towards the 1312 (or possibly even 1307) level before climbing higher. The area roughly between 1350 and 1330 had caused prices to consolidate in the past. If the bulls manage to shatter the first barrier at 1345, it is technically possible to see a bullish continuation targeting the 1351 - 1352 area. Only a daily close above this level might give the bulls extra fuel they need to march towards the 1360 level. To the down side, the first challenge will be waiting the bears in the 1331/28 area. If this support is broken, then the market will probably continue to retreat and test the supports at 1324 and 1321.