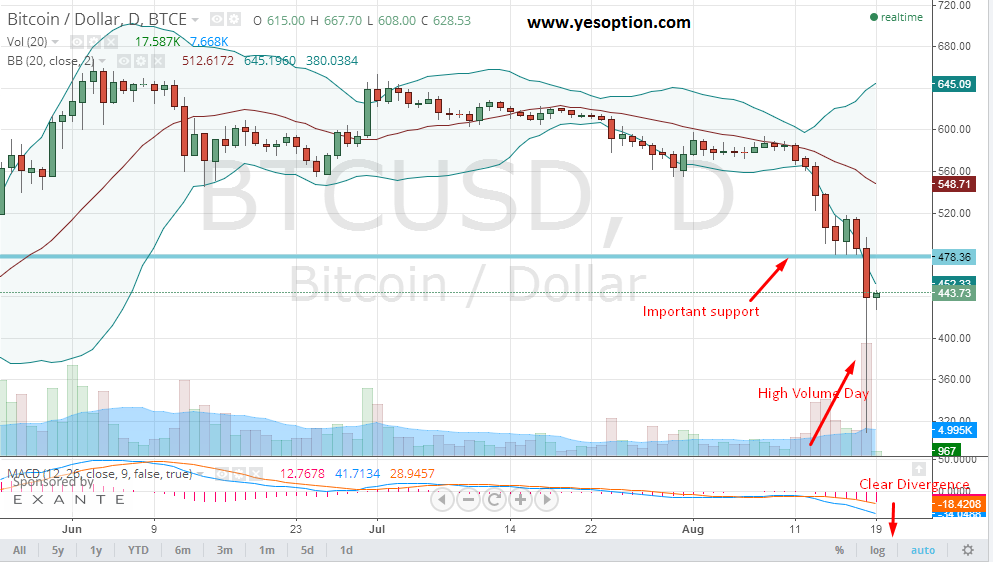

BTC/USD had a very volatile session yesterday on back of above average volumes. The price action saw the digital currency move by close to $100 dollars and recover most of losses by the end of trading yesterday. Yesterday it also saw the breach of the all important zone at $478 which might have triggered stop losses. The BTC/USD opened lower and the downward pressure continued and witnessed a panic sell off which took the BTC/USD lower to levels of $310 before witnessing a pull back and closing near $430 in intraday trade. The momentum indicator for the BTC/USD have given a clear sell signal and showing a clear divergence between the moving averages which is considered to be a bearish signal and indicates towards momentum firmly in the hands of the bears at the current moment.

Actionable insight:

At the current moment, one can sell the BTC/USD for a primary target at $310 with a strict stop loss at $478

It is small but could eventually be a big development for Bitcoin in Europe as Sweden moved to ask the European Court of Justice (ECJ) about the applicability of value-added tax on Bitcoin for the fees that is charged on service. While some states in Euro Zone have adopted their own rules for taxing Bitcoin, Sweden thinks it best to take it to the ECJ. According to law experts, the ECJ's decision could take even two years to come, but it will have the power to change the Bitcoin law in other countries as well as broadly in the Euro zone itself.

As Euro contemplates on the taxation of the virtual currency, Argentina is focussing on expansion of the Bitcoin at the moment. A new brokerage service named Ripio has reached to every nook and corner of Argentina through its 8,000 convenience stores. These stores will offer a convenient exchange of Bitcoin for money to a customer, who has a Ripio number. The transaction will not need even the bank account number and is a simple and quick way to push adoption for the virtual currency.

At the same time, entrepreneurs in developing countries have been capitalizing on the growing mobile industry and Bitcoin simultaneously. The firms are extensively using Bitcoin in international money transfers taking the leverage of speed and reduced transaction fee. They believe that the new method of remittance could relieve the poorest people of high transaction costs involved in the conventional form of money transfers. The global remittance market is worth $600 billion industry and the Bitcoin adoption in this segment could completely revolutionize the way people receive and transfer money.