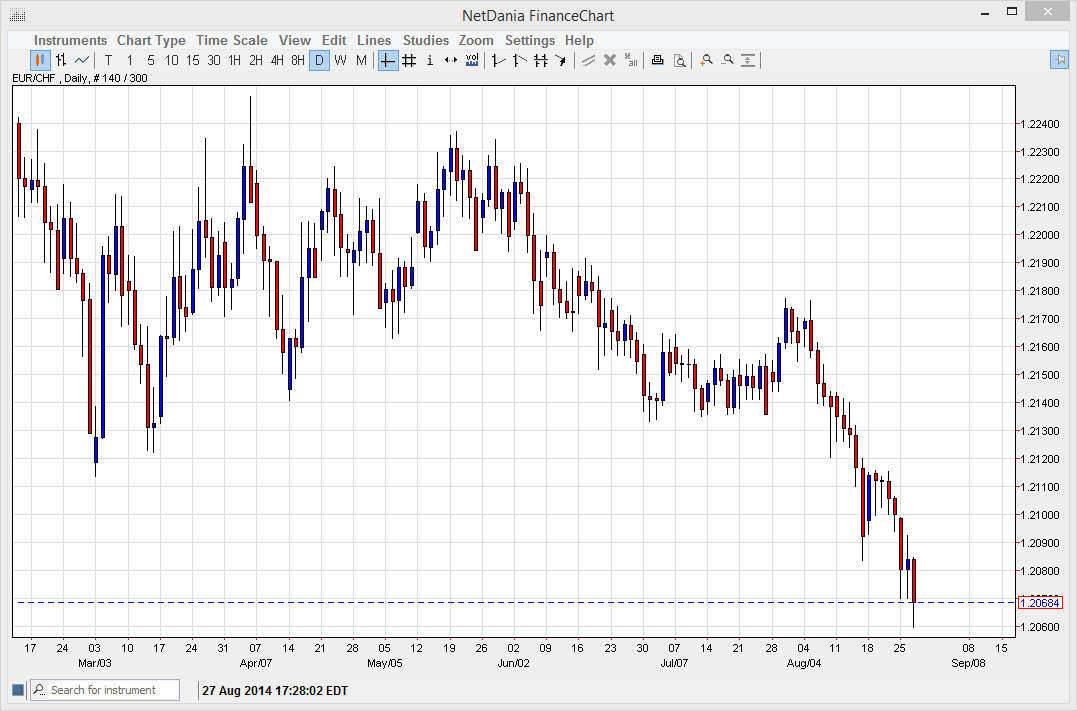

The EUR/CHF pair is a market that a lot of people have forgotten. This is because the Swiss National Bank is effectively put a floor in this market at the 1.20 handle not too long ago, and the market simply has not been able to break below that for some time. However, we are getting close to that level so I cannot help but think it’s only a matter of time before the Swiss get aggressive about selling the Franc again.

The closer we get to the 1.20 handle, the more likely the SNB is to get involved. Because of this, I’m waiting to see if we get a little bit more bearish at this point, as this would be an excellent trading opportunity. I have actually bought this pair closer to central bank intervention a couple of times now, and as a result I have woken up the next day with significant profit. I think we are starting to get close to that type of situation again.

The Swiss simply cannot be happy.

The Swiss cannot be happy about this. After all, the Swiss seem to be somewhat at the mercy of the European problems, and as a result will have to be aggressive yet again. In fact, they have essentially said that they would print an “unlimited” amount of currency in order to keep the value of the Euro propped up against the Franc. As the Swiss trade with the Europeans more than anyone else, and overvalued Franc is very detrimental to the Swiss economy.

It wasn’t that long ago that the Swiss declared that anything below 1.20 in this market was completely “unacceptable”, and I firmly believe that it’s only a matter of time before they show that again. They cannot let this pair drift too much to the downside of that handle, simply because if they do the markets will smell blood and start selling drastically. That being said, I’m going to be buying this pair somewhere just below where we are, and sitting patiently waiting for the inevitable to happen.