USD/JPY Signal Update

There is no outstanding signal.

Today’s USD/JPY Signal

• Entries may only be made between 2pm and 5pm London time today, and then during the following Tokyo session.

• Risk 0.75% of equity.

Long Trade 1

• Long entry following bullish price action on the H1 time frame after the first touch of 100.88.

• Place a stop loss 1 pip below the local swing low.

• Adjust the stop loss to break even when the price reaches 101.25.

• Remove 50% of the position as profit at 101.65 and leave the remainder of the position to ride.

Short Trade 1

• Short entry following bullish price action on the H1 time frame after the first touch of 102.22.

• Place a stop loss 1 pip above the local swing high.

• Adjust the stop loss to break even when the price reaches 101.86.

• Remove 50% of the position as profit at 101.86 and leave the remainder of the position to ride.

USD/JPY Analysis

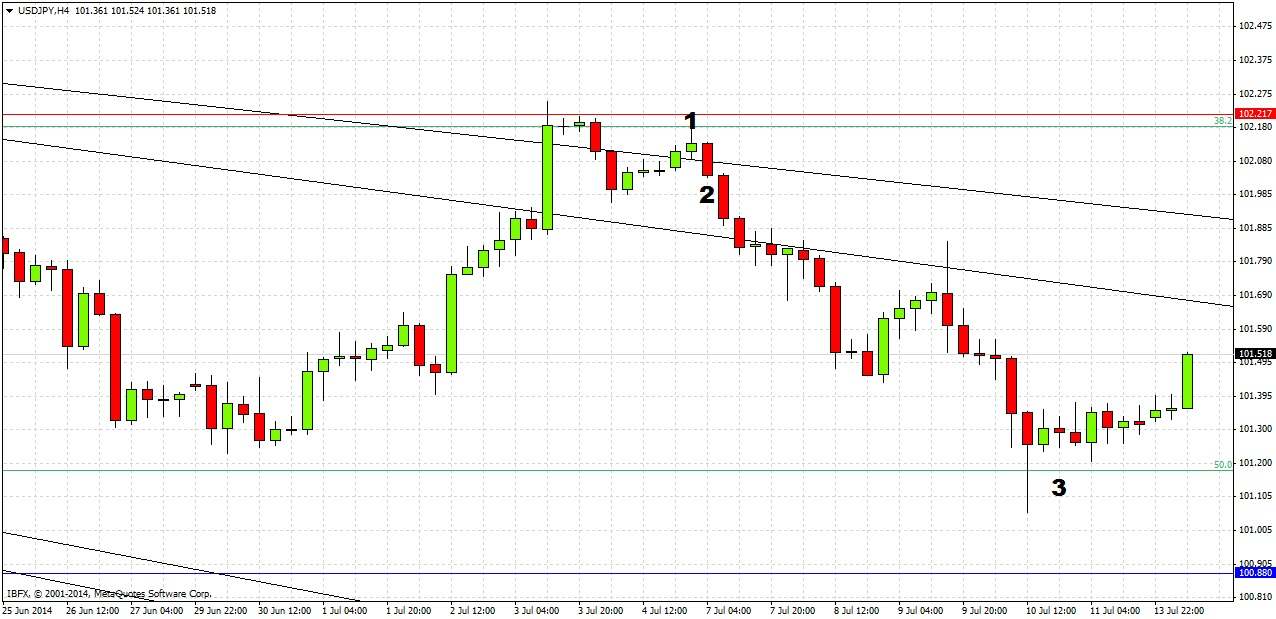

For more than one month we have been stuck in a range between 102.22 and 100.88 or thereabouts. This has been a hard pair to trade but the resistance and support at these two levels still seems to provide likely trading opportunities at which to catch reversals.

We did move down from just below 102.22 at the start of last week, but we only got as low as the 50% Fibonacci retracement of the major upwards move last year. This line at about 101.18 has acted as nice support over the past few days and seems to have been enough to turn the price around. The action now looks quite bullish.

I have left two old bearish trend lines on the chart as although they were broken it still seems they might have some influence. If the fast move up this morning continues, either of them might pause or halt it.

There are no high-impact news releases due today that will directly affect the USD, although the Bank of Japan will be releasing a Monetary Policy Statement towards the end of the Tokyo session. Therefore it is likely to be a very quiet day for this pair until the Statement is released.