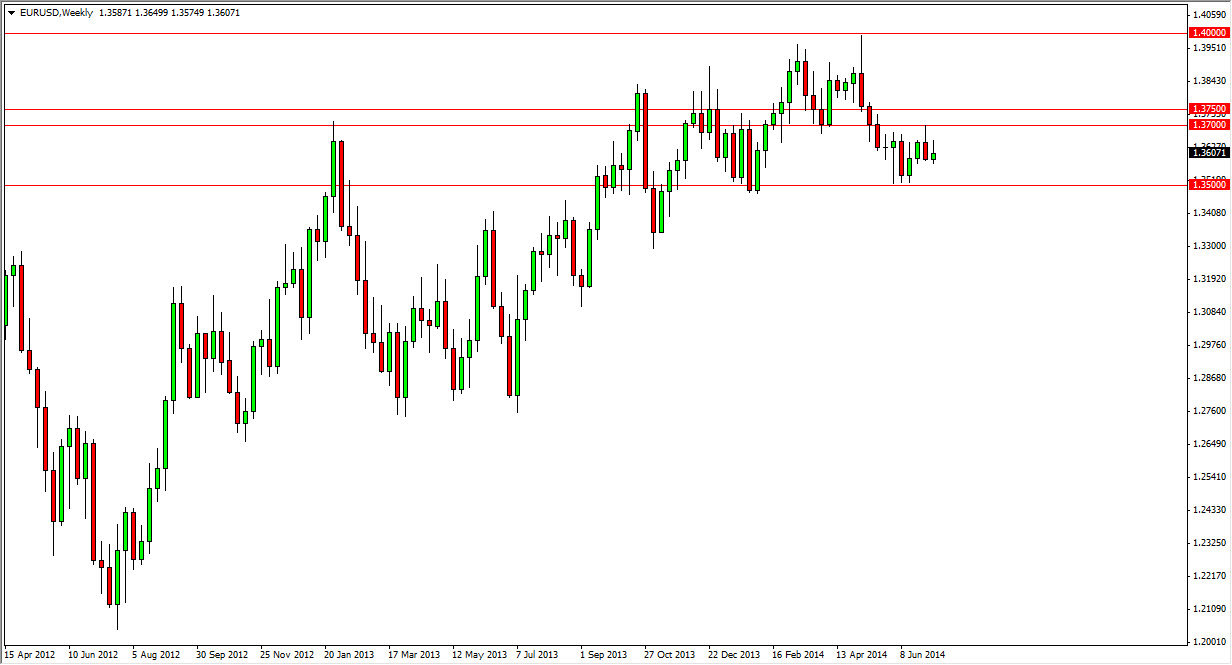

EUR/USD

Until we can break out of the 1.35 – 1.37 region, this pair is going to be almost impossible to trade for anything longer than a scalp. With that being the case, I am completely disinterested in this marketplace, and therefore really haven’t been trading at. However though, I do pay attention to what the Euro is doing in order to get an idea of how to trade it against other currencies around the Forex markets. Until we break out of this range though, it doesn’t really look like a market that’s going to be easy to deal with by itself.

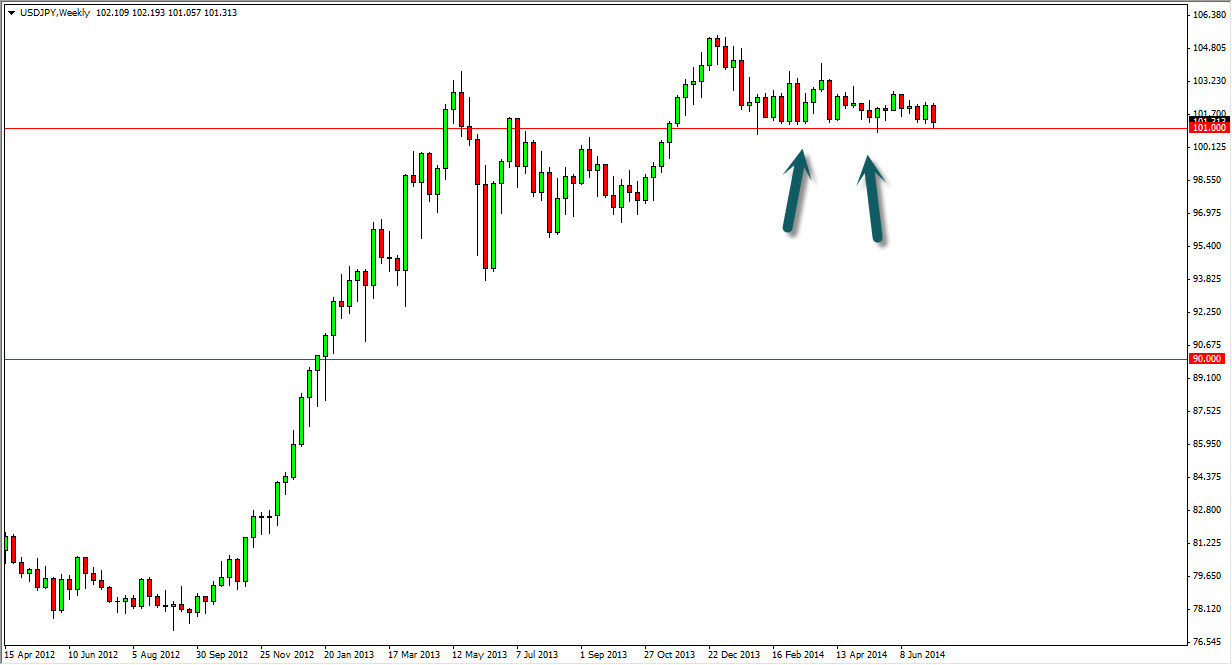

USD/JPY

The USD/JPY pair has been very stable or some time now, showing the 101 level to be massively supportive. Because of this, we feel that the market should continue to find buyers in that region, allowing the short-term traders to continue to range trade in a very stable marketplace. With that being the case, I will be trading a long-term trades in this market, but it’s the short-term charts that I will find interesting. I believe that the market goes to the 102.50 level again, so I will be looking for short-term buy signals in order to continue to profit off of this marketplace and its reliability.

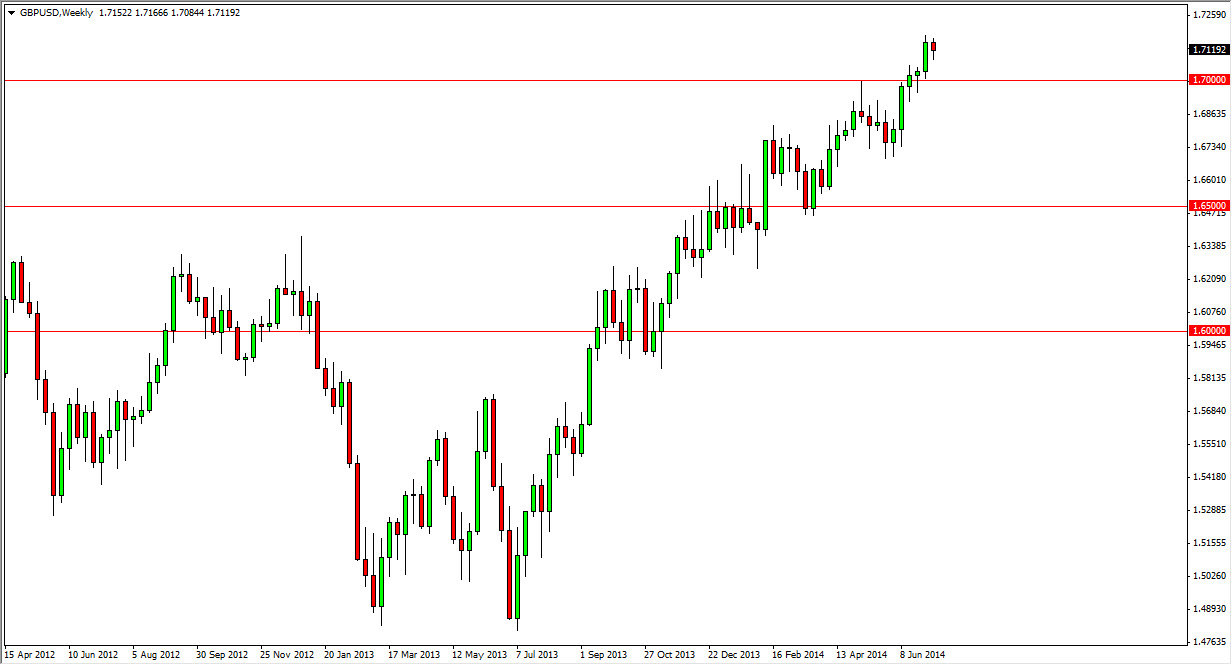

GBP/USD

The GBP/USD pair fell during the course of the week, but as you can see the 1.71 level offered enough support to turn things back around and form a hammer. I believe that if we break above the 1.72 level, this market should be ready to go higher, probably heading to the 1.75 level, as it has been a longer-term target of mine for some time and I believe that is the next major resistance barrier. Ultimately, I do think that the 1.70 level is the “floor” in this market.

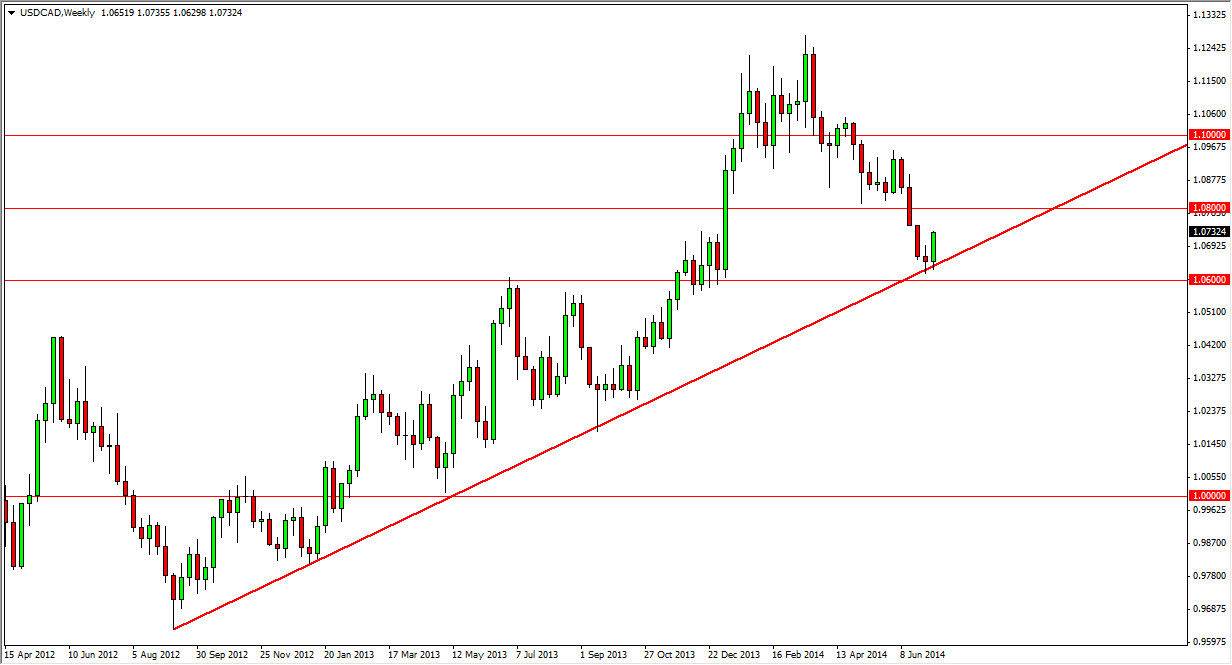

USD/CAD

The USD/CAD pair found a lot of support during the week, based upon the uptrend line that we have been following for some time. Because of this I believe that the market will continue to go higher and that the uptrend is still in effect. The 1.08 level should be resistance, but I do believe that ultimately we will break higher and trying to reach the 1.10 level. At this point in time, as long as we can stay above the 1.06 level, I feel that this market is one that can only be bought, and therefore I am bullish.